The broader crypto market has seen better days. Bitcoin took a hit and fell by 3.7% in the same duration with liquidations rising to $120 million. What do these conditions entail for Bitcoin after the recent market volatility?

Another day, another dip for the crypto “big brother.” After falling by another 3.7%, skeptics were quick to raise their eyebrows on the present market situation of Bitcoin. Recent data shows new trends in the market that must be closely looked at by investors.

Stat-Alert

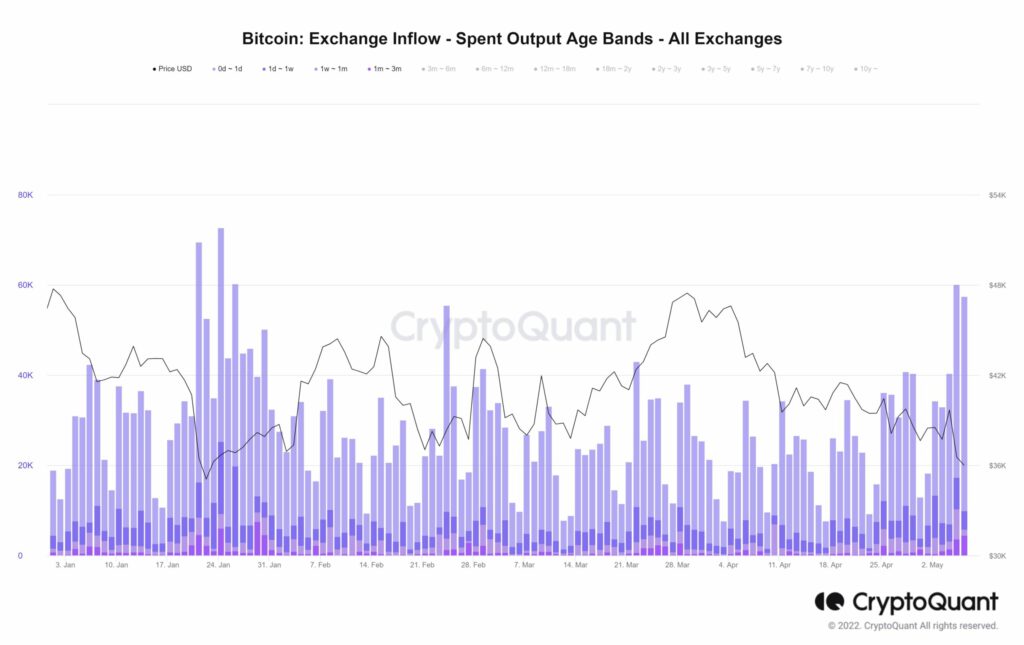

CryptoQuant data was quick to point that the decline in recent days may be dominated by short-term holders. On 5 and 6 May, a total of 11.7k “young” BTC held for less than 3 months flowed into exchanges. This is a critical observation since inflows are generally driven by FUD sentiment across the market.

As per a latest Glassnode tweet, there is also sudden increase in “BTC Exchange inflow volume”. This metric reached a 3-month high over $57.3 million today. Interestingly, the previous 3-month high was just shy of $57 million was observed yesterday.

This indicates a massive selling-pressure in the market fueled by negative sentiments from the crypto crash amid major changes in global fiscal policies.

The MVRV Ratio is another metric that is complementing short-term headwinds for Bitcoin. The flagship crypto reached its lowest MVRV ratio to 1.45 which is the lowest recorded value since 22 January, 2022. Amid heavy selling pressures from the widespread BTC sell-offs by the weaker hands – Bitcoin prices are slowly falling towards an oversold situation.

All these indicators are indicating a short-term painful run for Bitcoin. But there is rested hope for the future with the following data.

BTC exchange withdrawals reached a new 2-month high today. This is important considering the short-term bears are increasing the selling pressure in the market.

This metric provides weight to the theory of a long-term strategy for the HODLers who transfer their assets to cold wallets for security reasons. The number of exchange withdrawals reached 1,944 today; the highest number of withdrawals since early March.

So it seems like Bitcoin should be able to survive the near-term bears. However, a safe future could be on the horizon with increasing institutional and retails adoption.