Bitcoin price might have crashed on 6 March and the short-term outlook could appear bearish, but the long-term outlook remains bullish as ever. There are three significant on-chain metrics that paint an uber optimistic scenario for BTC in the upcoming bull run.

Extreme bullishness for Bitcoin price

Perhaps the most widely used and equally significant on-chain metric for Bitcoin price is the 365-day Market Value to Realized Value (MVRV) model. This index is an insight into the investor sentiment at any given point in time. It can be used to assess the average profit/loss of market participants that purchased BTC over the past year.

The major advantage of using this metric is that it provides a signal as to when a sell-off is likely to occur. And, when an investor should be bullish. Based on Santiment’s research a value below -10% indicates that short-term holders are selling at a loss and is typically where long-term holders tend to accumulate.

Hence, a value below -10% is often referred to as an “opportunity zone,” since the risk of a sell-off is less. However, the opposite is also true, which reveals that a high MVRV value indicates that many holders are in profit and are likely to sell to realize their gains.

At present, the 365-day MVRV is hovering around the zero line, indicating that the investors are not profitable. However, over the past four years, the local top for BTC has occurred when the MVRV hits 24%.

So, a conclusion states that there is still more room for BTC to move to the upside before a threat of a sell-off emerges.

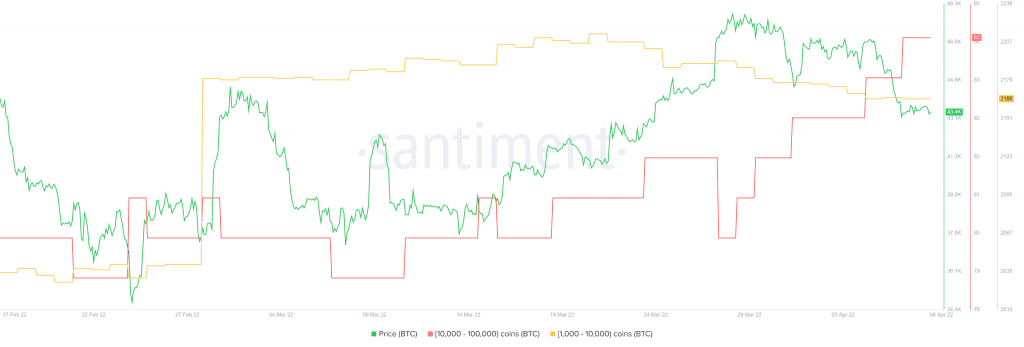

The next significant indicator that long-term investors should pay attention to is the supply distribution of whales holding BTC.

Investors holding between 1,000 to 10,000 BTC have been accumulating since June 2021 and the same can be said for the wallets holding between 10,000 to 100,000 BTC. The number of former market participants has increased from 2,034 to 2,166, representing a 6.5% spike.

The next category of holders with 10,000 to 100,000 BTC has increased from 78 to 85. A spike in such holders only indicates that institutions are heavily optimistic and are expecting an explosive performance of the Bitcoin’s price.

The exchange net position change indicator also paints a picture of the behavior of large investors. Since March 2022, a total of 100,000 BTCs have flown out of centralized entities, effectively reducing the sell-side pressure.