hourly

1

The digital art platform claimed to have been working on making the non-fungible tokens trading experience into something “easier for anyone” interested in collecting NFTs, as Ethereum gas fees are a known problem that might keep some users away.

Nifty Gateway says that “Paying for gas is a huge burden to not only new people joining in the space but for veterans of the space as a whole. ” They intend “to help remove the friction” between new users and their first NFT or experienced users and the value of their collection. The new wallet feature is set to launch in January 2022.

Ethereum defines gas as “a unit value that quantifies the work Ethereum does”. Is a fee charged for transactions on its blockchain and the amount of gas varies for each transaction depending on its complexity. Nifty Gateway Illustrated the case for NFT buyers:

For example, let’s say that you’re trying to buy an NFT at a set price of .01 Ξ … the price could potentially become close to DOUBLE the amount you were expecting to pay. This unfortunately is the current state and experience of buying an NFT and it ultimately discourages people from being more active collectors.

Related Reading | Ethereum Founder Puts Forward New Fix For High Gas Fees

Nifty Gateway Upcoming NFT Event

The non-fungible tokens platform also released a “Gas Savings Calculator” where users can connect their Metamask address to see an approximation of how much they “would have saved” by using the new wallet-to-wallet feature.

Furthermore, they are also preparing for a new event after the August Secondary Summer Slam, which rewarded the top 150 spenders on Nifty Gateway’s secondary market, and the platform’s fees were rebated. The new event is called WAGMI Winter Wham and will work in conjunction with the gas-saving feature.

#WAGMIWW is a follow up to the highly successful Secondary Summer Slam event we held in August 2021 and will feature a ton of amazing collector rewards for people who participate.

As Nifty Gateway was preparing to announce the new service, the platform saw an auction sell around 250,000 NFTs by the anonymous artist Pak for a total of $91.8 million, which he allegedly called “the largest ever art sale by a living creator” and was overjoyed “it happened on a web3 platform”.

26,000 collectors participated in the sale, which featured an art project called ‘The Merge’ that had a built-in scarcity mechanism and was set to defy traditional ways artworks are sold.

Related Reading | Eminem Releases Beat-Inspired NFTs In Partnership With Gemini’s Nifty Gateway

Bitcoin itself has posted various recovery trends that have brought its value back up towards $50K. However, the coveted price point remains elusive for the digital asset as its struggles to find its footing above it post-crash. Nevertheless, pseudonymous crypto analyst TechDev, has said that this may only be temporary as bitcoin could be readying for a parabolic move.

Related Reading | Only In Crypto: Ted Cruz Cosigns Argument That Bitcoin Miners Are Fixing Texas Electric Grid

A Discussion Of Analysts

In a discussion with fellow crypto analyst Benjamin Cowen, TechDev lays out some of the indicators that could point to a possible bullish pattern for bitcoin in the short term. If there is one thing that the digital asset is known for, it is its highly volatile nature. While most tend to focus on negative connotations of the word volatile, it also carries some positives for the asset.

Bitcoin can surge in price just as quickly as it crashes and this has characterized the space for the longest time. TechDev uses a number of indicators to lay out his argument for an impending parabolic move, including logarithm growth curves in addition to Fibonacci levels. He lays both of these atop a Bitcoin long-term chart that shows two-week candles on them.

Related Reading | Ethereum Fees Suggest DeFi Is Becoming The Playground Of The Rich

Focusing on the Fibonacci level, TechDev explains that when bitcoin breaches the 1.618 level, then the asset is set to go parabolic. Coincidentally, this Fibonacci level is also in the same place as the middle logarithmic band. The crypto analyst also revealed that the market looks to be right on track and healthy.

“As of today, we’re kind of right at what I would call a key intersection point between this mid curve of the log regression band, this 50% fib curve of this band, and this 1.618 level. If we can close a 2-week candle above it, I am expecting some explosive price velocity upwards, and I’m excited to see where that takes us.”

