One of the principal aspects of on-chain analysis is to examine transactions over the network. Unlike exchange-involved transactions, which often lead to price volatility, transactions outside of exchanges demonstrate the network utility as possible payments among users. It makes a positive contribution to the development of the network over the long term if users are interacting with one another. Therefore, it is essential to examine the transaction behavior over the network.

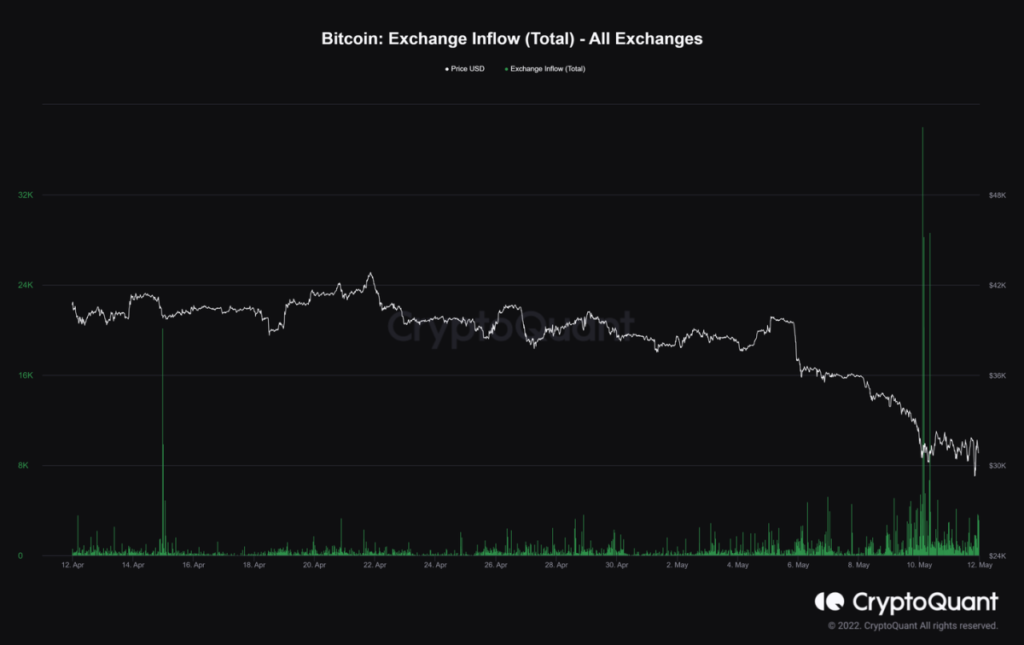

The recent spike of bitcoin inflows to exchanges make many worried, but does it adversely affect the entire network on the macro view? (source)

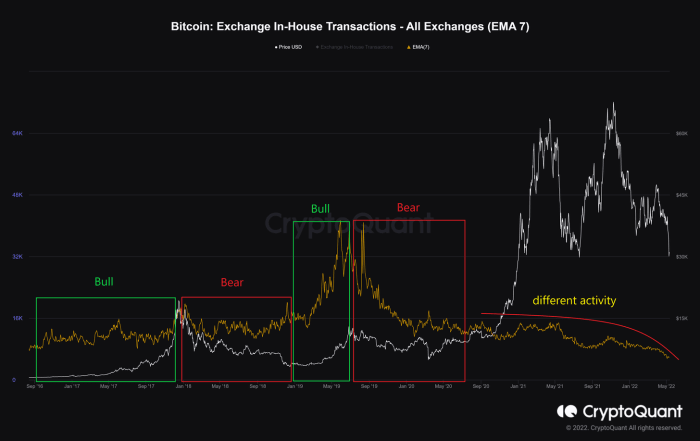

Regarding the sum of all exchange in-house transactions, the number of transactions circulated within the exchanges’ wallets have been trending lower from the May 2021 peak. That means there is not as much transfer activity through the marketplace. It looks different from the previous price cycles when this number was strongly correlated to the price action.

