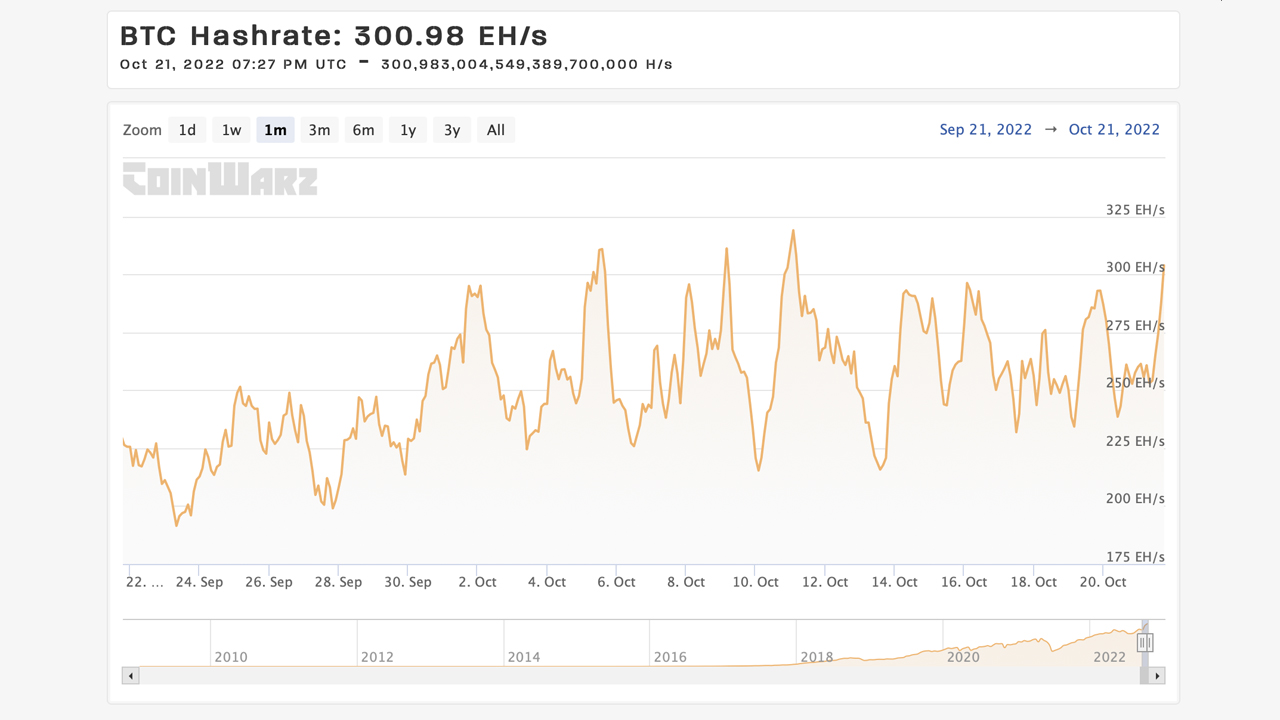

Despite the fact that bitcoin miners are getting bare minimums in profits per petahash per second (PH/s), and the myriad of headlines showing specific mining operations folding from the crypto winter, the network’s total hashrate continues to chug along at close to 300 exahash per second (EH/s). With lower bitcoin prices and the mining difficulty at an all-time high, the current trends have not pushed bitcoin miners back in the least. Meanwhile, the next difficulty retarget scheduled to occur on or around October 23, shows another increase will take place.