Bitcoin Price Continues To Fluctuate

Bitcoin price fluctuations have not really come as a surprise. If anything, these kinds of dips are expected when an asset grows as much as bitcoin has in the past few months. Although market sentiment tends to skew in the negative during times like it, it has always presented as an opportunity for investors to load up at what some refer to as ‘discount prices.’

BTC bounces above $50,000 | Source: BTCUSD on TradingView.com

Bitcoin had mostly consolidated below $50K following the crash but a recovery trend in the early hours of Tuesday saw the asset breaking through this resistance level and landing snugly above $51K.

Featured image from Toshi Times, chart from TradingView.com]]>

That could be signaling change this week, as French videogame developer Ubisoft has officially launched Ubisoft Quartz, the firm’s first endeavor into NFTs that features three free collectibles, built on Tezos.

Don’t Say You Didn’t See It Coming…

Our team at Bitcoinist covered the beginning of this storyline for Ubisoft back in October, when the company’s CFO called blockchain tech a “revolution,” and contributed funding towards crypto blockchain firm Animoca Brands. The perspective was seemingly more bullish than those shared from competitors Epic Games and Valve.

Ubisoft Quartz will bring to life NFTs that the company is calling ‘Digits.’ According to the launch site, Quartz is “built upon [the] vision of creating an ever-greater connection between you and the game worlds you love.”

The initial unroll of Digits will be three free NFTs for Ubisoft title, Ghost Recon Breakpoint. The Digits will start hitting the market on Thursday, December 9 2021. Digits will be minted once (so past Digits will not be re-minted), and will include serial numbers and be connected to player usernames. Resale support will be included through third-party NFT sites like Rarible and Objkt.

Related Reading | How NFTs Are Changing The Face Of Crypto Trading Contests

Tezos (XTZ) was the blockchain of choice for Ubisoft, and has reacted positively after some recent challenges. | Source: XTZ-USD on TradingView.com

Gaming & Crypto

Crypto’s emergence into gaming, and related verticals, has been host to more visibility lately. Tezos, the blockchain of choice for Ubisoft, has been one chain that has been highlighted in gaming and has overcome substantial challenges as of late.

Other major chains that have been stepping to the plate include Polygon, who designated a $100M allocation for NFT gaming projects earlier in the year, as well as Solana, WAX, and Algorand. Of course, metaverse platforms like Decentraland and The Sandbox are certainly gaming-adjacent as well.

We’ve also seen major players get involved at a sponsorship level. Coinbase, for example, has teamed up with the likes of ESL Gaming this year, and has engaged with partnerships on the organizational level as well.

For more on blockchain gaming, play-to-earn, and related topics, check out our recent report from sister network NewsBTC.

Related Reading | NFT Platform Starly Welcomes VC Funding, Gears Up For Listing

Featured image from quartz.ubisoft.com, Charts from TradingView.com The writer of this content is not associated or affiliated with any of the parties mentioned in this article. This is not financial advice.

Related Reading | El Salvador To Build The First Bitcoin City Using Tokenized Bitcoin Bonds

DeLorme Pays For Coffee With Bitcoin

The big international chains were the first to figure out how to successfully receive Bitcoin payments. We’ve seen videos from every El Salvador visitor and their grandmothers paying for a cup of coffee through The Lightning Network. DeLorme’s observations, however, provide new insights. He declares Starbucks “one of the most seamless Bitcoin user experiences I had has thus far.” Of course, they didn’t use the Chivo Wallet. They used the Guatemalan payment solution, IBEX Mercado.

Now, check out this alpha he gives us:

“IBEX Mercado appears to use Lightning as its default. Interesting to note what appears to be a Chivo logo in the info bar at top of the cashier’s UI. They may be running Chivo on the same phone. One person has told me that for merchants running more than wallet, if you look Salvadoreño, the cashier will most likely present you with Chivo; if you look like a foreigner, they will most likely present you with IBEX.”

