- Huobi has predicted that 2022 will be a bear market year for Bitcoin as central banks tighten their monetary policies and the market sees a liquidity crunch.

- The exchange also predicts that DAO will become a major on-chain governance form, cross-chain interoperability will shoot up and DeFi 2.0 will take center stage.

Yet another major entity in the cryptocurrency sector is predicting a gloomy year for Bitcoin in 2022. Huobi exchange foresees a bear market for the top cryptocurrency as liquidity crunch ensues following tightening of monetary policies by the Federal Reserve and other central banks. On a positive note, DeFi will continue to grow and evolve and DAO governance will become a major driving force of growth for on-chain activity.

2021 was the crypto industry’s biggest year yet, DeFi, NFTs, cryptocurrency adoption, blockchain use, and more factions seeing great growth. Web 3.0 and the metaverse also brought blockchain technology to the limelight. Regulators are also catching up, with 40 countries promulgating over 150 separate regulations for crypto as per the “Global Crypto Industry Overview and Trends” report by Huobi Research in partnership with Blockchain Association Singapore.

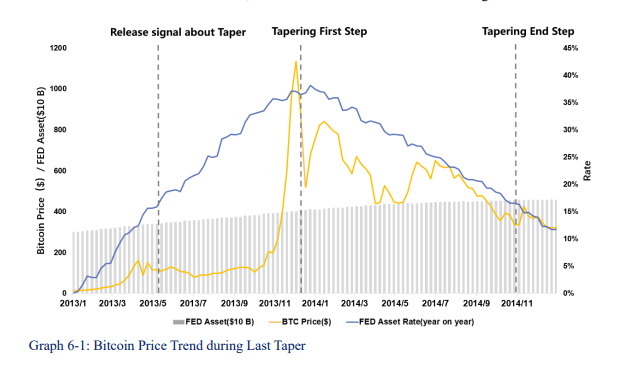

And while many of these sectors will continue growing in 2022, it may be a bleak year for Bitcoin. In its report, Huobi noted that the U.S Federal Reserve has started to engage in tapering, a process in which it pulls back on the liquidity it has been injecting into the market, signifying a diminishing return on dollar liquidity.

Huobi notes:

Although it does not inherently change the direction of liquidity, it is likely to alter the direction of fund flow or the degree of mismatch in assets. Highly risky assets like Bitcoin, are theoretically more sensitive to the change in dollar liquidity.

Back in 2013, the Fed took a similar step, and it was followed by a bear market that lasted for two years. While the market has greatly changed and there’s more liquidity and more BTC owners now, Huobi believes that a similar move can’t be ruled out.

DeFi 2.0, cross-chain interoperability, DAO and more in 2022

Despite the bleak prediction on Bitcoin, Huobi predicts that there will still be plenty of growth in other sectors of the industry.

One of these is DeFi, a sector that shot up from $19 billion in January 2021 to close the year at $250 billion in total value locked. In 2022, we will see the sector evolve into DeFi 2.0.

“DeFi 1.0 is inefficient in capital turnover, liquidity and consumption, which limits growth potential,” Huobi says.

For DeFi to grow, we must have better liquidity, higher profitability and more products.

DeFi 2.0 projects, represented by OlympusDAO and Alchemix, have progressed for the first time. DeFi 2.0 projects will be more adaptive to market changes due to advantages in the form of liquidity, profitability and potential of innovation. More DeFi 2.0 projects will likely appear.

DAOs will also become a major on-chain governance form, Huobi predicts.

“In the future, there will be demand for the management of DAOs and funds they oversee. Specifically, the management of DAO funds could connect with various DeFi applications, facilitating a venue for treasury management,” the exchange predicts.

Related: Huobi celebrates 8th anniversary by sending one lucky winner to space