- Bullish Bitcoin price prediction ranges from $62,357 to $82,264.

- Bitcoin price might also reach $100,000.

- Bitcoin bearish market price prediction for 2021 is $28,743.

This 2021 Bitcoin (BTC) price prediction is based on the analysis of technical indicators. Below, we have outlined the key factors that contributed to our BTC price prediction.

Over the past few weeks, the crypto market seems to be making a fast recovery. After the dip a few months ago, the digital asset industry was growing steadily. At the moment, it seems that the crypto industry may finally be on the up and up again.

Bitcoin (BTC) is the king of cryptocurrencies which has a lot of potential in the crypto industry. Interestingly, BTC broke its all-time-high record of December 2017, when it surpassed $19,798 in November 2020.

BTC has also succeeded in nailing a growth rate of over +375% in the past 12 months. As a result, BTC is now one of the most talked about virtual assets in the crypto world. With all these achievements, we can say that BTC is a cryptocurrency with a lot of potential.

In this Bitcoin price prediction, we take a look at the performance of BTC if it will reach $100,000. But before that, let us learn more about Bitcoin, what is Bitcoin (BTC) and its current position in the crypto market.

Overview

| Cryptocurrency | Bitcoin |

| Ticker Symbol | BTC |

| BTC Price | $63,892.86 |

| All-Time High | $64,863.10 |

| All-Time Low | $65.53 |

| Market Cap | $1,204,318,863,327 |

| Trading Volume | $38,704,249,310 |

| Circulating Supply | 18,849,037 BTC |

| Total Supply | 21,000,000 BTC |

| Max Supply | 21,000,000 BTC |

Table of contents

What is Bitcoin (BTC)?

The first cryptocurrency Bitcoin (BTC) was designed in 2009 in order to become a peer-to-peer electronic cash system. Moreover, BTC is a virtual asset which is controlled by a decentralized network of users.

Some advantages to be noted is that BTC has made it possible to send and get money anywhere at any time. Even more, users are the only owners of their money, there is no higher authority needed. Also, any kind of transaction is possible no matter how much it is, it is totally safe and secure.

Bitcoin, also known as the brainchild of the unknown individual or possibly a group under the pseudonym Satoshi Nakamoto, Bitcoin, also named as ‘grandfather’ of cryptocurrency, the first well-known application of the novel blockchain ecosystem.

More so, the Bitcoin has a significant effect on the digital asset market by influencing altcoins. Moreover, BTC proves to be the most liquid digital asset which contains over 5,000 altcoin trading pairs.

BTC Current Market Status

Bitcoin is one of the most budding virtual assets in the crypto market today. In fact, BTC was able to record a huge growth rate of over +377% in the past 12 months. For this reason, Bitcoin has become one of the most talked about crypto assets in the crypto world.

In terms of its market standing, the crypto positions itself as the top cryptocurrencies in CoinGecko. As a result, BTC market capitalization increased to almost $1,049,416,800,377 with a 24-hour trading volume of

$35,544,331,566. Indeed, this market status of BTC attracts global investors around the world.

Now that you already have an idea about the current market status of Bitcoin. Do you think Bitcoin is a good investment this year? Let’s look at a quick background on “What is Bitcoin (BTC)?”.

Factors Influencing Bitcoin Price

At the start of the year 2021, it is evident that Bitcoin has geared up and skyrocketed in its price. Is the same bullish trend performed before? Now, let’s look into the factors that influenced the early and current BTC price.

Factors Influenced Early BTC Price

The supply and demand of Bitcoin plays a major factor in the prices. Currently, there is a cap of 21 million bitcoins. When that cap is reached, Bitcoin mining will no longer create new bitcoins. As we all know in general, the price of Bitcoin goes up when the demand cannot keep up with the supply.

More so, the huge price changes happen when market manipulation takes place like the ban on digital asset trading platforms. In addition, the crypto exchanges which control significant reserves of Bitcoin also affects Bitcoin’s price track.

Events at Mt. Gox which is one of the world’s first digital asset exchanges which mainly contributed to sudden BTC price change in 2014. Let us consider one example, the price of BTC declined 32% from $850 to $580, this takes place after the exchange claims to have lost 850,000 bitcoins in a hack and filed for bankruptcy in February 2014.

In December 2013, rumors of poor management and lax security practices at Mt. Gox had caused a steep drop of 29% in its price. Consequently, the other main factors that affect BTC’s price in its early days is that the price of Bitcoin crossed the $1,000 mark in January 2014 after online retailer Overstock revealed that it will start accepting Bitcoin for purchases.