This has nothing to do with discrimination. Only Salvadorans can use the Chivo Wallet, and the system seems to work when it’s Chivo to Chivo. On the other hand, when a foreigner approaches they know that he’s going to use any other Lightning Wallet, so Starbucks whips out IBEX Mercado’s payment solution. Pretty clever, if you think about it. A way to navigate the mess of the first few months, until everything settles down.

Paying For Fast Food With Bitcoin

When it was time for lunch, Stephen DeLorme went to Dennis. This time, the experience wasn’t nearly as smooth. After a few hilarious scenes, much confusion, and several wallets, this happened:

“Having experienced the dollars QR code once before, I knew this wouldn’t be LN or BTC compatible, so I pulled out Strike to see if it (by chance) would work. The “Pay” functionality in Strike is not compatible with Chivo’s dollar QR code, so this seems to be a Chivo only feature.”

DeLorme manages to get Dennis’ employee to switch to Bitcoin and pay with Strike… they end up charging him twice because the Chivo Wallet doesn’t register the payment at first. And then, this happens:

“They opened the cash drawer and gave me a refund in cash. Why is that? Does Chivo app not offer a “refund” function? That’s a little frustrating that the Chivo app doesn’t automatically refresh when a payment is pending.”

So, once again, the Chivo Wallet is the one causing the problem.

BTC price chart for 12/07/2021 on Bittrex | Source: BTC/USD on TradingView.com

DeLorme Goes To The Market, Supermarket, And Mall

The next day, DeLorme goes to San Salvador’s Centro Histórico. There’s an outdoor marketplace there. What did he find? Or better yet, what didn’t he find?

“I did not find any “Aceptamos Bitcoin” signs. This was definitely a largely cash-based market. Fortunately, cell phone signal was decent in the area, so Bitcoin is an option here.”

Then, he goes to the mall. Once again, almost nobody accepts Bitcoin yet. And people were worried about Article 7’s implications. But back to DeLorme’s text:

“I then went over to the MetroCentro mall and wandered for a bit. “Aceptamos Bitcoin” signs are few and far between. I saw a homemade sign at a t-shirt vendor’s booth, as well as some official Chivo ones.”

At the supermarket, DeLorme witness a sad story. A couple can’t figure out how to pay with the Chivo wallet and leaves “the store without their groceries.” Apparently, the man forgot some kind of pin number. “It was sad to watch. It was a somewhat small order, about $10.”

Then, DeLorme enters a store called Dollarcity, in which they once again charge him twice. For the same reason.

“I paid on-chain using Strike wallet here. After about 30 seconds, her device had no indication that my payment was received. She guided me towards attempting to perform the transaction again.”

This time, they don’t give him a refund. It’s not out of malice, but out of confusion. The whole Bitcoin system is new to them, the Chivo Wallet is malfunctioning, and there’s also the language barrier. Luckily, that doesn’t stop DeLorme from making a genuine connection. This was at Wendy’s at lunchtime.

Related Reading | From The Ground: The “Bitcoin In El Salvador” Documentary, What Did We Learn?

“A local man in line behind me saw me paying in Bitcoin and approached me to ask about it. We spoke for a few minutes while waiting in line, and then after we ate as we were both leaving.

I explained that I was here researching how people are using the technology. I asked him how he felt about Bitcoin. He said that at first it just seemed like a political thing to him, but once he saw the value of Bitcoin rising, it made sense to him as a potential investment.”

So, the hunger for knowledge is there, even if it’s fueled by Bitcoin’s Number Go Up technology. DeLorme expertly points the man to the Mi Primer Bitcoin group that we met in his first On The Ground report.

Featured Image: TheDigitalArtist on Pixabay | Charts by TradingView]]>

Cascade Of Long Liquidations Lead To 24.5% Reduction In Futures Open Interest

As per the latest weekly report from Glassnode, when the price of Bitcoin crashed down to $42k a few days back, futures open interest dropped by around 24.5% as long liquidations cascaded.