Transactions conducted within exchanges’ wallets in downtrend. (source)

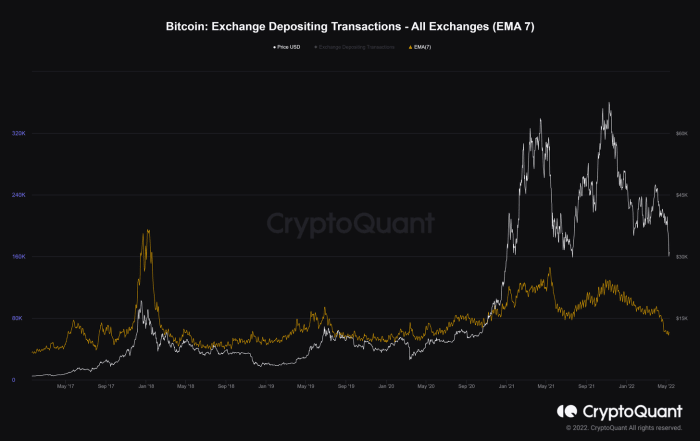

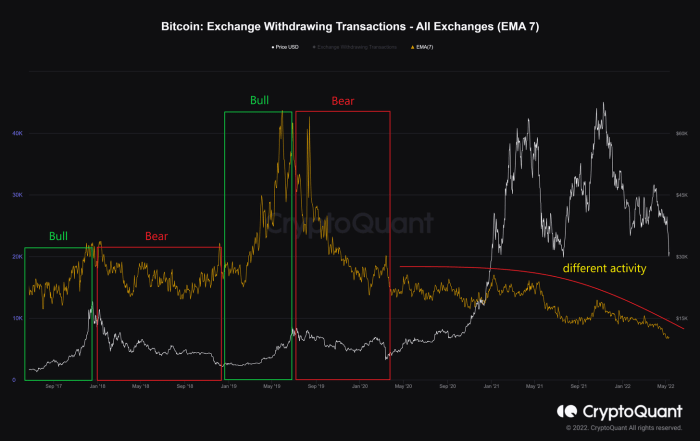

Meanwhile, the total number of deposits and withdrawals to and from exchanges has plunged downwards, demonstrating that people may be less engaged in the exchanges.

The deposits to exchanges plummeted. (source)

The withdrawals from exchanges are also decreasing. (source)

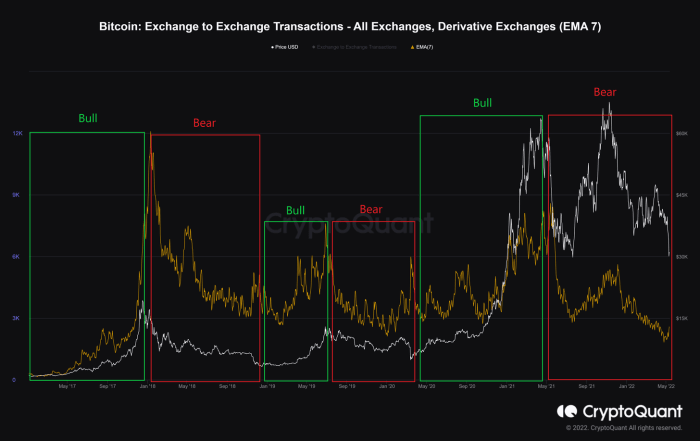

Additionally, the number of transactions from all exchanges to derivatives exchanges has plummeted as a clue that derivatives trades are not very attractive at the moment.

Fewer transactions into derivatives exchanges. (source)

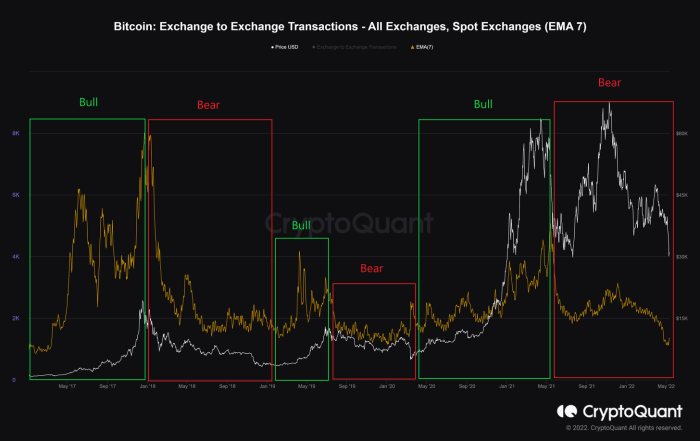

In the meantime, there is no further possibility of cumulative selling pressure due to the substantial drop in the number of transactions from all exchanges to spot exchanges. This offers the slightest of encouragement and mitigates bearish sentiment among stakeholders.