Factors Influencing Current BTC Price

Regulatory Developments: The number of factors that influence Bitcoin price has changed significantly. In 2017, when BTC got mainstream attention, regulatory developments showed a huge impact on its price due to its extended cryptocurrency reach. Based on whether the impacts are positive or negative, each regulatory pronouncement raises or drops the BTC prices.

Institutional Investors’ Huge Interest in Purchasing BTC: Institutional investors interest in buying Bitcoin is also one main factor that influences the BTC price. The BTC price surge in 2020 is mainly because many respected names in finance spoke approvingly of its potential to develop Bitcoin as a store of value to hedge against inflation from increased government spending in times of pandemic. All-in-all, MicroStrategy Inc. and Square Inc. have both announced commitments to using Bitcoin rather than cash as part of their corporate treasuries.

Industry Developments: Third major thing that influences Bitcoin price is industry developments. Notably, the announcement of the launch of Bitcoin futures trading at the Chicago Mercantile Exchange (CME) and the CBOE Options Exchange (CBOE) were greeted with price changes at crypto exchanges and helped to move BTC’s price closer to the 20,000 mark in 2017.

During the Bitcoin halving event, the rewards of Bitcoin present in the market reduced due to a miner rewards reduction because of the algorithmic change that catalyzed price surge. More so, the price of Bitcoin since May 2020 halving has seen a surge of almost 300%. Previous Bitcoin halving events in 2012 and 2016 offered significant price gains of 8,000% and 600% respectively. The halving reward offered to miners also doubles the asset’s stock-to-flow ratio and also seems to have a huge impact on Bitcoin’s price.

Economic Instability: The economic instability is notably another indicator of Bitcoin price changes. Since its beginning, the digital asset has positioned itself as a supranational hedge in spite of local economic instability and government-managed fiat currency. As per reports, there is a period of increased economic activity on BTC’s blockchain after an economy hits a road crash due to the government policy.

Countries like Venezuela have experienced hyperinflation of their currency which has seen a huge surge in the use of BTC as a means of transaction and also storing wealth. Moreover, analysts believed that the crypto’s price surges and global economic turmoil are linked.

For example, capital controls announced by the Chinese government are accompanied by an uptick in BTC price. Additionally, the 2020 pandemic shutdown offers macroeconomic instability on a global scale and causes BTC price, resulting in a price rally.

Bitcoin Taproot

Bitcoin’s (BTC) network upgrade is known as Taproot which is scheduled for November 2021. Moreover, the upgrade enhances the overall network usability by making faster, and cheaper transactions. In addition, the upgrade also enables the development of smart contracts gradually.

More so, Taproot initiates significant privacy promises. Notably, the framework is developed by the security-based crypto offerings available. As a result, BTC moves near to a few of the privacy-related coins at least from a design point of view.

$ETH price has pumped on the London Hard Fork and EIP-1559.$ADA is mooning based on the Alonzo Hard Fork and upcoming smart contracts.

Imagine what will happen to #Bitcoin when Taproot is initiated.

Don’t sleep just because the media has stopped talking about it.

— The Wolf Of All Streets (@scottmelker) August 16, 2021

The Wolf Of All Streets made a recent tweet in comparison with the price surge of Bitcoin (BTC) with Cardano (ADA) and Ethereum (ETH). The recent upgrade made the price of ADA and ETH to increase, this scenario might be the same for BTC after the Taproot upgrade.

Pros and Cons of Bitcoin

Let us all understand what makes bitcoin ideal for today’s generation and why it should be handled properly to avoid risks and losses. Below are a few pros and cons of Bitcoin.

Pros

- Bitcoin enables seamless transactions within a few seconds.

- Bitcoin’s wallet private key protects your bitcoins from any hacking attempts.

- BTC offers verifiable and transparent transactions.

- One of the cheapest and fastest methods of sending funds.

- Assets can be sent directly to a merchant without gatekeepers’ need.

- Growing acceptance of BTC leads to asset’s great liquidity.

Cons

- Influences price movements of its altcoin pairs.

- BTC is volatile in nature.

- Transactions are irreversible.

- Bitcoin is one of the most used baits by scammers.

- Unsustainable process of BTC mining.

- Crypto wallet vulnerabilities – a lost private key cannot be recovered.