Bitcoin’s Hashrate Remains High Despite Current Obstacles

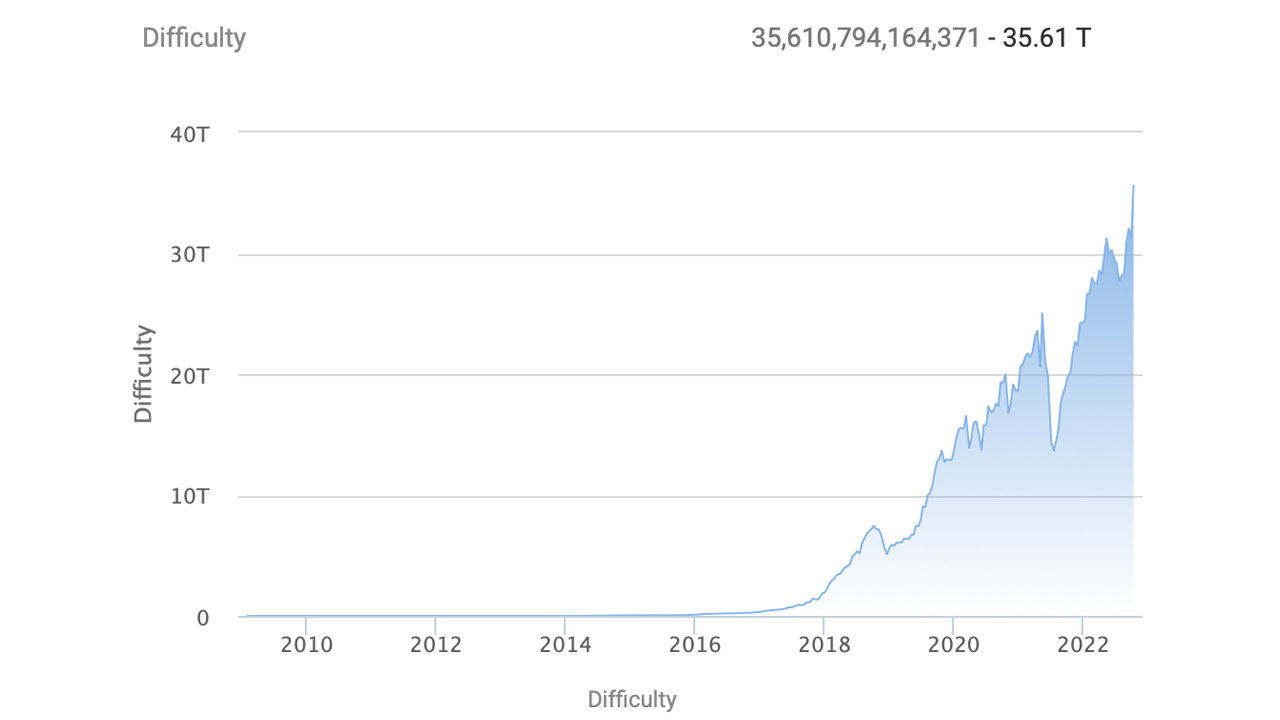

With less than two days left, it looks as though bitcoin (BTC) miners will get another upward increase in terms of the network’s difficulty. Currently, Bitcoin’s difficulty is at an all-time high (ATH) at 35.61 trillion and the next change is scheduled to happen in less than two days on or around October 23, 2022.

While the difficulty ATH makes it a lot more challenging for bitcoin miners to find a block subsidy, miners still have a great deal of hashrate dedicated to the leading crypto asset’s network security. Today, coinwarz.com statistics show BTC’s total hashrate during the past hour has been between 290 to 315 EH/s.

The metric is just below the October 11, total hashrate ATH recorded at block height 758,138. At that time, the total network hashrate reached a lifetime high at 325.11 EH/s.

Current block times on Friday are less than the ten-minute average as well, as a few data points show the current block times today have been between 8:30 minutes to 9:35 minutes. Usually, when the 2,016 blocks are found faster than the ten-minute average, the retarget date is less than two weeks.

When this trend occurs, the blockchain network’s mining difficulty will increase in order to make it tougher for miners to find a BTC block. Satoshi created the system this way, so block times would stay within a consistent ten-minute average.

At the time of writing, the difficulty is estimated to rise between 4.03% to 4.6% higher than the current 35.61 trillion. The predicted percentage increase would hike BTC’s mining difficulty up to the 37 trillion range.

