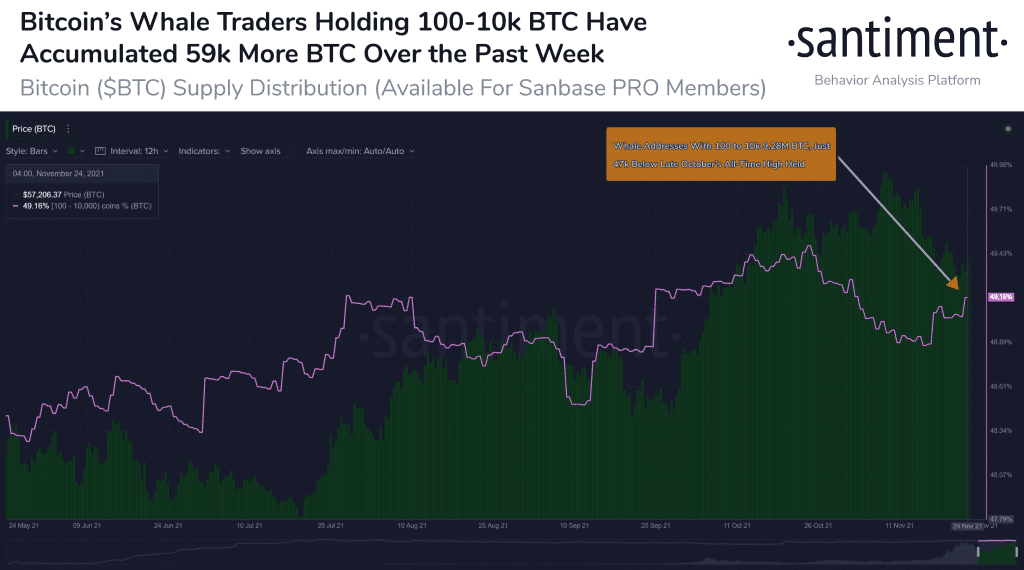

As Bitcoin (BTC) continues to move sideways whales have been grabbing the supply in the meanwhile. As per on-chain data provider Santiment, Bitcoin millionaire-tier whale addresses have accumulated a staggering 60,000 Bitcoins over the past week. The data provider noted:

If you’ve been waiting for #Bitcoin whales to show signs of accumulation, our data indicates it’s happening once again. In the past week, a total 59k $BTC has been added to addresses that hold between 100 to 10k $BTC. This is 0.29% of the total supply.

Another popular analyst Will Clemente explains that there have been clear signs of bullish divergence between the Bitcoin supply moving to strong hands and the BTC price.

Over the last two weeks, clear bullish divergence between BTC supply moving to strong hands and price. pic.twitter.com/6jeairtXX8

— Will Clemente (@WClementeIII) November 24, 2021

Bitcoin In Deep Oversold Territory

As the Bitcoin (BTC) price has been trading sideways around $56,000 levels, crypto analyst Philip Swift spotted a bull flag on Bitcoin’s Advanced NVT Signal. The Advance NVT uses Bitcoin’s market cap and its network volume to determine the extent to which Bitcoin is oversold.

Thus, the Advanced Bitcoin NVT is the total BTC marketcap divided by the 90-day moving average of the network transaction volume. In his recent tweet, Swift wrote:

Advanced NVT (blue line) has now dropped deep into oversold territory (green bands). #Bitcoin is looking seriously cheap relative to network activity here on high time frames. Expecting a strong reaction in the not too distant future.

While Bitcoin whale accumulation continues, other big institutional players have also been accumulating over the last few months. In its recent filing with the U.S. SEC, banking giant Morgan Stanley revealed that some of its funds added Bitcoin in the quarter ending September 30.

For e.g. the Morgan Stanley’s Growth Portfolio Fund added a staggering 1.5 million shares of the Grayscale Bitcoin Trust (GBTC). Similarly, the bank Insight Fund also added 600,000 shares of GBTC.

In new SEC filings, Morgan Stanley has disclosed a dramatic increase in Bitcoin exposure in its asset management business.

Earlier this year, Morgan reported buying Grayscale BTC in a large number of investment funds. For the three funds with the largest Grayscale holdings…

— MacroScope (@MacroScope17) November 24, 2021

All these indicators suggest that the Bitcoin (BTC) price rise is on the horizon.