One of the simplest strategies for trading cryptocurrencies involves the application of moving averages (MA). The basic premise is that if the price of an asset is above its moving average for a certain number of days, this is considered a buy signal. Once it falls below its moving average, the asset is sold, and a cash position is maintained until the price crosses the moving average again in the upper direction.

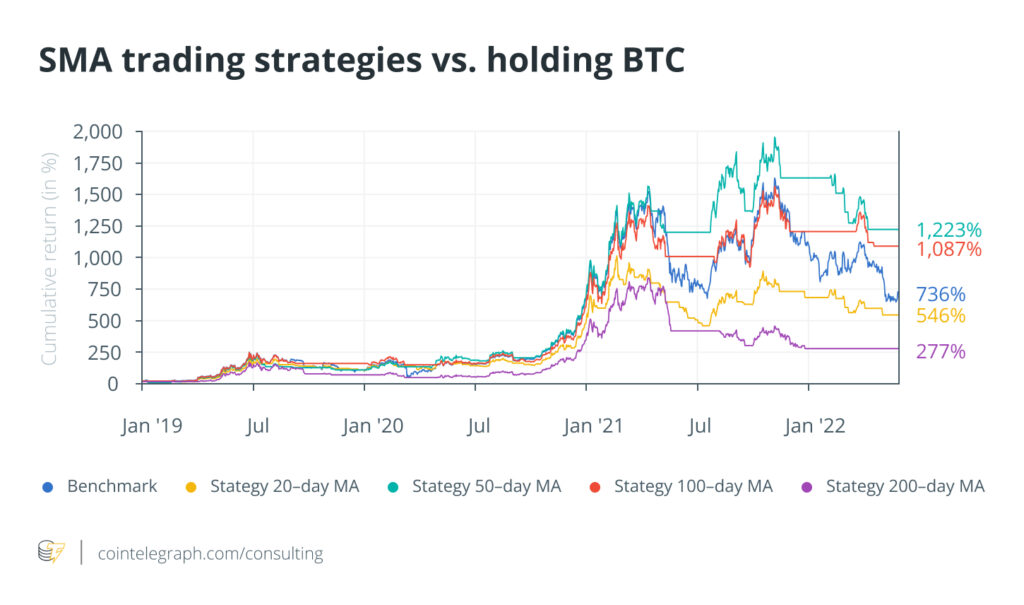

Cointelegraph Consulting’s latest bi-weekly newsletter issue looks at the many ways moving averages can be tweaked to catch Bitcoin price swings. Using Coin Metrics’ price data, this analysis is broken down into four parts. The first part uses trading strategies for different simple moving averages (SMA) — i.e., equal weighting of all past prices within the specified time window. The second part of this analysis looks at a specific form of moving average, the exponential moving average (EMA), where the weight of the more recent periods increases exponentially.

The third part looks at strategies that only trade once significant momentum signals appear, namely the golden cross and the death cross. Finally, rolling returns of different moving average strategies will be considered to evaluate which strategy was most successful.

Simple moving averages vs. exponential moving averages

For the sample period chosen in the charts below, the 50- and 100-day SMA strategies outperform their EMA counterparts. However, choosing a 20- or 200-day EMA strategy yields better results compared to the simple moving average strategies. It comes with the added benefit that maximum drawdowns are significantly lower.

In general, it is not clear which type and length of moving average will yield the best results. As EMAs put higher weight on more recent market moves, they are more likely to provide a trading signal earlier, albeit at the cost of some signals being wrong.

Comparison based on different entry points

Some of the strategies described above appear to be successful. However, beating the market is more difficult than following simple timing strategies. Especially in a bull market, many strategies yield results simply because the general trend is positive. In more difficult times, many strategies cannot shield from incurring losses.

If one invested based on these strategies in January 2022, all strategies would have beaten the market. The 200-day MA strategy would have signaled not to invest at all, which would have yielded the best outcome. All other strategies generated losses. The 50-day MA strategy illustrates how false signals can lead to value destruction that can at times exceed losses from a simple buy-and-hold strategy.

“Two crosses” strategy

In the field of technical analysis, traders often talk about the golden cross and the death cross. Both terms refer to the behavior of moving averages to each other. The most common version of the golden and death cross is related to the 50-day and 200-day MA. Once the 50-day MA moves above the 200-day MA, this golden cross signals an upcoming bull market, while the death cross — i.e., the 50-day MA moving below the 200-day MA — often marks the start of a bearish period.

The strategy that only considers a golden cross and death cross gets the general market trend right. It enters ahead of significant uptrends and exits once a serious downturn occurs. However, as this strategy reacts to larger market trends, it does take some time to exit the market and enter it again. This can shield from heavy losses but may also lead to some missed opportunities when the market changes direction.

Rolling analyses

The above results show that strategies based on moving averages are no panacea for bear markets or market fluctuations. Since the entry point matters for the performance of such strategies, one should look at different starting points.

The chart below shows what returns could have been made by applying a given strategy for one year — i.e. the return displayed for Jan. 1, 2017, is the result of a strategy that started on Jan. 1, 2016.

The same analysis can be done by executing each strategy for two years instead of one. While differences between strategies are at times wider compared to the analysis with one-year returns above, a similar picture emerges as the 20-day MA strategy yielded promising returns in 2018 and 2019, while the 50-day MA strategy performed better in 2021 and 2022. Yet in both analyses, a simple buy-and-hold strategy can outperform for some periods of time.

Rolling returns of executing a strategy for three years are qualitatively not too different from the two-year rolling analysis but come with higher returns in market run-ups, except for the one in 2021. However, when comparing all three time windows, it becomes clear that the ordering of strategy success can change over time. While the 20-day MA strategy has been dominant for some years (depending on the time frame of the rolling analysis), it has significantly underperformed in other years. The same can be said about the other strategies. Therefore, past returns are not a reliable predictor of the future success of a particular strategy.

Averaging out

Momentum strategies based on moving averages can provide some guidance for traders and may at times provide relevant information about the general market trends. Nonetheless, they should be treated with caution as length, type of moving average, and starting point of an analysis can yield different results. Investors should carefully evaluate the data used and make sure that they are able to react to any signal in a timely manner.

Cointelegraph’s Market Insights Newsletter shares our knowledge on the fundamentals that move the digital asset market. The newsletter dives into the latest data on social media sentiment, on-chain metrics and derivatives.

We also review the industry’s most important news, including mergers and acquisitions, changes in the regulatory landscape, and enterprise blockchain integrations. Sign up now to be the first to receive these insights. All past editions of Market Insights are also available on Cointelegraph.com.

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.