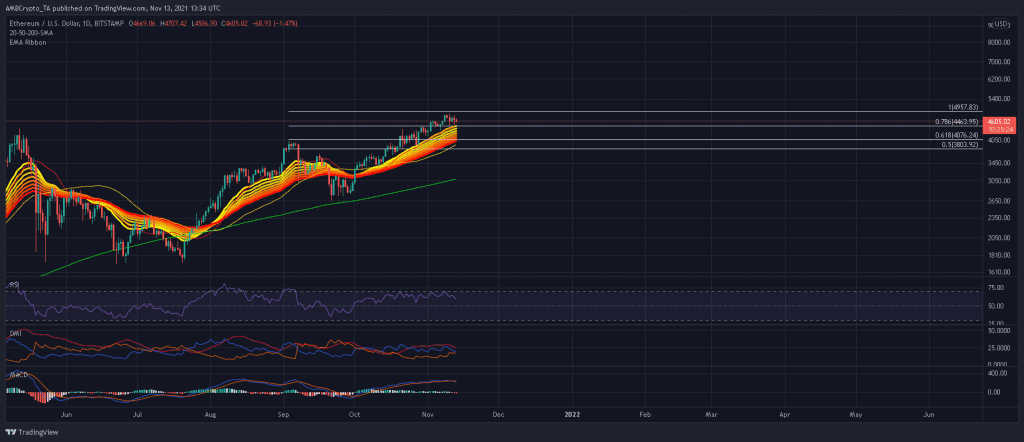

Ethereum is eyeing a near-term correction following a bearish crossover on the MACD and a double top along the RSI. With the EMA Ribbons still flashing a healthy position, ETH had plenty of defensive resources at its disposal. Once selling pressure is relieved, expect ETH to make headway towards the $5,000 mark. At the time of writing, ETH traded at $4,605, down by 0.2% over the last 24 hours.

Ethereum Daily Chart

Ethereum was closing in on its near-term defense at the 78.6% Fibonacci Extension after outflows continued to be observed within the broader market. Now the aforementioned support was bolstered with the daily 20-SMA (red) which added an extra cushion. Should sellers puncture beneath this confluence, the 50-SMA (yellow) and 61.8% Fibonacci level would lend a helping hand.

As per the nature of ETH’s daily EMA Ribbons, the alt was well within an uptrend and large sell-off’s are unlikely in such a situation. The last time these bands were flipped was during May’s crypto crash. During the next upcycle, ETH would make way to earlier targets of $5,018 and $6,038.

Reasoning

The RSI has formed two tops within the overbought territory and has moved south over the last five days. The index could continue on its trajectory before finding support around the mid-line. As mentioned earlier, the MACD flashed a sell signal after registering a bearish crossover. The DMI was also close to an unfavorable crossover, which could generate further near-term sell pressure.

Conclusion

Ethereum faced near-term woes, but its long-term trajectory was backed by the EMA Ribbons’ bullish nature. Hence, expect ETH to bounce back from the 78.6% Fibonacci and carve a path towards the $5,000-mark. In case ETH does slip below $4,463, another defensive option was available at the 61.8% Fibonacci level.