Grayscale has continued to make strides in its crypto investments. The asset manager had first made waves in the market when it had launched its bitcoin fund. Since then, it had added altcoins to various funds that it manages on behalf of its clients. With the bull rally continuing this year, Grayscale has made waves with its crypto assets under management.

Gains have been the order of the day with bitcoin and other cryptocurrencies hitting new all-time highs multiple times this year. These gains have pushed Grayscale’s funds well into the green and have given their net assets under management a big boost. Recently, Grayscale announced that its net assets under management have hit a new all-time high.

Related Reading | Crypto Stablecoins Double US Junk Bond Yields

Grayscale Crypto AUM Hits $60 Billion

For those who do not follow the investments that Grayscale has made during the past months, it may seem a bit disproportionate that it holds this many assets under management. However, this is expected given the strides that cryptocurrencies have made when it comes to adoption. Not everyone wants direct exposure to crypto by purchasing them, so firms like Grayscale have provided the perfect investment opportunity.

They fill a need in the space and it has paid off tremendously. Shares of its various funds have been gobbled up by the market due to increased interest, directly translating to higher assets under management. The total of Grayscale’s AUM is now $60.8 billion.

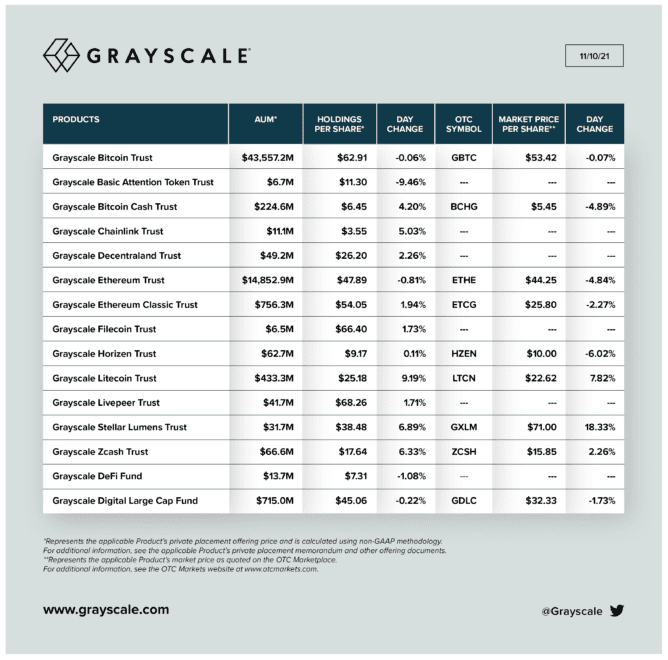

Grayscale's AUM hits $60.8 billion | Source: Grayscale

Grayscale’s flagship fund, Grayscale Bitcoin Trust, alone has an AUM of $43.5 billion. Its Ethereum trust has clocked more than $14 billion, and Etheruem Classic holdings have now hit $756.3 million.

Grayscale has now toppled the world’s leading gold fund, SPDR Gold Shares (GLD), proving that crypto is now king. It beat out SPDR Gold Shares by $1.7 billion in assets under management.

How Grayscale’s ETFs Are Faring

Grayscale had filed to have its flagship Bitcoin Trust turned into a Spot Bitcoin ETF. It had done this after the Securities and Exchange Commission had approved three Bitcoin Futures ETFs to begin trading in the market. Although the futures ETF were largely successful, crypto market experts pointed to there being more potential with a Spot bitcoin ETF and Grayscale did not want to miss its chance.

Related Reading | Robinhood Hack Sees Millions Of Users’ Data Exposed

However, there has not been much good news regarding the ETF filing so far. It has been largely hinted at that the SEC will not approve this filing. So Grayscale has now moved on to another filing.

Grayscale plans to launch a Future of Finance ETF to give clients an opportunity to invest in businesses that carry out digital asset transactions. It had filed the ETF with the SEC last week and plans to trade on the NYSE. Grayscale is yet to reveal what the expense ratio will be for its latest fund. For now, focusing on getting the regulatory body to greenlight its ETF filings.

Crypto total market cap recovers to $2.78 trillion | Source: Crypto Total Market Cap on TradingView.com

Featured image from Nairametrics, chart from TradingView.com