Ethereum balances have continued their decline that began earlier this year. The decline of coins being kept on centralized exchanges has pointed to bullish sentiment among the large holder base of the digital asset. Despite the increase in the price of the asset in the past weeks and hitting new all-time highs since then, ETH being held on exchanges have continued to plummet.

Ethereum Exchange Reserves Hit 3-Year Low

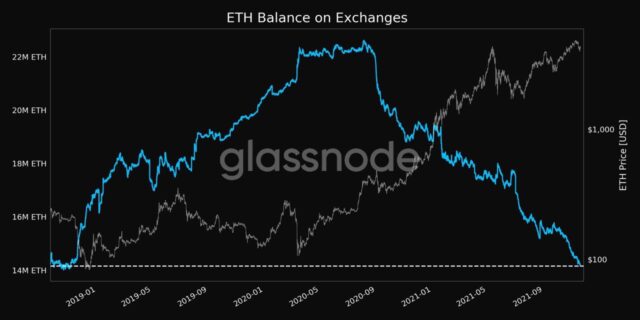

Data from Glassnode shows that Ethereum exchange reserves have plummeted towards new lows. The chart shows that this has been long in the making as the downtrend throughout the year 2021 has not faltered. The price of the digital asset and centralized exchange balances have shown to be inversely correlated as the latter has plummeted while the former is on the rise.

Ethereum exchange balances hit three-year low | Source: Glassnode

There is currently 14,241,063 ETH present on exchanges, representing 12% of the total supply of Ethereum. The last time volumes were this low was in 2018 after the bull run had ended.

Related Reading | TIME Magazine Will Hold Ethereum On Balance Sheet As Part Of New Deal

Exchange reserves had picked back up again in 2019, running into 2020. However, the beginning of the bull run towards the end of 2020 saw volumes plummet despite high prices.

Factors Driving Towards A Supply Shock

There are periods where coins on exchanges have tended to decline in the past, mainly during bear markets when investors are snapping up as much crypto as they can. This time, exchange balances have been declining during a bull market. This goes against past behavior in the market where investors would be moving their holdings to exchanges to take profit.

Related Reading | Real Vision CEO Raoul Pal Maps Out A 300% Rally For Ethereum

The reasons for this decline spread across several factors. One is the rise of decentralized finance. A good portion of Ethereum leaving centralized exchanges are usually headed for decentralized exchanges where users can put their coins to work for them and earn passive income. Services like staking and yield farming have become the order of the day as investors can hold their coins and earn sizable interests from them at the same time.

ETH holding above $4,000 | Source: ETHUSD on TradingView.com

Another reason is the rise of bullish sentiment among investors. The multiple bull rallies of 2021 have demonstrated what the crypto market is capable of. Investors have seen that they stand a better chance of seeing higher gains when they hold their coins. In addition, the crypto market is still arguably in its early stages. So, investors are stocking up on the coins while they await even better market conditions.

Ethereum is not the only digital asset that has seen declining balances on centralized exchanges. Top cryptocurrency Bitcoin has also recorded plummeting exchange reserves all through the bull rally, signaling the beginning stages of a supply shock.

Featured image from Crypto News Flash, chart from TradingView.com