- Block partnered with Wakefield Research to address misconceptions surrounding Bitcoin.

- The survey included 9,500 respondents from varying age groups, genders and ethnicities from around the world.

- The data reveals something telling about the knowledge gaps in Bitcoin and what strengthens the network effect.

Block, a Bitcoin-oriented financial services firm previously known as Square, just released Bitcoin: Knowledge and Perception, a report detailing a survey of 9,500 participants conducted in partnership with Wakefield Research to address common misconceptions about Bitcoin.

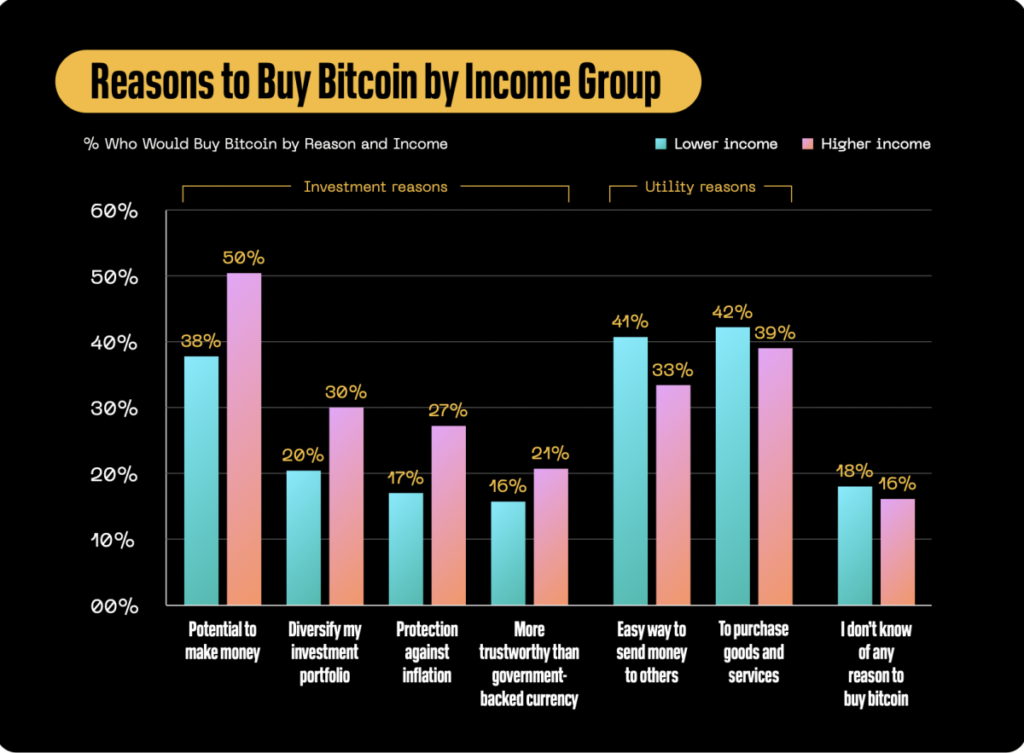

One immediately noticeable trend uncovered in the survey addresses a simple question. Why should someone buy bitcoin?

One of the most common conceptions involving bitcoin is people just want to invest in it to make money. Block’s report states:

“People with below-average income more frequently note using bitcoin as a way to send money and buy goods and services than people with above-average incomes,” as noted in the graph below.

While 50% of higher income respondents cite the potential to make money as their reason for purchasing bitcoin, over 40% of low-income respondents prefer to use it to purchase goods and send money to others.

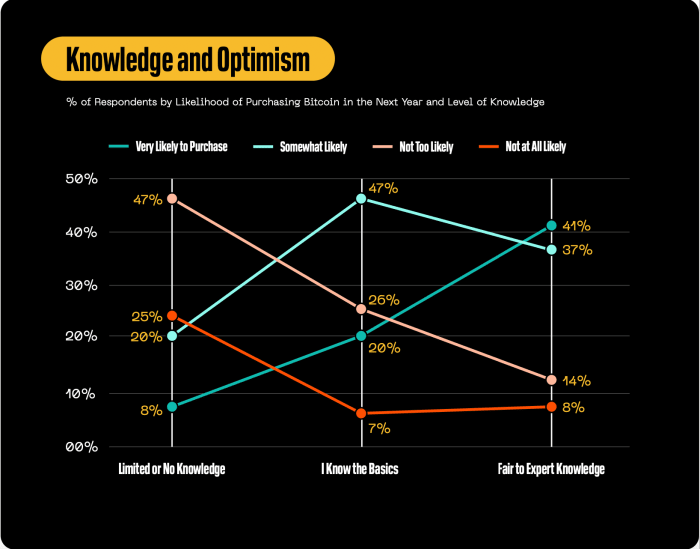

The survey also found that knowledge of cryptocurrency largely dictates whether or not investors are interested in purchasing bitcoin. Over 40% of respondents who claimed a “fair to expert knowledge” level in the space noted they would likely purchase bitcoin within the next year showing a large amount of optimism.

