Bitcoin (BTC) will hit $100,000 once the sustained selling pressure from China starts to “ease up” after the end of this year, according to bitcoin expert Samson Mow.

Cryptocurrency markets have fallen sharply since bitcoin reached a record high of $69,000 on Nov.10, in large part dragged by Asian investors.

“There is significant sell pressure [from China] at the moment,” Mow, chief strategy officer of Canadian blockchain firm Blockstream, told BeinCrypto in an interview on Dec. 20.

Mow said markets have taken a knock as crypto-related firms scramble to leave mainland China to comply with a new law banning bitcoin.

He cited the example of Binance and Huobi Global, two of the largest digital asset exchanges globally, which are targeting to have shut down all peer-to-peer (P2P) services in China over the next ten days.

Both platforms are popular with Chinese users, but they stopped new registrations of accounts by customers from the mainland once the ban was announced in September.

“So people are closing positions before the peer-to-peer applications are gone,” said Mow, who is also credited as the main architect of El Salvador’s bitcoin bonds.

“There’s also some overlap with the preparation for the Chinese New Year [beginning in early February] for which people need cash.”

Prices fall as China clamps down on bitcoin

China, one of the world’s largest bitcoin markets, introduced a blanket ban on all crypto mining and trading in September.

Since then, several bitcoin exchanges and other crypto-service companies have severed business ties with users from mainland China to comply with local regulations.

While China officially banned cryptocurrency trading in 2019, users continued doing so online through overseas platforms.

However, there has been a significant crackdown this year. The September ban made it clear that those involved in crypto activities were committing a crime and will be prosecuted.

Authorities also warned that foreign-based exchanges providing similar services to Chinese citizens over the Internet will be investigated.

Crypto markets tumbled amid the crackdown, with the price of BTC missing forecasts as it see-sawed between $42,000 and $54,000 in the last few weeks.

Analysts were looking for a price of somewhere between $100,000 and $135,000 by end of December.

Chinese capital to flow back into crypto

Samson Mow expects the selling pressure from China to “ease up after the year’s end,” leading to a recovery in crypto prices.

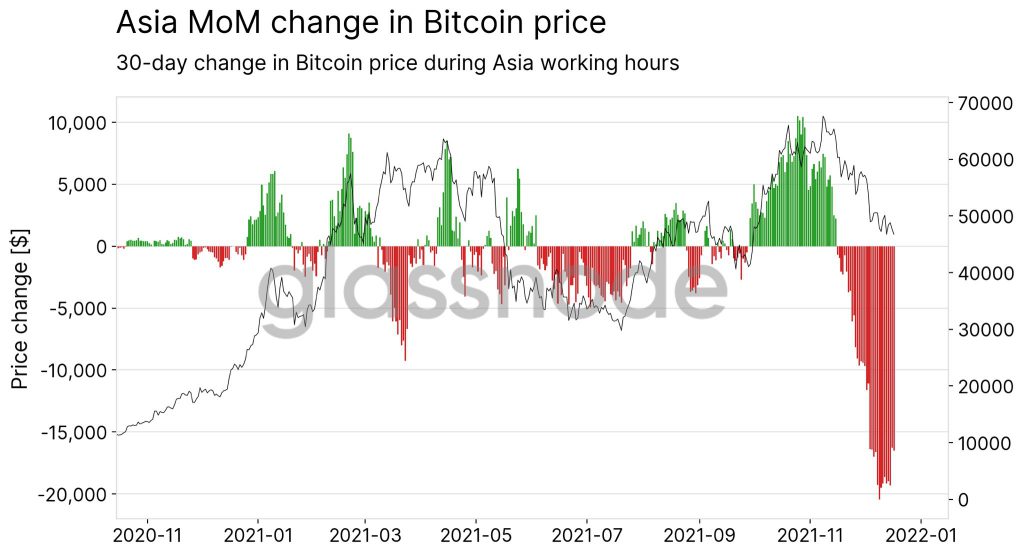

He pointed to how the data suggesting this to be correct, with an “unprecedented amount” of selling from the region tending toward a decline in BTC prices during Asian working hours.

This selling pressure intensified in November and December, according to a new report by blockchain analytics firm Glassnode.

The report says that markets often trade lower during Asian business hours compared with European or U.S. business hours – something that shows investors from Asia, it adds, as driving much of the selling.

To arrive at this conclusion, Glassnode compared daily bitcoin prices with those from a month ago and considered huge monthly price changes at different times of the day.

Mow said much of the Chinese money that appears to be leaving the crypto market now will eventually come back.

“It’s not so much that Chinese money is leaving the market, but that there is uncertainty right now about trading venues and access to trading. People are selling and sitting back in RMB [Chinese yuan],” he explained.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.