The decreasing possibility of selling pressure on spot exchanges with fewer bitcoin on spot exchanges. (source)

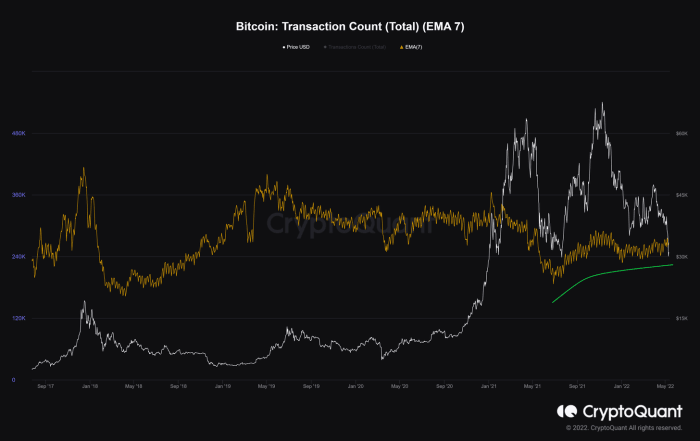

Concurrently, the sum count of transactions has moved up in contrast to the downtrend in exchange-related transactions. It implies an increased supply/demand outside of exchanges, resulting in a high usage of the Bitcoin network.

High network utility, as total transaction count is increasing and exchange transactions decreasing. (source)

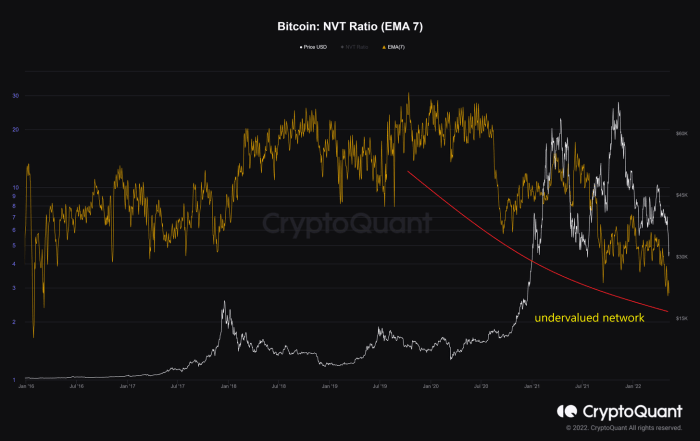

Network value-to-transaction (NVT) is the ratio of market capitalization divided by transaction volume. That helps gauge the relativity between network value and network usage as transaction volume represents network usage. A falling NVT proves that the velocity of coins circulating in the bitcoin economy has risen, and the network value is relatively undervalued compared to its high utility.

NVT ratio illustrating the undervalued network and high velocity. (source)

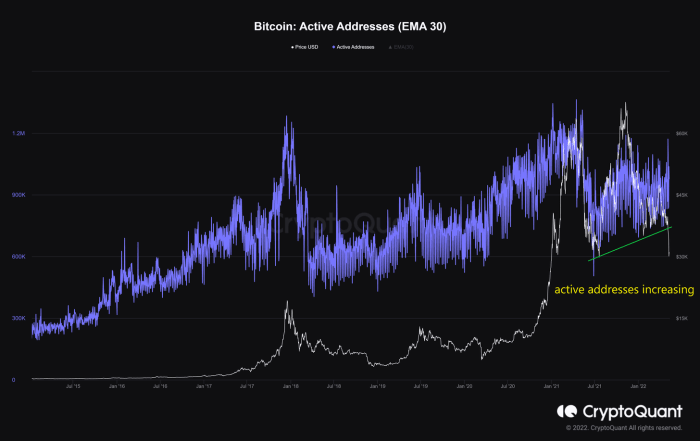

It is clear how quickly and proportionally transactions are conducted on the network in and outside of exchanges. We should pay attention to the sum of unique active addresses, including both senders and receivers. The sum of active addresses has gradually increased since the July 2021 bottom. This has been a good indicator for the development of network activity since Bitcoin’s inception.