The “futures open interest” is an indicator that measures the amount of derivatives contracts still open at the end of the trading day.

When this indicator has high values, it may mean that the Bitcoin market currently has an excess of leverage. Such a situation can create a volatile environment for the price of the crypto.

On the other hand, low open interest values might suggest there isn’t much leverage in the market, and so the coin may suffer lesser volatility.

Related Reading | New Study Says Ethereum May Become A Better Inflation Hedge Over Bitcoin

Now, here is a chart that highlights the trend in the Bitcoin futures open interest over the the past week:

Looks like the indicator plummeted alongside the crash | Source: The Glassnode Week Onchain (Week 49)

As the above graph shows, the value of the Bitcoin open interest was around $22 billion shortly before the crash. However, within the matter of a few hours, the metric had dropped 24.5%, or around $5.4 billion.

Related Reading | Only In Crypto: Ted Cruz Cosigns Argument That Bitcoin Miners Are Fixing Texas Electric Grid

The cascade of long liquidations responsible for this drop amounted to around 58,202 BTC in value. The below chart shows how this decline in the open interest compares with previous such events.

The May 19 change in the indicator seems to be the largest for the year | The Glassnode Week Onchain (Week 49)

According to this graph, the drop on 4th December was the second largest single day change in the Bitcoin open interest for 2021.

The 19th May sell off was the only time the indicator’s value saw a greater change within a 24 hours span. There the drop amounted to about 79,244 BTC.

Bitcoin Price

At the time of writing, BTC’s price floats around $51.5k, down 11% in the last seven days. Over the past thirty days, the crypto has lost 16% in value.

Here is a chart that shows the trend in the price of Bitcoin over the last five days:

BTC's price seems to be recovering a bit from the crash | Source: BTCUSD on TradingView

Following the crash, Bitcoin mostly consolidated sideways for a few days. However, in the past 24 hours, the crypto has broken above $51k again, which may mean that the coin could be back on the path to recovery.

Featured image from Unsplash.com, charts from TradingView.com, Glassnode.com]]>

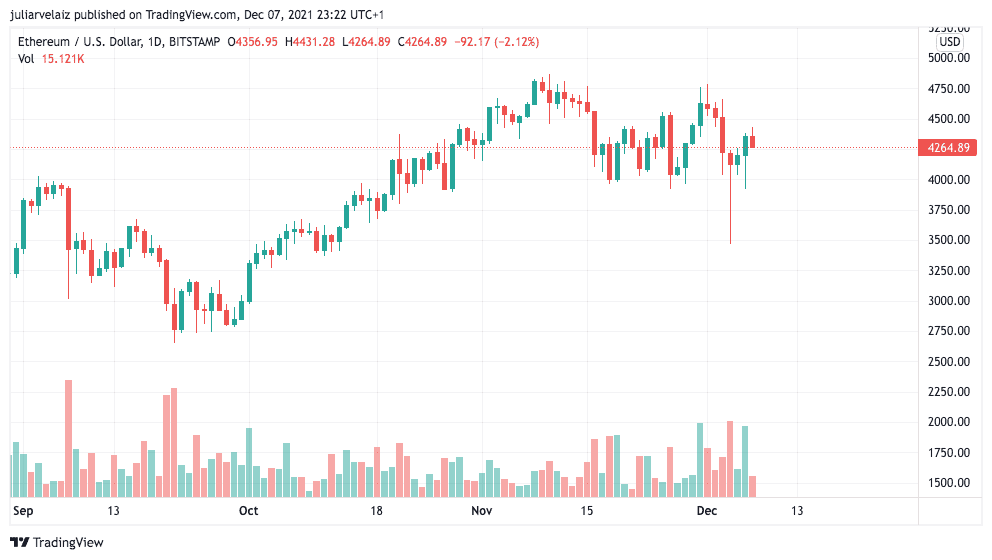

Bitcoin began last week trading in the $57,000 range, with some movement during the week, but nothing remarkable. This changed on Friday however as the cryptoasset began to fall precipitously. BTC declined to a low of $45,412 in a matter of hours – a near 20% collapse.