Moreover, Bitcoin is one of the most talked-about digital assets in the crypto world lately. This is because of the fantastic performance that the crypto has delivered in the past months of the year. For this reason, the crypto was able to maintain its position along with top digital assets. Will the price of BTC reach over $100,000 soon? Let’s discuss it in detail in this BTC price prediction article.

Analyst Views on BTC Price Will Reach $100,000

Many crypto analysts have different views on Bitcoin price prediction to $100,000. Recently, Crypto analyst Tone Vays says Bitcoin price will hit $100,000 by 2021. He shared a video on Twitter explaining the reason why he believes Bitcoin (BTC) could hit the $100,000 price mark this year. Moreover, Vays explains that BTC may bounce back to $50,000. Using the BTC price chart, he mentioned that after this pullback, Bitcoin will most likely skyrocket to $100,000.

A couple of months ago a few more analysts delivered their views on BTC price. Nexo Co-founder Antoni Trenchev says that the price of Bitcoin (BTC) will reach $100,000. In addition, the price of Bitcoin (BTC) will hit $160,000, says Celsius Co-founder. The Twitter account Bitcoin Archives also shared one interesting analysis explaining about the price movement of BTC.

As per Crypto analyst Lark Davis, the all-time high of Bitcoin’s $64,804 price level is not the final ATH. Even more, the tweet came when the flagship cryptocurrency fell to over three-month lows again, dropping to about $34k.

$64,804 is not the final all time high price for #bitcoin

— Lark Davis (@TheCryptoLark) May 31, 2021

Lark Davis also added that the BTC will grow 15 times from current price. This indicates the price of BTC will reach over $100,000 soon.

#bitcoin will go on to rival the market cap of #gold this decade. That is a 15X from the current price, which will give a per unit price of $550,000 per BTC.

— Lark Davis (@TheCryptoLark) June 28, 2021

Fundstrat’s Managing Partner Tom Lee has explained his Bitcoin price prediction from $100,000 to $125,000 by year-end.

Tom Lee says,

It is probably better to view it as a call to action for the bitcoin industry to focus on renewables or more efficient ways to provide proof of work.

From the above view of a few experienced Analysts, the Bitcoin price may soon hit $100,000 by 2021.

Now that we have a few backgrounds about BTC, do you think BTC will be profitable crypto in 2021? Join me and let us see the charts in this BTC price prediction.

Bitcoin (BTC) Price Analysis 2021

As of the time of writing, the crypto market continues to show wild market swings that make most crypto bleeds. However, Bitcoin is one of the digital assets in the crypto world that recovers fast.

Do you think this aggressive performance of Bitcoin is enough to attract more potential investors around the world? Are you already interested to know? Therefore, what are you waiting for? Join me and together, let us see the charts in this CoinQuora price analysis.

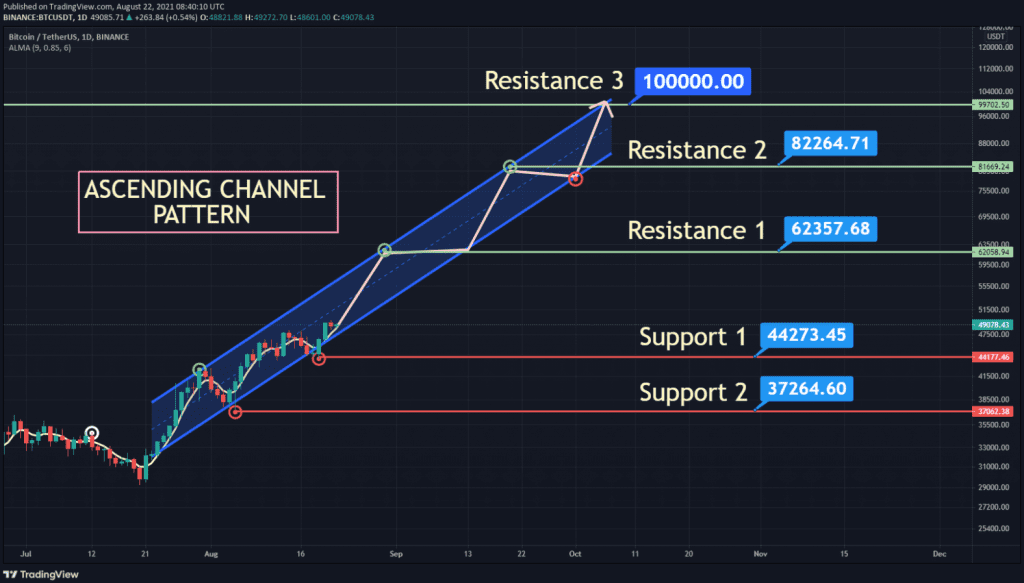

The above chart shows the Ascending Channel pattern of Bitcoin. This is a bullish pattern which is formed by joining higher highs and higher lows. Based on the graph above, Bitcoin was able to defend its position well against the bears in the early days of the month.

