Decentraland’s native token MANA has generated a monthly ROI of 370% and looked determined to set higher records following a descending wedge breakout. Although the breakout target had been achieved, strong buy volumes could push MANA to its 78.6% Fibonacci level before an overbought RSI triggers a correction.

At the time of writing, MANA traded at $3.62, up by 20% over the last 24 hours.

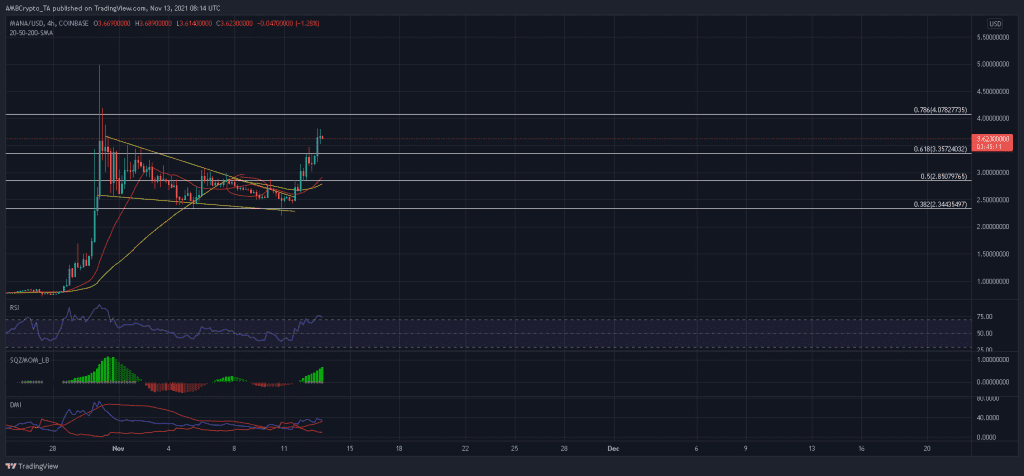

MANA 4-hour Chart

MANA continued to push north from its breakout target at the 61.8% Fibonacci level and set sights on $4 over the next few sessions. It was also helped by a bullish crossover between the 20-SMA (red) and 50-SMA (yellow). Now interestingly, MANA was the fourth most traded crypto over the last 24 hours, with volumes of over nearly $8 Billion. Should MANA continue to add on these numbers above the 78.6% Fibonacci level, 30 October’s high at $5 would be its next destination.

However, it’s worth noting that the 4-hour RSI was at overbought levels and a near-term correction was on the cards. If sellers do take countermeasures, the first line of defense stood at the newly flipped 61.8% Fibonacci level. A more reliable support lay at the 50% Fibonacci level, which coincided with the short-mid term moving average lines.

Reasoning

MANA’s breakout was underpinned by bullish signals along most of its indicators. The Squeeze Momentum Indicator flashed rising green bars following a ‘squeeze release’, while the DMI witnessed a bullish crossover. An ADX reading of 34 even indicated a strong directional trend in the market. On the flip side, RSI’s overbought nature could generate some selling pressure as investors cash out on the rally.

Conclusion

MANA could extend to its 78.6% Fibonacci level and even $5 should buy volumes not waver. Once a correction takes place, expect MANA to find respite at the 50% Fibonacci level, which was backed by the 20-SMA and 50-SMA.