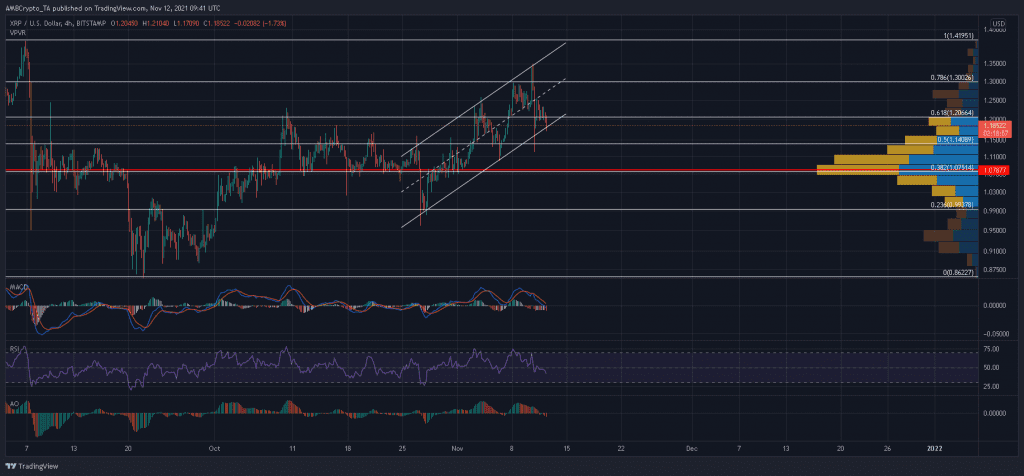

XRP is at risk of an ascending channel breakdown following an impeding fourth assault at the bottom trendline. A close below 10 November’s swing low of $1.12 would confirm a breakdown and carve a path towards the 38.2% Fibonacci level.

For the optimists, this defensive region would present long opportunities since it also clashed with the Visible Range’s POC. At the time of writing, XRP traded at $1.18, down by 2.5% over the last 24 hours.

XRP 4-hour Chart

XRP’s up-channel has been active since 25 October, characterized by three higher highs and three higher lows. Following a double top on the MACD and RSI, XRP lined up a fourth hit at its bottom trendline.

If sellers successfully puncture through this trendline and overwhelm bulls at the 50% Fibonacci level, XRP could extend losses all the way to the 38.2% Fibonacci level.

The aforementioned defense has staved off multiple attacks during October but eventually fell prey to a wider market sell-off on October 27. This time around, the Visible Range’s POC at $1.07 would bolster XRP’s support and help contain selling pressure.

On the flip side, should XRP rebound from the bottom trendline, the next higher high can be expected around the $1.40-region. Bulls would hope that prospects of an oversold RSI would help fuel an upwards rally.

Reasoning

XRP’s indicators lined up a weak near-term narrative. The MACD was on the verge of crossing below its equilibrium and exposing XRP to further losses. The Awesome Oscillator had already breached its mid-line – a development which would invite short-sellers to the market.

Even the RSI traded in bearish territory and provided more aid to sellers. However, the RSI just needed to drop a few more points to tag its oversold zone from where a reversal can be expected.

Conclusion

XRP faced the threat of an up-channel breakdown on the back of a bearish MACD, AO and RSI. Traders can long XRP once again after it touches its defenses at the 38.2% Fibonacci level and Visible Range’s POC. However, stop losses must be kept at $1.05, as XRP would be exposed to additional losses should sellers breach this support.