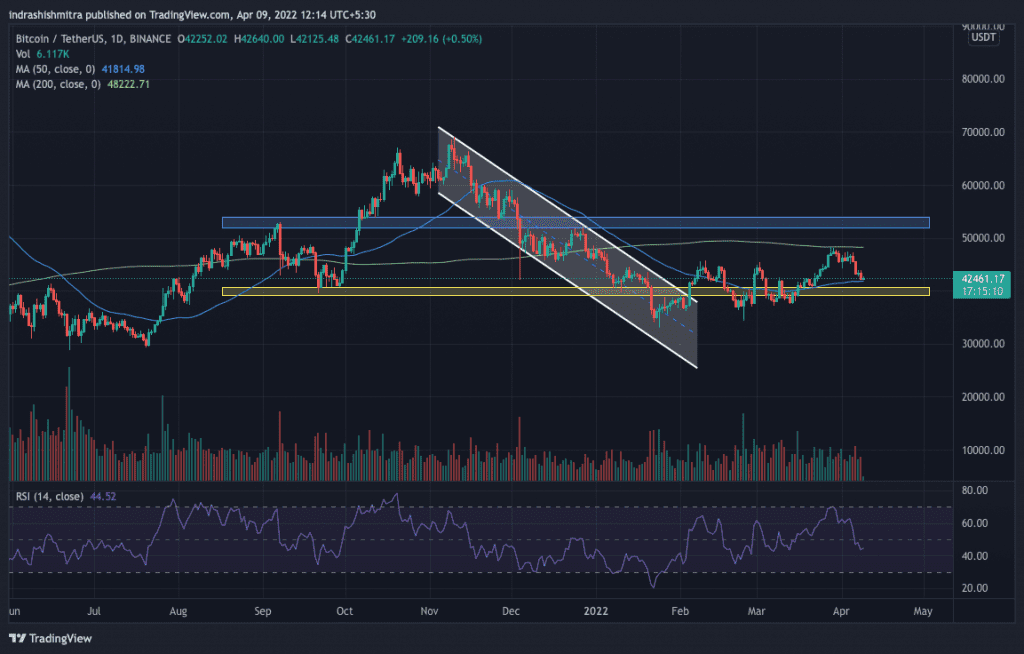

The cryptocurrency market’s flagship coin, Bitcoin has definitely seen better days. Its tragic fall from the beginning of November 2021, after hitting its all-time-high just above $69k to the beginning of February – left a scar in people’s minds. Since then, however, Bitcoin has been consolidating in a range.

Nothing to worry

Amid all this, there was some jubilation, as, towards the end of March, BTC had managed to breach the $45k mark and touched $48k. There was a lot of pomp and celebration around as $50,000 seemed well within reach but then another minor correction played spoilsport. The correction pushed prices back down to the $42k region.

However, data suggest, that the current correction has done very little to impact Bitcoin too negatively. Despite Bitcoin’s recent downfall over the past two days, technically speaking, all hope isn’t lost yet. It is still above two crucial levels that are nearly coinciding – the 50 DMA and the $40,000 psychological level. It can be assumed to be consolidating and accumulating within a very broad range, which is unusual but not impossible either.

Along with that, liquidations data from Coinglass also suggests that despite the fall, all’s not lost yet. However, it doesn’t point at extreme bullishness either. Comparing historical price movements and liquidations data – it can be clearly seen that whenever there has been a fall, a lot of longs have been liquidated.

BTC Total Liquidations | Source: Coinglass.com

But this time around, the long liquidations haven’t been that harsh. The most were on 6 April- of a little over $100 million but the following days have been negligible. Thereby, suggesting weaker hands have been thrown out and stronger hands are still holding on.

To add to that, Santiment’s Adjusted Price DAA Divergence has been showing buy signals all throughout, suggesting good opportunities to buy in and hold on.

Positive ‘future’

The funding rate for BTC according to Glassnode data also looks positive. This suggests those with long positions on BTC Perpetual Futures are still willing to pay to hold on to their lost positions despite the correction in the past two days. This further lends weight to the above point where weaker hands have been eliminated with stronger hands still holding on.

And, along with that, the BTC options put/call ratio is also hovering close to just below 0.5. This also goes on to show that derivatives traders are buying up call options aggressively at current levels thus bringing down the ratio.

So overall, despite the dip in the past few days, there is nothing really to worry about Bitcoin. This point may be taken advantage of through buying-the-dip thus getting a better average price for those who have been holding on to BTC at higher prices. This is merely a breather before a continuation of the rally unless major headwind news crops up to defeat the bullish sentiment.