Blockchain technology has opened a vast array of use cases across different sectors of the economy. As inflation rises, institutions and investors look for a way to generate revenues. In that sense, the crypto industry offers great opportunities often by innovating and improving an aspect, feature, or assets already consolidated in the legacy financial world.

Landshare (LAND), a platform running on Binance Smart Chain, seeks to be the catalyzer of the next financial disruption. The platform allows its users to own real estate properties on the blockchain via a mechanism called Asset Tokenization without the need to resource to an intermediary or pay for management fees.

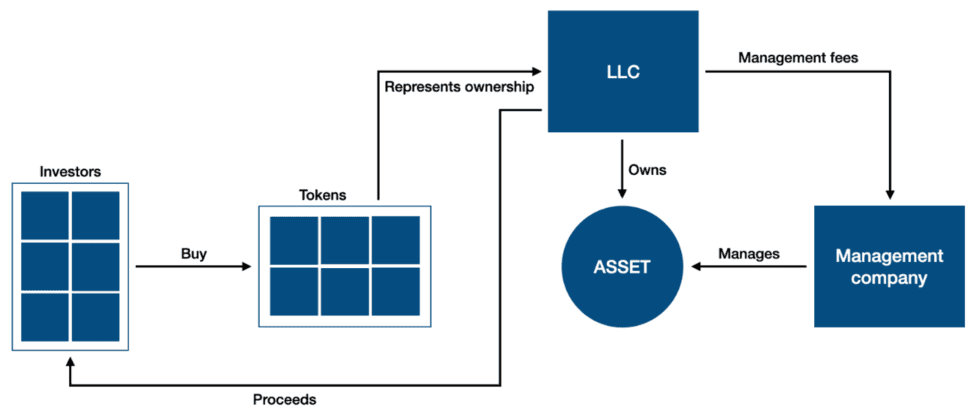

In that way, users purchase tokens that represent their ownership of real estate assets. Thus, anyone can participate in this market, generate yield, use the asset as collateral, and more without the need to maintain the physical integrity of the underlying asset or deal with the complexities of rent collection.

The platform and its tokenization process are fully legally compliant as properties are held by standalone corporations, according to Landshare’s official website. These companies’ shares are tokenized making each one of the investors a “legal shareholder of the asset” and of the underlying properties themselves.

The real-world assets are rented to tenants allowing token holders to receive a monthly rental yield. This fractional ownership model is entirely supported by the blockchain with the potential for everyone around the globe to create their own real-estate portfolio.

Landshare will not only provide users with exposure to the global real state market, but will also include house flips, and rental properties entirely tokenized so that users can choose their own investment strategy. A steady monthly income, or profits for flipping houses.

How Does Landshare Work? A Way To Own Property, General Yield, Without The Trade-offs

In addition, Landshare will offer its users decentralized finances (DeFi) features such as staking, stablecoin vaults, and a chance to make decisions about the future of the project via its governance model. Supported by the platform’s governance token LAND, this will allow investors to have more control over the underlying assets.

In order to acquire assets on Landshare, a user needs to hold an estimate of 25 LAND tokens. After the process of acquiring represent ownership over a real-world asset is very straightforward, as seen in the chart below, and more efficient in cost and time than the process followed by the legacy financial sector.

Source: A General Model Of Asset Tokenization – Otonomos.com

In addition, the tokenized assets are far more liquid and with more financial utility than their real-world counterparts. An investor can take their token, borrow against them, and use the proceeds to expand their portfolio. Thus, users can leverage an efficient method to compound their yield into more assets and strengthen their portfolios.

With the rise of the metaverse, in the hands of initiatives supported by big tech giants, such as Facebook and Microsoft, tokenized real estate ownership seems poised to become a hot trend in the coming years. Early investors will benefit from an asset with digital scarcity that has only started to realize its potential.

Image: Pixabay