Bitcoin (BTC) checked its latest advance on Feb. 23’s Wall Street open as Russia repercussions continued to play out.

Stocks sour crypto recovery

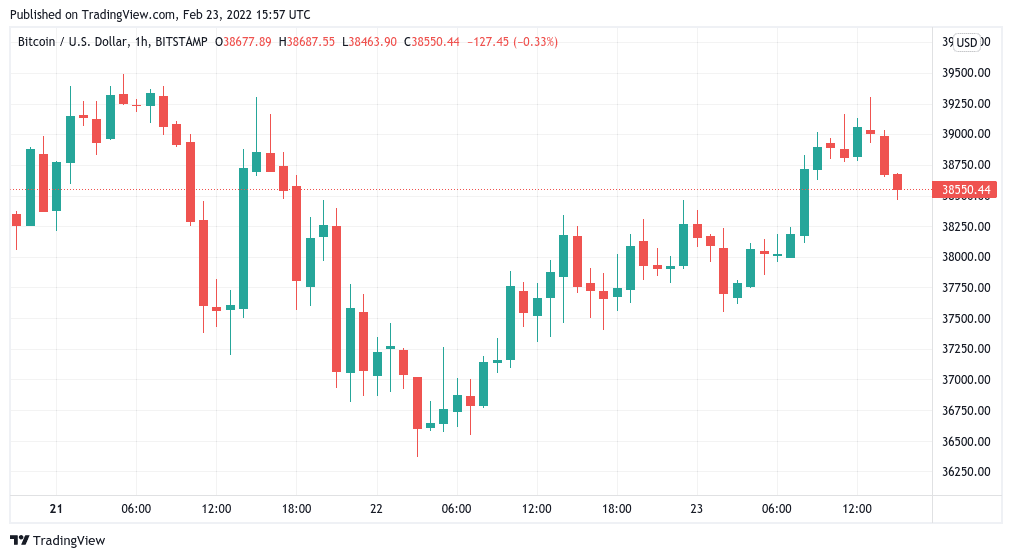

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD falling back towards the $38,000 mark during Feb. 23, having earlier reached $39,200 highs.

Pressure from the Russia-Ukraine conflict remained an ever-present threat to equities, with which both Bitcoin and altcoins are closely correlated.

The S&P 500 traded down 0.25% in its first hour, while Russia’s MOEX index furthered heavy losses from Feb. 23, down another 7.3% at the time of writing.

The Russian ruble continued its decline in step, accelerating past 80 to the dollar on news that the United Kingdom would stop Russian businesses clearing in either dollars or British pound sterling.

With much uncertainty in the air, market participants looking for low-timeframe shots were having to reassess their approach on a constant basis.

Bitcoin

Bullish Inverse Head and shoulders bottom forming

good risk reward entry here with stop at $34K pic.twitter.com/fk8N6fAwQo— Will Meade (@realwillmeade) February 23, 2022

“Am bullish BTC over next few months,” Blockware lead insights analyst William Clemente tweeted on the day about the longer-term macro prognosis.

“Strong holding behavior on-chain paired with a lot of relative dry powder sitting on exchanges, stacked bidside in order books, & prolonged regime of spot premium over perps. March will be here next week, max hawkishness likely priced in.”

In terms of Bitcoin continuing to follow global equities, meanwhile, Ki Young Ju, CEO of on-chain analytics platform CryptoQuant, argued that it was not all bad news for those hoping that Bitcoin would decouple to become an asymmetric hedge against global uncertainty.

“Good News: BTC is getting adopted by traditional institutions. Its ownership is changing by new players who trade stocks. Bad News: BTC is not a safe-haven asset. For now,” he summarized.

Supply Delta hints at possible price U-turn

Turn to on-chain metrics, however, and Bitcoin looked decidedly more promising, as Clemente had hinted.

Related: ‘You’d better buy some Bitcoin’ — BTC figures defy Canada gov’t as ETF assets hit record

In focus on Feb. 23 was the Supply Delta metric, which looks at the portion of the BTC supply held by short-term and long-term holders, respectively.

Its creator, Capriole founder Charles Edwards, notes that while “not perfect,” Supply Delta has been able to call at least local price tops. As of this week, it was printing a bottom for long-term holder share, which traditionally appears around price bottoms.

Long-term holders are defined as wallets with no selling in the past 155 days, while short-term holders conversely sell during that period.

Price tops seem to immediately follow peaks in short-term supply.

“From a supply side, suggests Bitcoin is in a major accumulation zone,” Edwards commented.