In fact, Bitcoin was able to record a price surge to almost +70% from Mid-July to Mid-August. As a result, BTC became one of the most discussed virtual assets in the crypto world.

Let us say that Bitcoin effectively removes itself from the bearish territory and opens its price above ALMA. In this scenario, Bitcoin might increase its price. It may break and go over its resistance level 1, leading the crypto directly to the bullish price of $62.3K. At this price level, the crypto will be in a bullish position, a level favored by investors around the world.

If this continues, Bitcoin might be able to reach and go over its ATH price which is just +32% away from its second resistance level. This price that we are talking about may reach and surge up to $100K in 2021 to 2022. Of course, all this can happen if the bullish market continues to favor crypto.

Conversely, if Bitcoin fails to overcome the bearish market, the price of the crypto might fall further. As a result, Bitcoin might lose its investors’ confidence along with its market value.

Bitcoin (BTC) Price Prediction 2021

Since day first of its launch, Bitcoin holds 1-st position in the market. But will the recent upgrades and changes in the blockchain help the digital asset price to reach higher? Let us find out in this CoinQuora Bitcoin price prediction 2021 to 2025.

- Resistance 1 – $62,357

- Resistance 2 – $82,264

- Next Resistance- $100,038

- Support 1 – $44,273

- Support 2 – $37,264

- Next Support – $28,743

As displayed on the chart above, we can see that Bitcoin aggressively entered the year of 2021 with a bang! Specifically, Bitcoin was able to surge its price from $30K to $64.8K, a price truly favored by global investors.

In addition, this price surge of Bitcoin made the platform record a huge growth rate of over +1500%. With all these achievements, we can say that Bitcoin was in a good shape to attract investors into its platform.

On the other hand, Bitcoin’s bullish rally did not last long due to the bloodbath experienced by the crypto market. From the ATH price of $64,863.10, the price of Bitcoin nosedived to $28,893.62. Yes, this is a bearish signal that could cause fear, uncertainty, and doubt (FUD) among its investors.

In this case, the crypto must find a way to regain composure and head back to its uptrend position. Otherwise, the bears might further pull down Bitcoin to $28,743 with a decline rate of -42% from its current price.

However, if Bitcoin were able to recover and break the Fibonacci level of .618, Bitcoin might regain its bullish position. Interestingly, the crypto may rally back its price to over $62,357 and boost all the way to $100,000. This price surge is most likely to happen if the crypto once again pumps its price like what happened in the past months.

If it does, Bitcoin may expand its rally to reach the high price of $82,264 to $100,000 in 2021. Of course, this will all be possible if the bullish market and global investors remain on the side of Bitcoin.

Bitcoin Price Prediction 2021 — RVOL, MA, and RSI

Since the start of 2021, BTC’s price has seen many bullish moves which are higher than the previous one. More so, these are followed by consolidation, fluctuations, and corrections right away.

The below chart shows the Relative Volume (RVOL) of BTC. It is an indicator that indicates to traders how the current trading volume has changed over a period of time compared to the previous trading volume. Currently, the RVOL of BTC lies below the cutoff line which indicates the weaker participants in the current trend.

More so, the Bitcoin’s Moving Average (MA) is shown in the chart above. Currently, BTC is in a bullish state. Notably, the BTC price is above 50 MA and 200 MA (long-term), so it is completely in a bullish state. Therefore, there is a high possibility of a Trend reversal at any time.

Meanwhile, the relative strength index (RSI) of the crypto is at level 68.6. This means that the crypto is in a nearly overbought state. In this event, traders and investors must trade with caution to prevent unexpected price dumps. With this, traders can avoid losing huge amounts of funds and maximize their profit potential in trading.

Bitcoin Price Prediction 2021 — ADX, RVI

Let us now look at Bitcoin’s Average Directional Index (ADX). In particular, the ADX assists traders in finding the strength of a trend rather than its direction. It can also be utilized to determine whether the market is changing or if a new trend is beginning. Specifically, ADX is linked to the Directional Movement Index (DMI).