Total active addresses revealing the development of the Bitcoin network. (source)

Ultimately, long-term investors are concerned about the digital attributes to the velocity of bitcoin usage in the economy rather than its trading price. With limited supply and increasing demand, an increase of transactions and active addresses over time demonstrates the growth of the Bitcoin network’s utility.

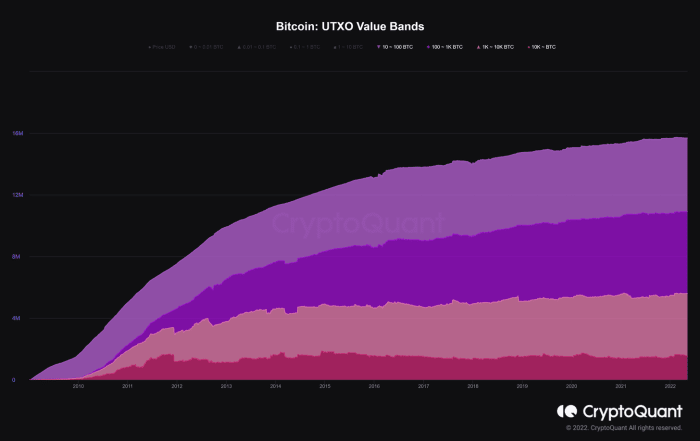

The key feature of the on-chain analysis is the HODLing behavior of long-term investors. One of the most reliable indicators is UTXO value bands which illustrate the distribution of all UTXOs in terms of their size. All studied UTXO bands herein represent the total value of all UTXOs ranging from 10 to more than 10,000 bitcoin, which focuses on the behavior of whales. As seen in the following figure, more UTXOs have been held in enormous quantities suggesting that whales are not distributing coins and are instead accumulating.

Whales are accumulating in line with UTXO value bands. (source)

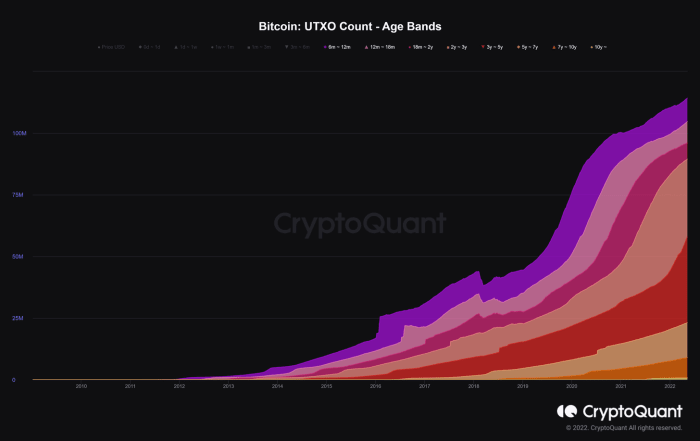

In addition, UTXO age bands display the number of UTXOs that last moved within a specified duration. All considered bands (over six months) have been maintained and gradually expanded. This implies that more investors have been holding and accumulating more coins.

Coin age maturity with reference to UTXO age bands. (source)

The UTXO count age bands and value bands suggest that short-term liquidity is dominant throughout the market, whereas long-term liquidity is still virtually dormant and slightly increasing. Simply put, long-standing HODLers are calmly confident regardless of the short-term volatility in bitcoin’s price.

On balance, the utility of the Bitcoin network has been growing during the recent semi-bear market. The transaction behavior outside of exchanges has been carried out as a feasible payment process, and the Bitcoin community has adopted the HODLing attitude.

This is a guest post by Dang Quan Vuong. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.