Bitcoin’s [BTC] bull cycle mostly ends with an improved performance over the last and this time, the case might remain the same.

Mr Papi, a CryptoQuant analyst opined that the coin’s holders might be in for long-term gains. According to him, the current BTC growth level could lead the price beyond the All-Time High (ATH) of 2021. Predicting the next bull cycle at 179% growth, Papi said BTC could trade at $115,000.

Here’s AMBCrypto’s Price Prediction for Bitcoin for 2022-2025

Any truth in this?

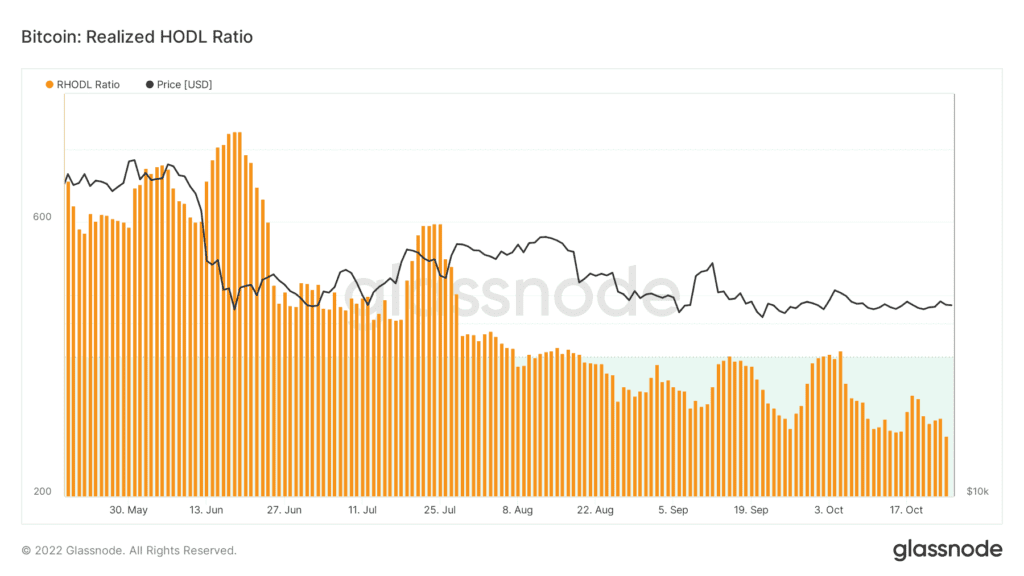

Interestingly, it could seem that there were some facts in his opinion. According to Glassnode data, the Realized HODL ratio was at 254.94 at press time.

Compared with previous years, this signaled an extremely low point. As a result of the current state, it indicated that Bitcoin was not overheated. Also, the price was far off from reaching cycle tops and there was possibly a further downtrend.

A look at the long-term holder SOPR indicated that much fewer holders were in profit. Hence, the bull cycle might not be close by in any terms.

At the time of this writing, the long-term holder SOPR was 0.66, meaning that most investors who have held for 155 days or more had sold at a loss.

However, all hopes might not be lost as the metrics inch closer to the value of one. This was because the SOPR was previously at 0.525 some days back, and this current momentum could take investors into profit. Irrespective of the short-term trend, BTC was almost certain to exit its month-long consolidation before the cycle began.

What else should holders expect?

Besides the aforementioned analysis, Mr. Papi also pointed out other things that could occur in the next bull cycle. According to him, the lack of large volumes injected into the market, like during COVID-19, could leave Bitcoin probably moving in two opposite directions.

First, BTC could decline by another 50% and start the bull run by 2023. Another option was the coin maintaining consolidation as it has recently been waiting till 2025 before becoming significantly bullish.

Additionally, it might seem that BTC holders have resolved to move their coins around rather than leave them comatose. Santiment revealed this status. According to the on-chain analytic platform, the 90-day BTC dormant circulation was 2687.

As this was lower than usual, it indicated the movement of long-term holdings. Despite the investors’ action, it could not impact much on the 90-day circulation.

Santiment showed that BTC’s circulation within the period was relatively low at 1.93 million. This indicated that the number of unique transactions was still stunted. BTC long-term holders might need to do more as per activity to make a crucial impact before expecting a significant uptick.