Ether likewise fell victim to the flash crash. Having traded up toward $4,700 midweek ETH began to fall in trading on Friday from around $4,600 to a low of $3,652 – a fall of over 20%.

Both cryptoassets have regained a measure of stability since, with prices rebounding modestly. BTC is now trading around $47,900 while ETH is trading around $4,000.

Speculation has been rife over what caused the flash crash, with some analysts citing the expiry of leveraged positions. Other evidence meanwhile points to significant increased activity with investors moving cryptoassets from wallets to exchanges – making reaction to price movement more precipitous when it comes.

The wider backdrop of investment market fears over Omicron seems to be in play too however.

Bitcoin spot ETF launches in Canada

Major asset manager Fidelity Investments has a bitcoin spot ETF in Canada.

The ETF – named the Fidelity Advantage Bitcoin ETF invests directly in bitcoin or through derivative instruments. At least 98% of the ETF’s holdings will be stored in cold wallets.

The fund is listed on the Toronto stock exchange with the ticker FBTC. The fund will have a 0.4% management fee for investors with customers given the option of investing via Canadian or US dollars.

Canada is a popular destination for crypto ETFs with more than 20 available to Canadian investors. Fidelity’s offering however is unique among crypto ETFs in offering physical holdings of bitcoin rather than trading on futures.

MercadoLibre to accept cryptoassets

Major Latin American online marketplace MercadoLibre now allows customers in Brazil to exchange and pay for products in cryptoassets.

The firm has announced users in Brazil will be able to buy, hold and sell bitcoin, ether and a U.S Dollar based stablecoin, Pax Dollar.

The combination of two major cryptoassets and a stablecoin on MercadoPago, the payments platform of MercadoLibre, will enable customers to conduct transactions for products priced in fiat currency using their cryptoassets.

MercadoPago is authorised by Brazil’s central bank, making it easier for the firm to begin its crypto operations there. But MercadoLibre more generally operates in many Central and South American countries, suggesting a potential customer base for new crypto payments of millions as it expands its offering.

Square rebrands in wake of Dorsey Twitter departure

Payments firm Square has announced it is rebranding to ‘Block’, days after its chief executive Jack Dorsey stepped down as head of Twitter.

The company said in its announcement the new name had many associations, but among them was the use of Blockchain technology in some of its projects.

Square Crypto, a separate initiative of the firm which aims to promote the use of bitcoin is also changing its name to Spiral.

The Square brand won’t be disappearing though – Square remains the name of the firm’s seller business, which is among a stable of brands that now also includes Cash App, TIDAL and TBD54566975.

Jack Dorsey announced his sudden departure from Twitter last week, with many speculating he would move to focus more of his time on crypto and blockchain projects, with his now rebranded firm Block at the forefront of this.

Meta crypto head departs firm

The head of Meta’s (formerly Facebook) crypto arm is departing the firm as the launch of stablecoin Diem remains in doubt.

David Marcus announced he would be departing the firm after seven years, having worked on Meta’s financial offering since May 2018, when the company’s Libra crypto project was first announced.

The project later morphed into a payments wallet called Novi with the cryptoasset to go with it called Diem. The crypto wallet has since launched, but the launch of Diem remains elusive.

Meta has faced significant hurdles in the launch of its crypto products. Commenting on the departure, Meta chief executive Mark Zuckerberg commented on Marcus’s post: “We wouldn’t have taken such a big swing at Diem without your leadership, and I’m grateful you’ve made Meta a place where we make those big bets.”

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results.

All contents within this report are for informational purposes only and does not constitute financial advice. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.

Image: Pixabay]]>

As a result of the crash, other Bitcoin-based investment products have taken a toll. According to Arcane Research and its Mining Index, BTC mining companies took a heavier loss than the cryptocurrency in a 7-day period.

