Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

Mirroring a wider market correction, Solana registered a 5.7% drop over the last 24 hours. Furthermore, a descending triangle setup exposed the market to a deeper retracement, should the 200-SMA (green) fail to cushion incoming losses. This outcome was backed by sell signals present on the RSI, MACD, and Aroon.

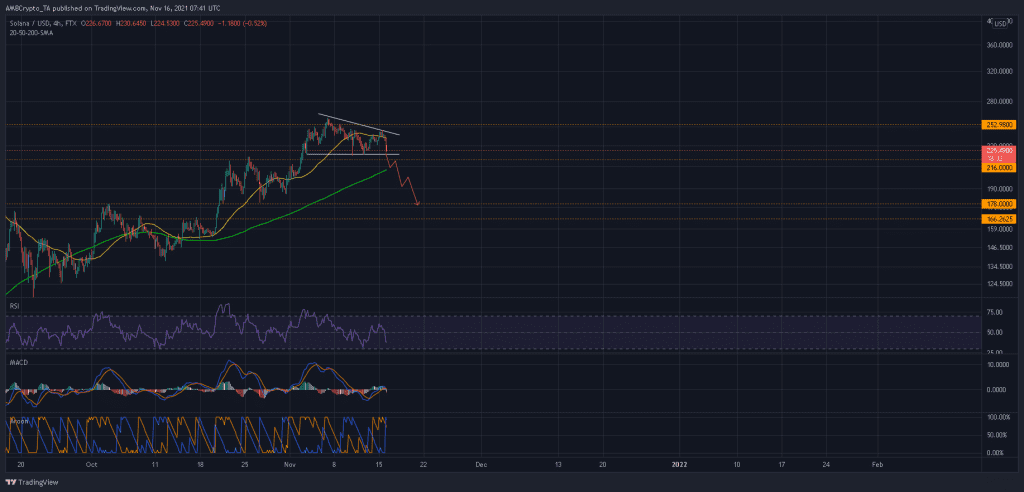

Solana 4-hour Chart

Consecutive lower highs and steady lows around $220 gave rise to a descending triangle setup on SOL’s chart. The bearish pattern usually triggers a breakdown once bulls are unable to contain selling pressure above the lower trendline. In SOL’s case, its closest defense was available between $220-$216. However, sell signals along the Aroon, MACD, and RSI would pile on pressure on this support region.

If SOL does weaken below $216, a 7% drawdown would see the price shift to its its 4-hour 200-SMA (green). From here, another 15% decline to $178 would be possible if the long term moving average line fails to trigger a bullish comeback.

Reasoning

SOL’s 4-hour RSI began declining from overbought levels on 3 November. It has continued to weaken at lower levels. Although a reversal was seen from oversold levels on 12 November, the lack of sufficient buy volumes halted the RSI’s progress at 60. Going forward, some more losses can be anticipated until the RSI tags its oversold region once again.

Sell signals were also present on the Aroon and MACD. Bearish crossovers on both indicators can be expected to generate more downwards pressure via short-sellers.

Conclusion

SOL stared down the barrel of a descending triangle breakdown. Should the 200-SMA (green) fail to offer a pushback, SOL could fall to as low as 21% over the next couple of days. Red flags on the RSI, MACD, and Aroon threw weight behind a bearish outcome.

Hence, a better call would be to short SOL once it closes below the lower trendline. Take-profits can be set at the defensive line of $178, while stop-losses can be placed above the 50-SMA (yellow) at $240.