In the last few days, Demeter announced its deployment on BSC on November 5, 2021, after which DMT tokens and DUSD tokens will be issued on HECO and BSC at the same time. Let’s explore the Demeter project and how does it work?

Migrating projects to Binance Smart Chain (BSC) provides several advantages to users. Binance Smart Chain allows for quicker and less expensive transactions than conventional blockchains. It also makes it simple for developers to migrate from other chains to BSC, and there have already been examples of success to back this up.

Many projects are also moving from other platforms to BSC to make use of Binance’s tremendous capabilities. That is where we at applicator come in; we are a solidity developer DeFi development firm that has previously executed blockchain projects like DeFi, dApps, and so many more. Therefore, Demeter decides to deploy their project to the BSC platform, cannot wait for it. Let’s discover what Demeter is

What’s new of Demeter on BSC:

- Same governance rules and the same amount of tokens max supply, but they will be divided equally on two chains (HECO and BSC)

- The 1 million DMT previously circulated on the BSC would be airdropped to users who engaged in the DAO lockup for 90 days.

- Following the deployment on BSC, Demeter will lower the DMT generation on HECO.

- Given the disparity between BSC and other parameters in the HECO chain, the maximum mint ratio of BSC’s DUSD will be raised from 40% to 60%.

Introduction

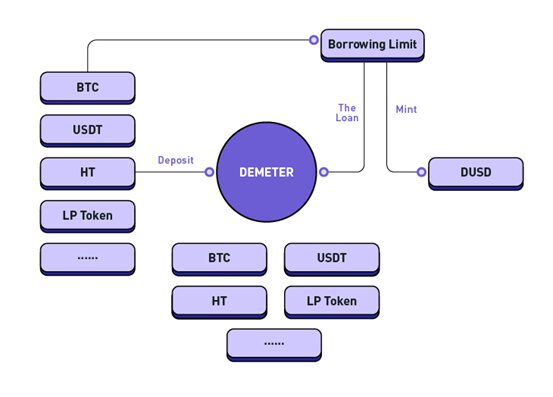

Demeter is a decentralized currency market technology. By combining collateralized lending with collateralized stablecoin generation, Demeter offers consumers a more robust stablecoin DUSD and a more safe loan service at a cheaper cost.

How does it work?

Demeter performs two functions: lending with collateral and minting stablecoins with collateral.

There are two kinds of tokens: the governance token $DMT and the decentralized stablecoin DUSD.

Mint stablecoins at a cheap cost: Demeter permits the synthesis and minting of stablecoins DUSD via over-collateralization while sustaining mortgage loans.

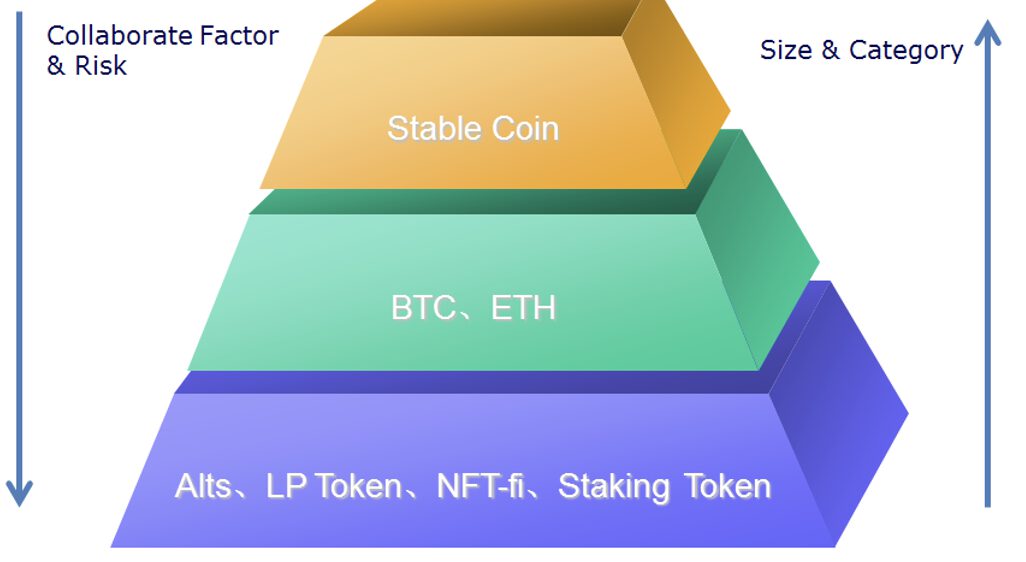

Collateral and collateral factor

In Demeter, credits are utilized for minting and borrowing; hence the minting and lending processes are inextricably linked. At the same time, various collateral factors correlate to different collateral asset kinds, which might improve the platform’s stability. What matters here is the “collateral” (collateral). In contrast to other stablecoin systems’ single-token collateral minting technique, Demeter offers a diverse range of collateral categories, including stablecoins, mainstream tokens, LP tokens, NFT-fi tokens, and extending the application or service of crypto assets. different

