In the wake of the geopolitical issue between Russia and Ukraine, Bitcoin has shown considerable volatility over the past two months. The coin price resonates between $45000 and $33000, implying a range-bound rally in the short term. However, amid the bearish cloud hovering above the crypto market, a swiss city-Lugano makes Bitcoin, Tether, and LVGA token legal tender.

source- Tradingview

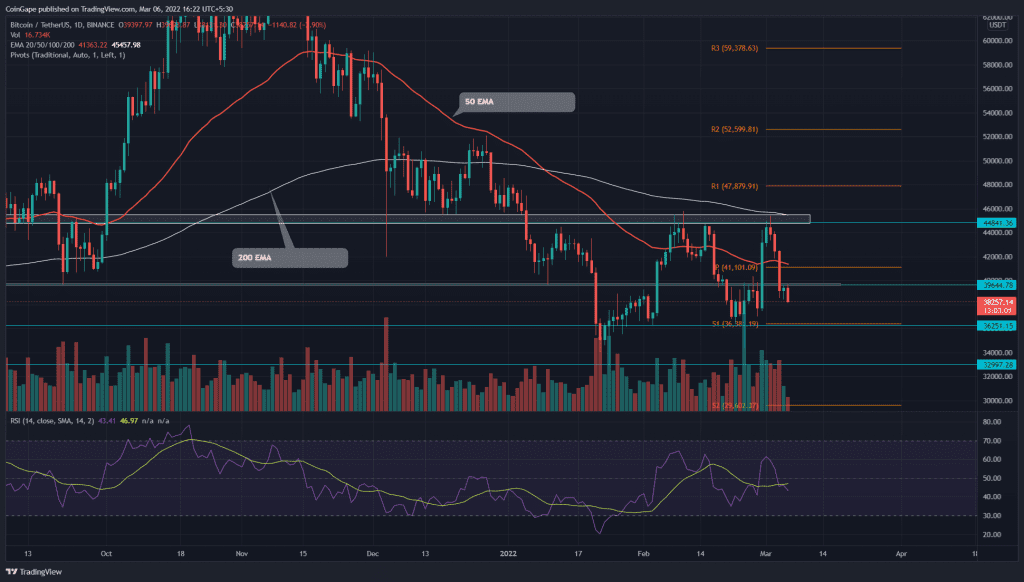

On March 1st, the Bitcoin(BTC) buyers failed their fourth attempt to overcome the $45000 in the last two months. An evening star pattern at this resistance suggested the sellers continue to defend this level with all their might.

The follow-up downfall has breached the $40000 psychological level, escalating the selling momentum. After spending a day to retest this flipped resistance, the coin price turns red today, exchanging hands at $38211.

The BTC chart shows that the coin has lost 18% in the last four days. The sufficient volume activity on the seller’s side suggests the coin would soon visit the $36000 monthly support. If sellers breach this support level as well, the bitcoin traders can expect another 8.5% fall, retesting the January low at $33000.

On a contrary note, if the shared support of $36000 and traditional pivot level(S1) bolster the buyers to regain control from the bears. Then, the coin price would surge higher to rechallenge the $45000 barrier. This formidable resistance is crucial for buyers to initiate a genuine recovery.

- Resistance level- $40000, $45000

- Support level- $36000, $33000

Technical indicator

The recent reversal has slipped the BTC price below the(20, 50, and 100) EMAs. Moreover, a bearish alignment among these EMAs indicates a bearish tendency.

The RSI indicator slope wavering above-below the neutral line accentuates a side-way rally in price action. However, the slope currently moving below the midline suggests the bears have the upper hand.