Related Reading | Why Celsius CEO Believes Bitcoin Doesn’t Work As A Form Of Payment

As seen in the chart below, while Bitcoin saw a loss of over 20% from its best performing period, publicly-traded BTC mining companies’ part of the Mining Index dropped from 300% to 134% Year-to-Date (YTD). Arcane Research claimed:

The mining index shaved off a significant part of its massive gains this year as it tumbled following the bitcoin sell-off last weekend.

Comprised of 15 of the biggest BTC mining operations according to their market cap, Arcane Research claims these stocks usually outperform Bitcoin whether it moves to the upside or downside. The stocks are used by many investors as high BTC beta, the research firm claims, and are susceptible to volatility. Arcane Research added:

The recent drop comes on top of a significant decline since the beginning of November, as the mining index has more than halved since then, showing us how volatile these stocks are.

More Pain Or Gains For Bitcoin-Based Companies?

In other words, as the U.S. is yet to provide institutions with access to a product that it’s capable of granting direct BTC spot exposure, they usually tend to buy BTC mining companies stock or stock from companies heavily invested in the cryptocurrency, such as software company MicroStrategy (MSTR).

Amongst the companies that comprised the Mining Index, as seen in the chart above, Hut 8 experienced the worst performance with a 27% decline in its stock price. Yet, the company maintains a 234% increase YTD.

On the other hand, MSTR dropped from above $600 into the lows at $500 on December 3rd. Although the price of this company’s stock has recovered with a 7.30% increase in the past day, it still displays a lot of correlation with Bitcoin.

As the price of Bitcoin recovers, these companies will do so faster. In the short term, BTC must reclaim the levels above $53,000 to take aim at its most important resistance for the past months, $60,000.

Related Reading | How A Bitcoin ETF Could Spell Bad News For MicroStrategy

A successful move into that zone could provide bulls with enough momentum to reach a new all-time high before the end of 2021.

]]>

With the recent success of NFT games like Axie Infinity and Gods Unchained, the gaming market has had no choice but to take a long hard look at play-to-earn games as a legitimate entry into the medium. So, what are play-to-earn games and what do they have to do with NFTs? While NFTs may be new, the idea of play-to-earn gaming has been around for a while. Fantasy trading platforms like StockBattle or Investr have been letting users earn real money by competing for years. We’ll go over the basics so that you can feel confident to hit the ground running on your NFT journey.

What Are NFTs?

NFT stands for “non-fungible token”. These are original assets that, like crypto, are created on the blockchain. These assets are unique and their identity is confirmed in the same way that coins like Ethereum and Bitcoin are. The biggest NFTs even use the Ethereum blockchain for validation. These one-of-a-kind assets are yours and yours alone and can be bought, sold, and traded just like any physical non-fungible asset.

Understanding Fungibility

When we talk about a valuable asset, we have to talk about fungibility. If something is fungible, it means that it can be exchanged for any other version without gain or loss. For example, paper money is fungible. A $20 bill is functionally identical to any other $20 bill. Cryptocurrencies are fungible, there is no physical token, so every single Bitcoin is identical to every other Bitcoin. This is the basis of every currency.

So, what kinds of things are non-fungible? A great example would be something like baseball cards. While all baseball cards are the same size, shape, and likely similar value to produce, some are inherently more valuable than others. Better players or older cards will fetch a higher price than a brand new card of a player no one’s ever heard of. Even cards of the same player can have wildly differing prices based on the physical quality of the card.

How Do NFTs Help?

NFTs can be thought of as a sort of digital baseball card. One of the biggest issues when it comes to ownership of a digital item is the ease with which any digital data can be copied and shared. Any image, song, or document can be effortlessly shared any number of times making “ownership” virtually impossible.