The above chart represents the ADX of Bitcoin. Currently, Bitcoin lies in the range at 73.3, so it indicates a strong trend. This shows that the price of ADX can go bullish in the future. The above chart shows the Relative Volatility Index (RVI).

In detail, RVI measures the standard deviation of price changes over a period rather than the absolute price changes. RVI is below 50 level, this indicates the direction of volatility is to the downside. In fact, RSI is at 49 level so it confirms a potential sell signal.

Comparison of Bitcoin with ETH, ADA

Bitcoin is the largest crypto by market cap and has shown a bullish trend. The below chart shows the price comparison between Bitcoin, Ethereum, and Cardano.

From the chart, it is found that the price of Bitcoin has a significant impact on the crypto market by influencing alternative cryptocurrencies simply referred to as altcoins. Moreover, it is found that the price pattern of ETH and ADA is the same as BTC. This indicates when the price of BTC surges or drops, the price of altcoins such as ETH, ADA, XRP, DOT, and many more also surges or drops respectively.

Would this be enough to make Bitcoin a profitable crypto in 2021 to 2025? Let us find out in this CoinQuora BTC price prediction 2021 to 2025.

Bitcoin (BTC) Price Prediction 2022

As per the latest upgrades, developments, BTC price prediction of the platform indicates that BTC may be the best investment as the price can surge and reach around $120K by the end of 2022.

Bitcoin (BTC) Price Prediction 2023

The price of Bitcoin is predicted to reach a minimum level of $130K in 2023. The Bitcoin price can reach a maximum level of $155K by the end of 2023. In addition, If Bitcoin holds the support level above 200-MA, the will definitely reach $160K.

Bitcoin (BTC) Price Prediction 2024

Our Bitcoin price prediction over the long term is very optimistic. As noted in the section above, Bitcoin does have some influential technical analysis and fundamental factors that flow in its favour, and BTC could reach over $200K.

Bitcoin (BTC) Price Prediction 2025

In the next four years, BTC prices could race up to $250k. However, reaching this level could not be so difficult for BTC as additional medium, short-term, and long-term price targets could be found to purchase or sell orders. This indicates that Bitcoin has a high possibility of reaching a new ATH soon in the next five years as per the prediction.

Bitcoin (BTC) Price Prediction 2021 — Conclusion

With the ongoing enhancements in the Bitcoin network, we can say that Bitcoin has a good year ahead in 2021. For this reason, the bullish price prediction of Bitcoin in 2021 is $62,357. On the other hand, the bearish Bitcoin price prediction for 2021 is $28,743.

Bitcoin is about to take off on yet another bull run, the opportunity to profit has never been greater. And with Bitcoin price expected to reach $82,264.71 to as much as $100,000 per BTC, it’s never too late to get started trading Bitcoin.

FAQ

Bitcoin is the first cryptocurrency developed to become a peer-to-peer electronic cash system. Its native token is BTC.

Most popular brokers and crypto exchanges will allow users to buy Bitcoin, either with fiat currency or by exchanging such as Binance, Tokocrypto, OKEx, CoinTiger, and Hotcoin Global.

Bitcoin is one of the active crypto assets that continues to maintain its uptrend position. If this bullish trend continues, BTC might be able to break from $62,357 and go all the way to $100K. Of course, this is very likely to happen if the bullish market continues to favor crypto.

Bitcoin is a good investment in 2021, this token could be considered by most crypto investors. However, BTC has a high possibility of surpassing its current ATH at about $64,863.10 by 2021.

Bitcoin is considered one of the top-rising cryptocurrencies this year. Also, along with the recorded achievements of BTC in the past few months, we can say that BTC is indeed a potentially good crypto to invest in this year.

Considering our research and analysis, our Bitcoin price prediction 2021 sees the coin being valued at around the $100,000 mark. This could make the crypto investors rich soon.

Bitcoin (BTC) price is expected to reach $120K by 2022.

Bitcoin (BTC) price is expected to reach $160K by 2023.

Bitcoin (BTC) price is expected to reach $200K by 2024.

Bitcoin (BTC) price is expected to reach $250K by 2025.

Disclaimer: The views and opinions expressed in this article are solely the author’s and do not necessarily reflect the views of CoinQuora. No information in this article should be interpreted as investment advice. CoinQuora encourages all users to do their own research before investing in cryptocurrencies.

Recommended Articles