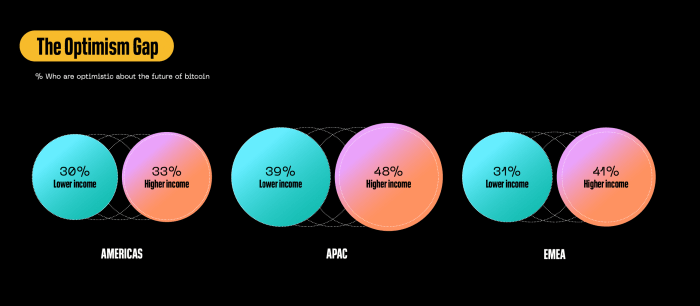

“Interestingly, though, the optimism gap between high- and low-income respondents is the smallest in the Americas, and that optimism gap disappears completely if you remove those who say they don’t know anything about cryptocurrencies.” – Block

“However, nearly a quarter of those who rate their knowledge of cryptocurrencies as ‘fair to expert’ remain skeptical of bitcoin’s future,” said the report.

Meanwhile, the report continues to explain that knowledge gaps are directly correlated to skepticism.

Knowledge of the broader cryptocurrency space shows a clear link to a respondent’s likelihood of purchasing bitcoin.

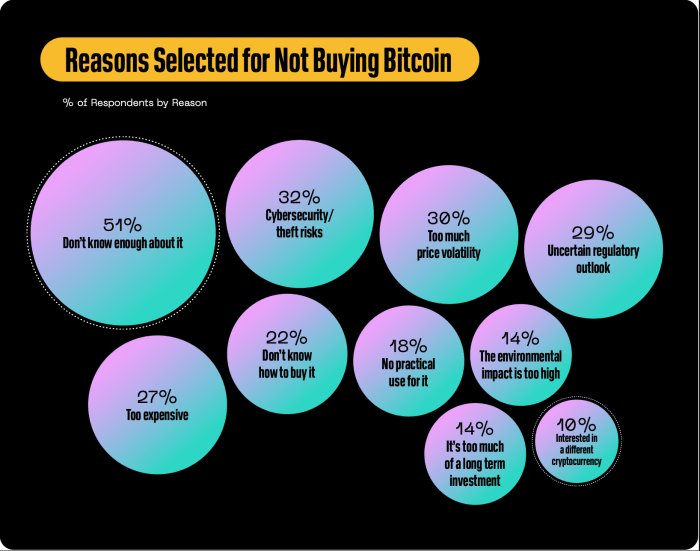

Cyber security and theft risks only rank highly when one considers those with a low-level of understanding of bitcoin.

“Again, we see not knowing enough about bitcoin was far and away the most common reason not to buy it, but cybersecurity, price volatility, and an uncertain regulatory outlook are also commonly cited reasons,” according to the report.

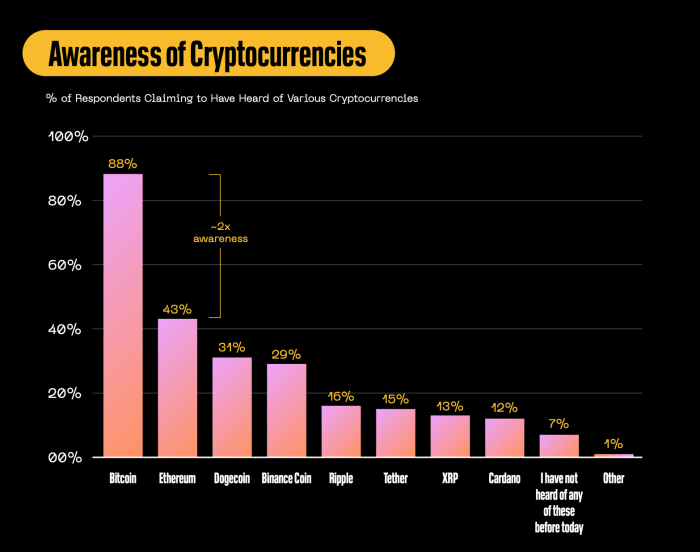

However, the lack of knowledge in bitcoin does not equate to a lack of awareness. Far above the other cryptocurrencies, 88% of respondents have at least heard of bitcoin. Millennials came in at 92.5% while baby boomers surveyed at 89.2% awareness of bitcoin, but all age cohorts surveyed still showed a high degree of awareness. The gap in awareness to even the second-most recognized cryptocurrency is…noticeable.

Knowledge gaps are most prevalent in respondents who did not know someone who owned bitcoin. One of the largest takeaways from this survey is the clearly defined network effect. Of non-bitcoin owners who know someone that owns bitcoin, 73% said they are likely to buy bitcoin. However, only 37% of respondents who do not know someone who owns bitcoin said they will likely be purchasing bitcoin.

“Interestingly, though, the optimism gap between high- and low-income respondents is the smallest in the Americas, and that optimism gap disappears completely if you remove those who say they don’t know anything about cryptocurrencies.” – Block