NFTs are all created on the blockchain just like all cryptocurrencies, meaning that there is a constant record of what happens to each one. Once it has been created, there is only ever one of them and there will be a permanent, verifiable record of what happened to it, who sold it to whom, and for how much. This creates a fair, consumer-driven market where people can finally have digital collections with real-world value. NFTs are typically bought and sold in crypto, many even have their own unique coins that are traded on sites like Binance and used to make purchases in-game.

What is a Play-to-Earn Game?

Play-to-earn is a title that fits a wide variety of games. Fantasy trading platforms like StockBattle let users earn money by selecting up to five cryptocurrencies to add to a virtual portfolio in head-to-head competitions. Technically, even video poker is a “play-to-earn” game, albeit it has a far lower reliance on skill than others.

The biggest NFT game on the market today is easily Axie Infinity. The basic idea of Axie Infinity should be familiar to anyone who’s ever played a game like Pokémon. Players can collect various creatures called “axies” that they can use to battle other players. As you win battles, your axie grows stronger and players can eventually sell them for real money to other players.

Axie even sells their own coin, AXS, on Binance and Coinbase. This means that even more traditional crypto users can benefit from adding it to their portfolio and removing any barrier to entry for crypto holders.

But that’s just one type of NFT game. The same basic idea can be applied to any genre of game. Collectible card games like Gods Unchained are a great twist on games that people already know and love, like Hearthstone, but with the added bonus that the cards that players buy are theirs to own forever and to sell/trade as they see fit.

This style of play means that players who put in the time to learn the mechanics and get good at the game have a chance to see financial gains from their time investment. That character that you’ve spent hundreds of hours leveling up might just fetch a huge price on the open market.

How Can I Make Money on NFTs?

In theory, it’s as simple as buying an NFT, increasing its value, and selling it to another user. However, the reality is often more complicated than that. NFTs are commodities, not a currency so, unlike Bitcoin, the price of one NFT can be radically different from another. Since the value of a given NFT is less dependent on large-scale market forces, it can be hard to predict how a certain one will behave in both the short and long terms.

This means that the value of any given NFT will depend on the overall size of the game. Games with larger player bases are more likely to have a better market and users who are more likely to pay for what you’ve got. However, things like balance patches and content updates can swing the value of NFTs in games wildly, so it’s important to always stay up to date on the latest happenings.

With that said, since many NFTs use their own decentralized cryptocurrency, changes in the larger crypto market can have significant impacts on the real-world prices of NFTs on that market.

Are NFTs Different From Crypto?

The biggest difference between play-to-earn NFTs and crypto is that these NFTs do not appreciate in value on their own. Whereas cryptocurrencies rise and fall based solely on market forces, the value of a play-to-earn NFT is based solely on the gameplay or collectible value of it. If a player puts the time in to level up their character in a game like Axie Infinity, they almost certainly will be able to sell it at a price higher than what they paid for it. Whereas crypto often rewards long-term holding, play-to-earn games reward users who actively participate and take the time to understand the mechanics and nuances of the system. Playing more makes your NFTs more valuable simply by having been used more.

What’s Next for NFTs?

As the idea of play-to-earn gaming has spread like wildfire, more and more groups have been looking into new avenues where the technology might fit. Two of the most likely are fantasy sports and fantasy finance. These make great avenues for combining NFTs with more traditional, real-world endeavors. Imagine if those baseball cards went up in value after a player had a good game or the market heated up for players from a championship-winning team.

Fantasy finance presents even more intriguing opportunities. Imagine a whole new market for company stocks, but one with no connection to Wall Street. A completely decentralized market owned by the users instead of the companies. Fantasy trading of NFT stocks could revolutionize what it means to invest in the stock market by removing the central hub and spreading the market among a much wider pool of users.

Get a Leg Up On the Competition

With the inevitable rise of NFT stocks in fantasy finance, it’s an ideal time to check out apps like StockBattle or WealthBase. Getting familiar with the basics of commodity trading will put you in a much better place to capitalize on emerging markets and get in on the ground floor of the next big thing.

]]>