It has been a brutal week so far for Bitcoin and crypto investors. The world’s largest cryptocurrency Bitcoin is down 10% over the last few days and is currently trading under $60,000 levels.

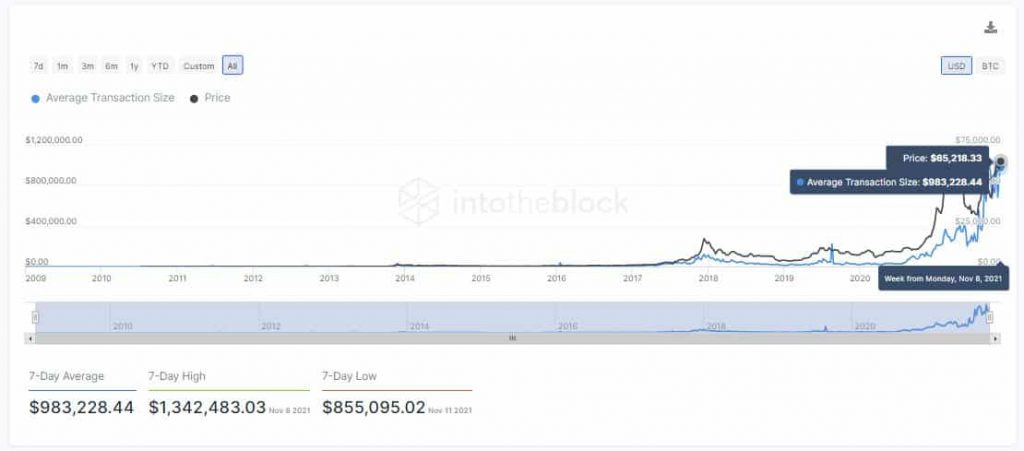

Several analysts have been giving six-figure targets for Bitcoin while comparing it to the 2017 bull run. However, the founder of IntoTheBlock Daniel Ferraro noted that the institutional activity in Bitcoin has been rapidly increasing. Earlier on Monday, Ferraro wrote:

Bitcoin average transaction size over the past 7-days is >983k Facts: Up roughly 8x from the 2017 ATH and 5x YTD During the April ATH, the average transaction size was 1/3, meaning that it was more speculative and retail-driven.

On the other hand, on-chain data provider Santiment noted that there’s been a growing interest from the traders for buying the dips. “Typically, a bit of crowd fear will be necessary to have prices fully rebound,” it adds.

Is Additional Correction In Store for Bitcoin?

It seems that for now, Bitcoin is finding it difficult to hold above $60,000 levels as of now. As CoinGape reported, popular analyst Peter Brandt is expecting that the Bitcoin price can go as low as $53,000 based on the technical charts.

Now, joining the chorus is another popular on-chain analyst Will Clemente. In his recent post about Bitcoin, the analyst writes:

Down $10K off highs, 4H RSI oversold, on chain setup for next few months unscathed. We could go as low as $50-$53K & maintain bull market structure, but starting to avg in buys here.

While that we have been closely comparing the recent rally to that of 2017, the daily trading volumes for Bitcoin have surged 10x from the peak mania phase of 2017. Popular crypto analyst Lark Davis explains: “We can easily absorb a couple billion of sell pressure spread out over a few months”. There’s nothing certain as to how much BTC can correct further.