Bitcoin is currently trading above $57,000 rekindling hopes that BTC might get to new record highs before year-end. Regaining last week’s losses triggered by the new Omicron Coronavirus variant and fears around regulations in India, Bitcoin price crossed above the $58,000 psychological level on Sunday nigh and is still up 5.77% over the last 24 hours.

The BTC price forecast remains uncertain for many for the remaining part of the years as fears around Corona remains. Bears still have the choice of taking advantage of the leveraged bulls against the backdrop of the recent rally.

Against this background and the month set to end in two days, it is important to understand how technical will shape BTC’s performance this week.

Bitcoin Price Bounces Off The 100 SMA

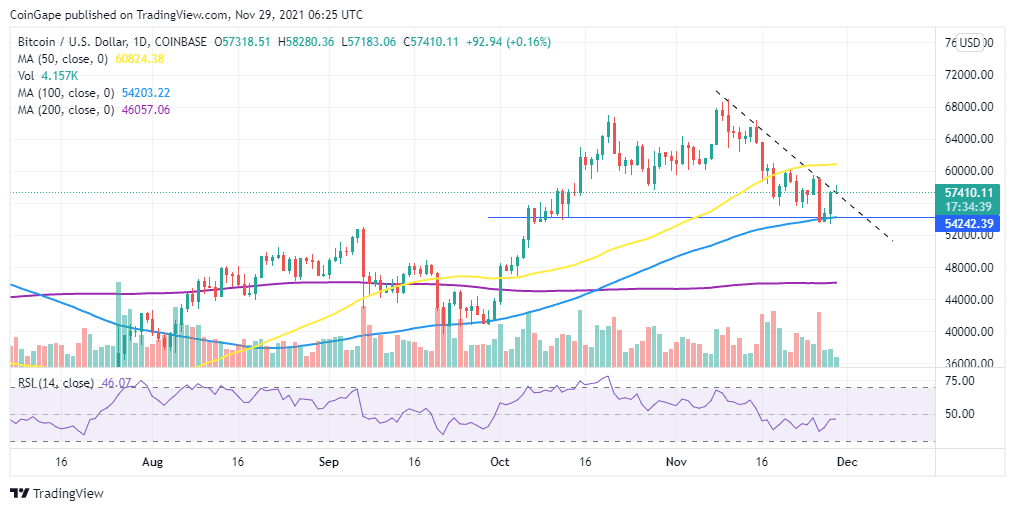

BTC/USD bounced off the 100-day Simple Moving Average (SMA) around $54,202 over the weekend as Bitcoin price rose to produce a weekly close of $57,248 according to data from CoinMarketCap. With this closure, BTC avoided its lowest weekly closure in two months.

Note that regaining the $58,000 level is crucial for BTC bulls sustaining the uptrend. At the time of writing, the big crypto is exchanging hands at $57,410 and is struggling to push above the downtrend line. A break out above the resistance line will see Bitcoin rise to tag the $60,000 psychological level.

The upward movement of the Relative Strength Index (RSI) indicator accentuates this bullish outlook.

BTC/USD Daily Chart

However, the RSI is still positioned in the neutral zone at 46.01 indicating that the overhead pressure might still push the BTC price further down.

Note that the $60K level remains untouched even after the rebound as BTC has been fiercely rejected from this point since flipping it into resistance on November 18.

However, there is still optimism from the Bitcoin community that the asset will close the Month above $60,000. Well, we have less than 48 hours to find out.