After a strong rally recently, the world’s second-largest cryptocurrency Ethereum (ETH) has been under selling pressure just two days before the Merge. ETH is currently trading at a price of $1,716 with a market cap of $208 billion.

Some market analysts believe that the Merge event will be a “sell the news” event and the ETH price could probably correct from here onwards. These analysts expect the optimism to end with The Merge and the global macro conditions to exert selling pressure.

However, BitMEX founder and CEO Arthur Hayes remains bullish and expects ETH to touch $3,000 by the end of the year. During a recent podcast interview, Hayes lauded Ethereum for undergoing a major infrastructural change with Ethereum’s PoS transition. “The flows are guaranteed as long as the merge is successful!” he added.

Being bullish for ETH, Hayes is taking a bet on the ETH price rally by the year-end. The BitMEX CEO added:

I have bought calls for $3000 by the end of the year. I am not worried about the FED because even if the FED raises rates by 20%, there will be a certain amount of demand for $Eth to use the dApps and the supply isn’t there to meet it!

Trending Stories

The reason behind choosing the December strike is that there would be strong liquidity at the end of the year.

Ethereum On-Chain Metrics

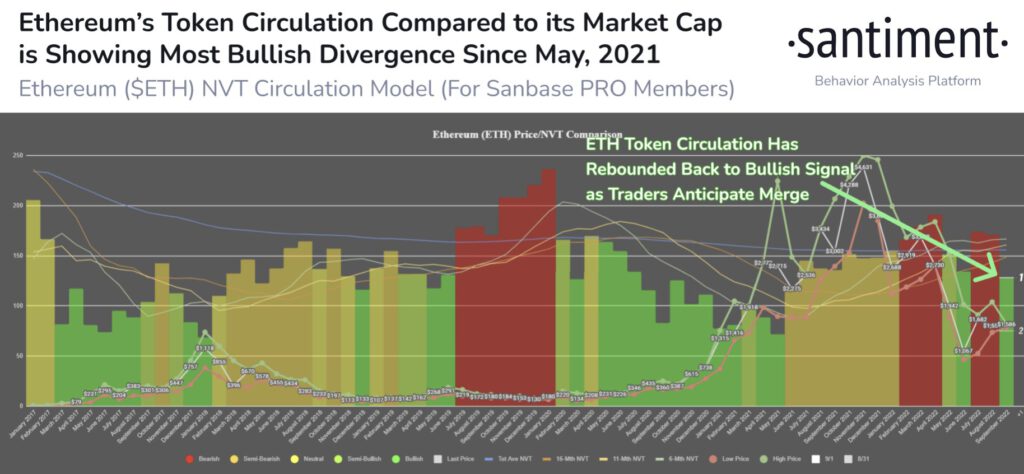

The on-chain metrics also suggest a bullish divergence for Ethereum. On-chain data provider Santiment explains:

We are officially less than two days from the big #Ethereum merge, & on-chain metrics are looking positive for the #2 market cap asset. According to our NVT model, the ratio between unique $ETH being moved and the network’s current market cap is in its best state in 16 months.

The world’s second-largest crypto ETH has shown a strong rally overwhelming Bitcoin’s gains since July 2022. Will the Ethereum Merge event help ETH to flip bitcoin in the upcoming years?