Admit it – Bitcoin’s rally slowed down and went into reverse and maybe you found yourself not just losing faith in cryptos, but also metaverse tokens and NFTs. Maybe you even wondered if the NFT era was over.

However, a report by Chainalysis provided a wealth of information about the NFT scene and how it is evolving – rather than crashing.

The gilded age. . .is still here?

The “too long, won’t read version” – the NFT market isn’t dying any time soon. While investors might be nostalgic for the NFT boom of 2021, profits are still coming in fast. The report stated,

“Overall, collectors have sent over $37 billion to NFT marketplaces in 2022 as of May 1, putting them on pace to beat the total of $40 billion sent in 2021.”

While there have been fewer spikes in 2022, the report pointed out that active NFT buyers/sellers were still rising in number.

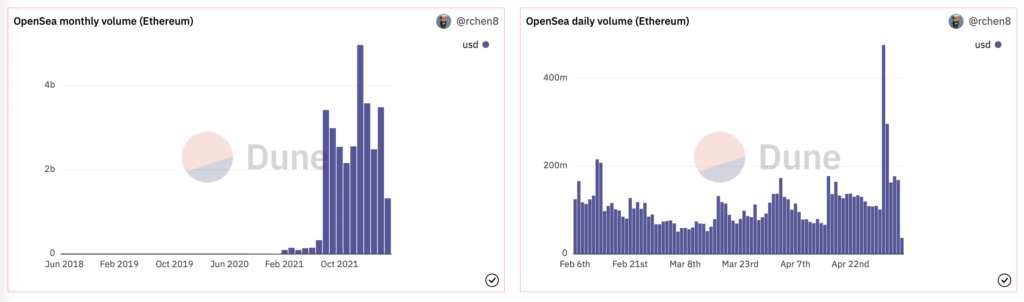

For further proof, let’s take a look at the stats for the NFT marketplace OpenSea [Ethereum], compiled by Dune Analytics. While larger market events did bring total NFT transaction activity from nearly $4 billion less than $1 billion, there was some recovery from mid-April even on OpenSea.

Source: Dune Analytics

Chainalysis’ report added,

“In Q1 2022, 950,000 unique addresses bought or sold an NFT, up from 627,000 in Q4 2021. Overall, the number of active NFT buyers and sellers has increased every quarter since Q2 2020.”

That being said, however, the latest crash which saw Bitcoin trading at $36,339.18 at press time has greatly weakened the value of metaverse tokens such as Axie Infinity [AXS], ApeCoin [APE], The Sandbox [SAND], and Decentraland [MANA]. Naturally, investors are watching the top NFT collections to see if they also follow suit.

After all, the 24 hours sales volume of the Bored Ape Yacht Club [BAYC] collection fell by 80.21% in the last 24 hours.

No NFT left behind

So what kind of NFTs are currently ruling the market? Are investors looking to the old and gold classics, or are they ready to try out newer and less expensive collections? Are these celebrity NFT traders or everyday users like you? Chainalysis’ report clarified,

“The vast majority of NFT transactions are at the retail size, meaning below $10,000 worth of cryptocurrency. NFT collector-sized transactions (between $10K and $100K) grew significantly as a share of all transfers between January and September of 2021, but since then have stayed flat.”