Stablecoin

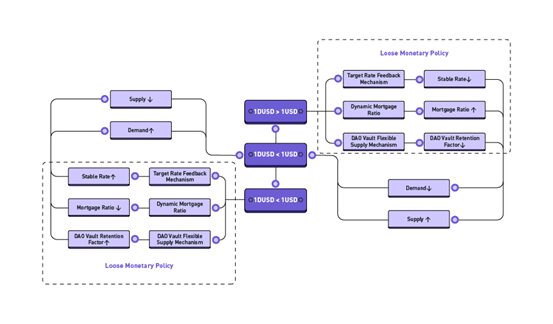

Stablecoin of Demeter is DUSD. To maintain the price of DUSD, Demeter will use Target Rate Feedback Mechanism (TRFM) and Dynamic Rate Supply Mechanism. To understand the systems, TRFM will be activated when the DUSD decreases below $1, which means the credits available for the same collateral, lowering the supply of DUSD. When the price of DUSD goes below $1, the stabilization rate necessary to retain DUSD rises, as does the cost of keeping DUSD, encouraging users to repurchase DUSD to return the loan.

Demeter has designed an over-supply distribution system in which a set amount up to 100% of over-supply income, as well as a portion of governance tokens, will be sent to the DAO vaults, guaranteeing that the actual yearly over-allocation rate is adjustable.

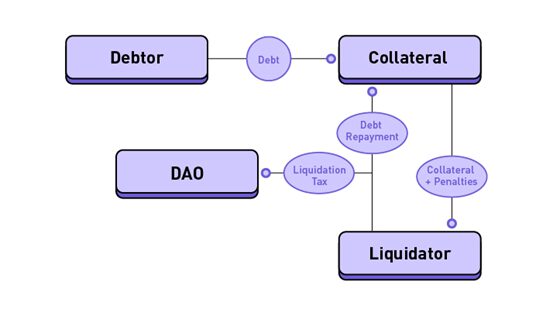

Liquidation Mechanism

Demeter has established a liquidation penalty rate of 9% and a liquidation tax rate of 3% for collateralized lending & collateralized stablecoins. Anyone may return their debt to the system at 103% of the liquidated person’s debt and get 109% of the collateralized assets after a liquidator’s account is liquidated. The user will spend 100% of the 103 % payback on repaying the loan, and the remaining 3% will be injected entirely into the DAO shared income pool for future revenue allocation.

