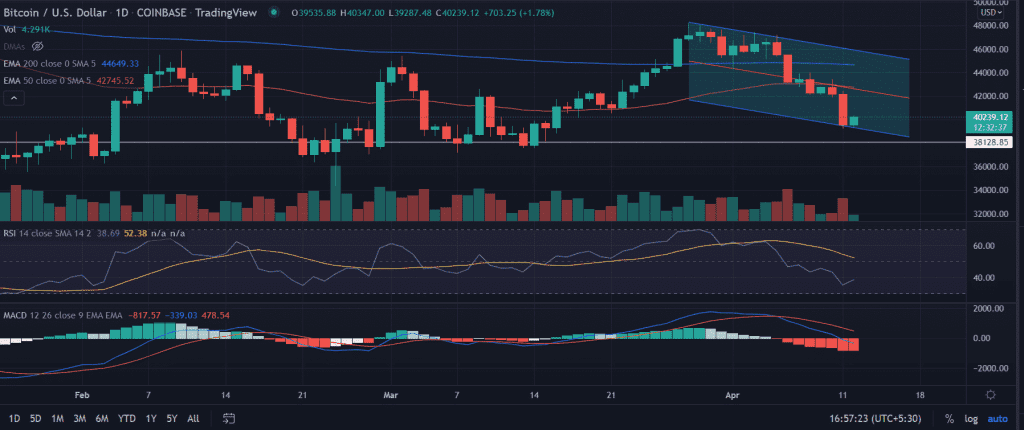

BTC’s price manages to hold the gains on Tuesday following an intense sell-off in the previous session. In fact, BTC is extending its retracement that began on March 28 as the bulls lack the conviction to carry forward the gains beyond $48,124.

- BTC’s price reclaims the $40,000 mark with decent gains on Tuesday.

- However, the price is not out of the woods yet, as it is far from oversold territory.

- A daily candlestick below $39,000 will again put the BTC price on the test once again.

Further, the BTC sellers sliced through the psychological $45,000 level on April 6 and resulting in a 13% correction in BTC price since then.

In the past two weeks, BTC’s price witnessed a steep pullback that pushed it to $39,000. However, despite the intense selling momentum, the investors seek a dip-buying opportunity that brings the major cryptocurrency back above $40,000.

BTC price remains sidelined

From a technical perspective, the BTC price seems exhausted after the recent pullback. Still to move back to the key upside zone at $45,000 and $50,000 looks challenging for the Bitcoin price.

A daily candlestick below the key support area of $39,000 will trigger another round of selling in the pioneer cryptocurrency. The price trades inside a ‘Parallel’ channel. Now, if the price breaks the lower trend line of the channel sellers could enjoy a move toward the horizontal support zone at $38,128.85.

An extended sell-off could bring $36,000 into play.

While things look pessimistic for the BTC price, a spike in the buy order could push the price to revisit the previous session’s high of $42,424.14 followed by the $44,000 key level above the 50-day EMA.

The daily relative strength index (RSI) is just a tad above the oversold zone giving bulls hope.

On the daily chart, the moving average convergence divergence fell below the mid-line with bearish momentum.

BTC price was trading at $40,227.06 at press time, up 1.23% for the day