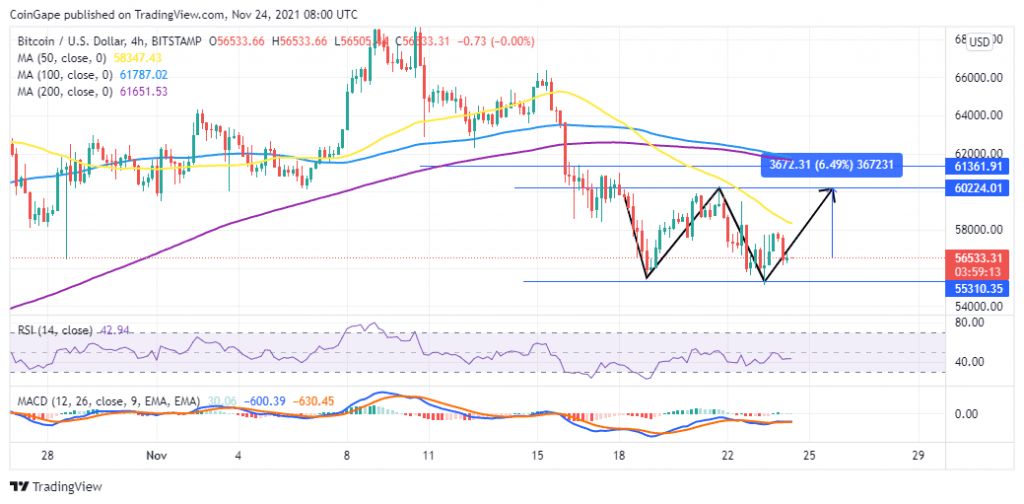

Bitcoin price is exchanging hands 2.24% higher than Tuesday’s intra-day low around $55,310. The BTC have been focused on undoing losses that gripped the entire market last week. But the attempts were curtailed by the $60,000 psychological level on November 21. This has seen the BTC price drop again towards the $55,300 support wall creating a double-bottom chart pattern.

Bitcoin Price To Reclaim The Crucial $60K Support

BTC/USD is hovering in the red at $56,533 and appears to have formed a double-bottom pattern on the four-hour chart after the sell-off was halted at $55,310. This level is embraced by the November 19 intra-day low. A double-bottom is an exceptionally bullish chart pattern that often results in a trend reversal.

Note that this pattern forms when an asset tests a support level twice without breaking below it. The two bottoms are usually separated by a moderate peak as shown on the BTC/USD four-hour chart.

A breakout from this technical pattern will be confirmed when the Bitcoin price jumps over the resistance level equal to the peak at $60,224. If BTC reaches this level, it would have surged approximately 7% from the current price rising above the all-important $60,000 psychological level..

BTC/USD Four-Hour Chart

This bullish narrative is reinforced by the Moving Average Convergence Divergence (MACD) that sent a bullish signal on the four-hour chart. This occurred yesterday when the MACD line (blue) crossed over the signal line. The uptrend will gain more momentum once the MACD crosses the neutral line into the positive region.

Note that a daily closure above the Bitcoin’s immediate barrier at $56,862 is crucial to sustaining the anticipated upward breakout.

Can BTC’s Upward Breakout Be Invalidated?

It is worth noting that the uptrend will be invalidated if the RSI retraces back towards the oversold zone. Closing the day under the $56,000 support level will also curtail the recovery efforts and trigger another sell-off, resulting in another correction towards the November 19 low at $55,310.