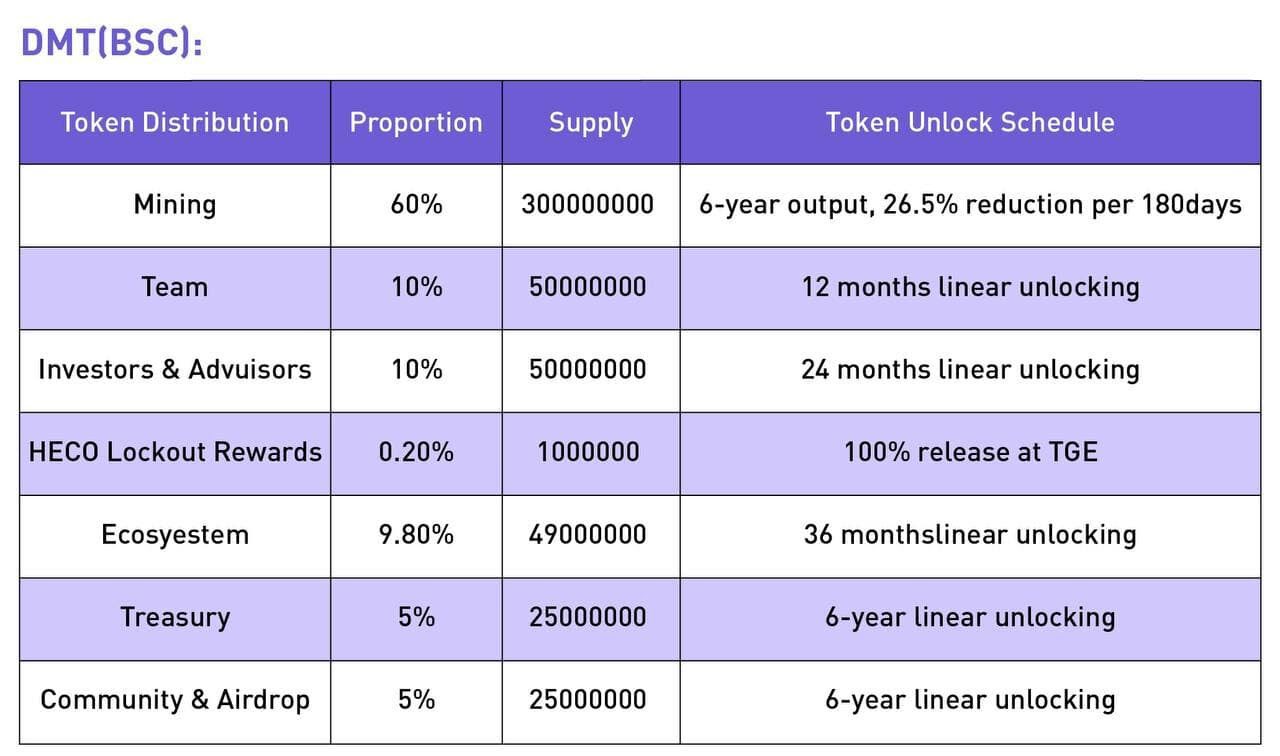

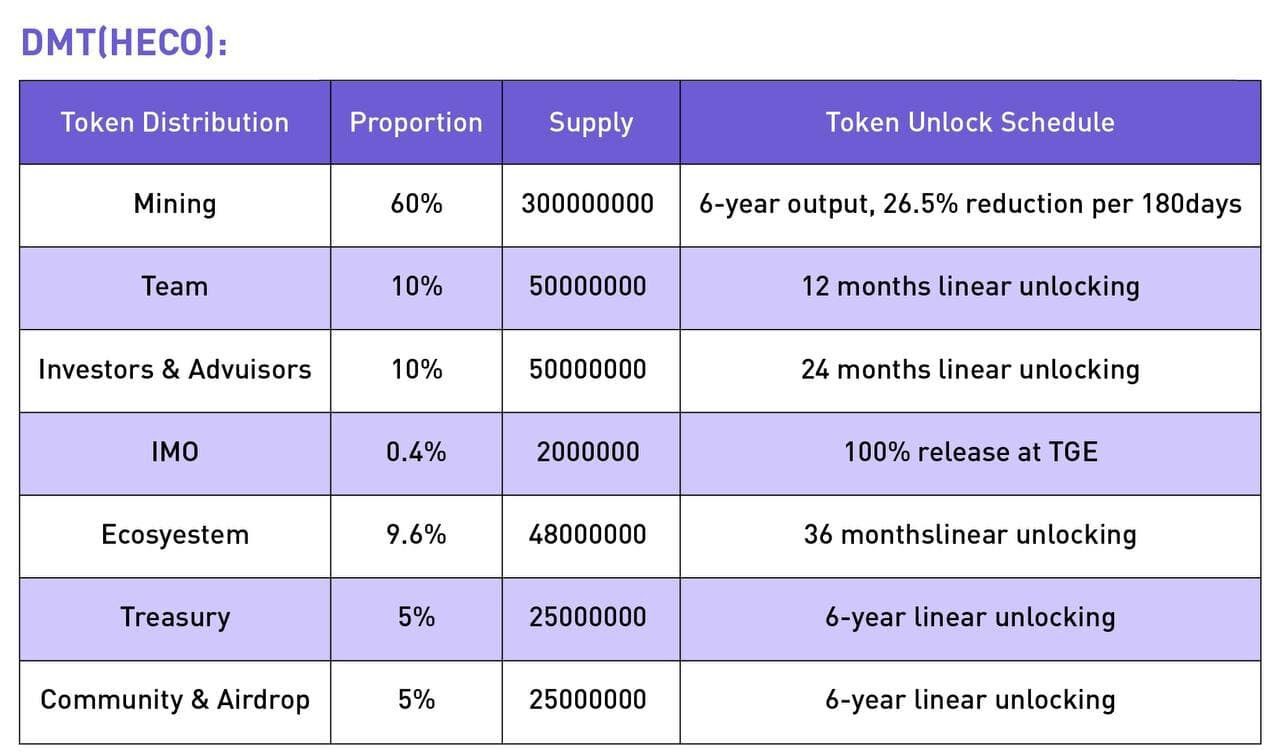

Tokenomics

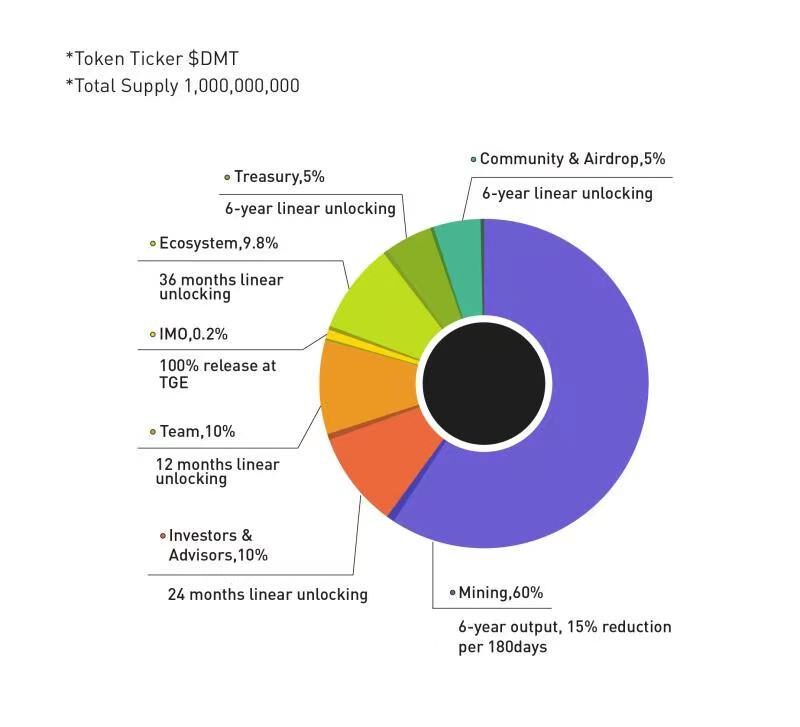

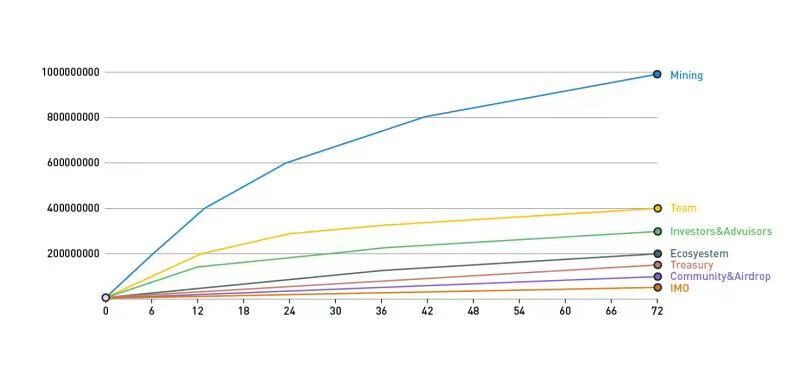

There are 2 tokens in the ecosystem of Demeter: governance token Demeter ($DMT) and stablecoin DUSD

Ticker: $DMT

Standard: HRC-20/BEP-20

Max Supply: 1,000,000,000

Token Distribution:

Roadmap

2nd Quarter of 2021

- Form core team members and initiate project development.

- Complete project financing.

3rd Quarter of 2021

- Complete Demeter core function development testing and contract audit

- IDO distribution on several reputable platforms

- Deploy HECO network Version1. (V1) and start liquidity mining

- Expand eco-partners, increase DUSD usage and usage scenarios

4th Quarter of 2021

- Strengthen cooperation in the BSC ecosystem and expand the use of DUSD.

- Deploy Heco network Version 2. (V2) to support scalable Demeter bridge and cross-chain lending.

- Build richer credit tiers and optimize Demeter interest rate markets

2022

- DUSD lands on more mainstream trading platforms and eco-networks, creating more convenient exchange venues for users.

- Launch graded Funds & fixed revenue bonds

- Launching the bonding agreement for non-standard assets, providing the financial market with high efficiency and liquidity for certified staking and refinancing, future cash flow bonds, and convertible bonds

- Explore smart pools, fixed interest rates and agencies, off-chain assets, on-chain lending, and other businesses.

Learn More

Website: https://dem,eter.xyz/#/

Telegram: https://t.me/Demeter_Official

Twitter: https://twitter.com/Demetervip

Medium: https://medium.com/@demetervip

Gitbook: https://dfgroup.gitbook.io/demeter-en/

Audit Report: https://github.com/peckshield/publications/blob/master/audit_reports/PeckShield-Audit-Report-Demeter-v1.0.pdf

Tutorial: https://medium.com/@demetervip/demeter-tutorial-92e49e8ea3d2