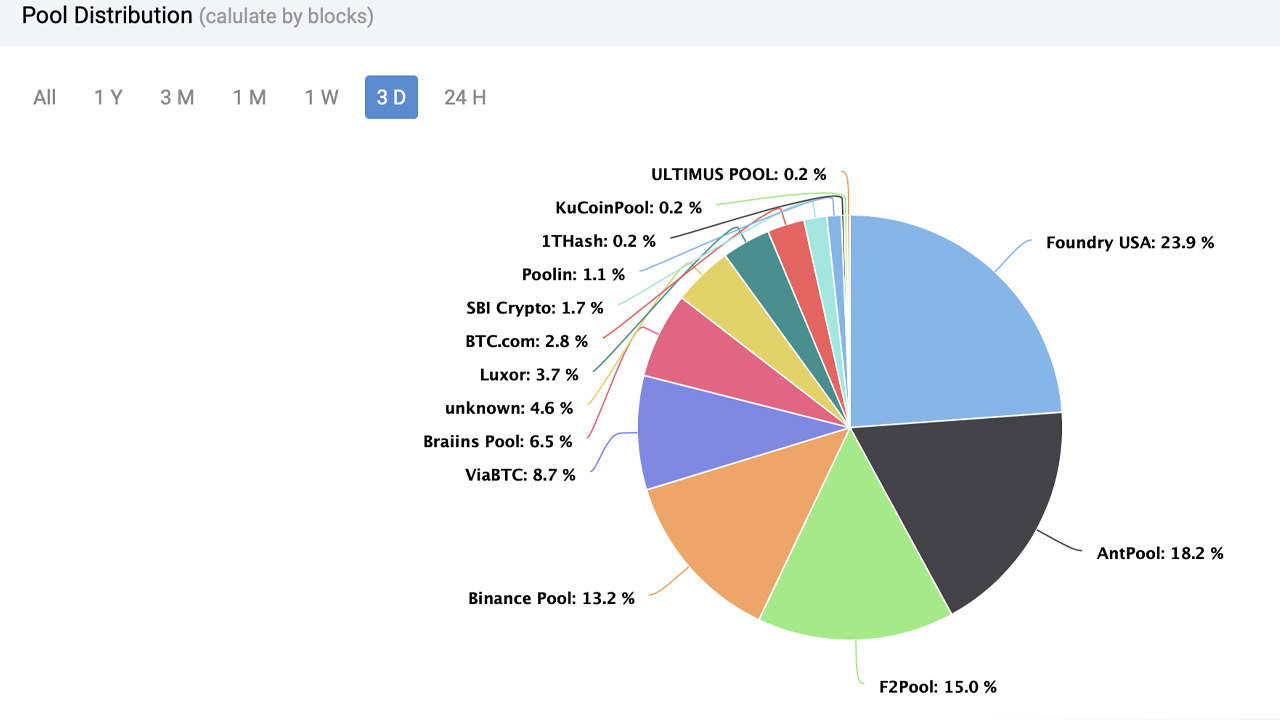

Currently, the largest mining pool today, Foundry USA, has an average of 63.34 EH/s dedicated to the BTC chain during the last three days. Foundry’s hashrate is around 23.86% of the total network’s computational power.

Below the top BTC mining pool Foundry includes miners like Antpool (48.37 EH/s), F2pool (39.73 EH/s), Binance Pool (35.13 EH/s), and Viabtc (23.03 EH/s) in terms of the top five hashers. There are currently 13 known mining pools dedicating hashrate to the BTC chain, and 12.09 EH/s, or 4.56% of the total network is controlled by unknown miners.

The record high hashrate comes at a time when a few large mining operations have been struggling with financial difficulties and bankruptcies. This week the investment bank DA Davison’s market analyst, Chris Brendler, downgraded the shares of Argo Blockchain (Nasdaq: ARBK) and Core Scientific (Nasdaq: CORZ) to neutral.

With the hashrate so high, a person simply observing Bitcoin’s computational power would not be able to tell that some BTC miners are struggling. It may be the case, that while a handful of BTC mining operations have faltered, larger operations are simply picking up their slack, their ASICs, and facilities for discounted prices.

What do you think about Bitcoin’s hashrate remaining high despite the obstacles it faces like the difficulty’s ATH and lower bitcoin prices? Let us know your thoughts about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer