It may seem far-fetched to compare the ninth and the thirty-fifth biggest blockchains by market cap, at press time. However, a closer look at Polkadot and Cosmos reveals several common elements. Most noticeably, their emphasis is on bringing interoperability to the crypto-ecosystem.

Popular crypto-analyst Max Maher recently compared the two blockchains using several metrics and arrived at a surprising conclusion.

Use it or lose it

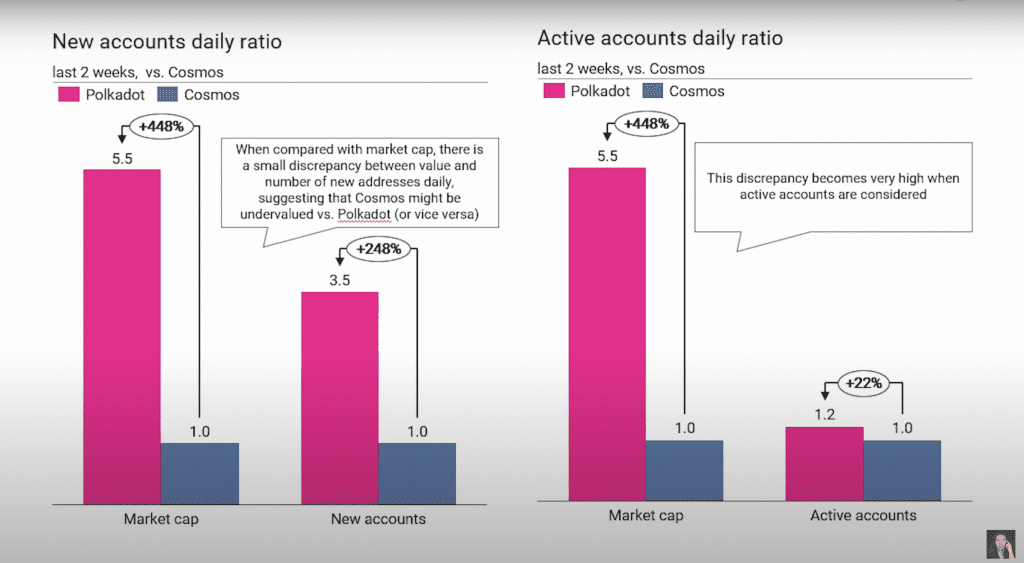

Naturally, a crypto-watcher might expect Polkadot to win by a clear margin, and this was certainly the case when it came to user accounts.

However, on the question of active accounts, Cosmos seemed to be hot on Polkadot’s heels and there was only a 22% difference. This, despite Polkadot having a market cap several times that of Cosmos’s market cap.

Source: YouTube

Maher said,

“…Polkadot has far more daily new addresses – 3.5 times more – and more daily active addresses of 1.2 times [than Cosmos]. However, Polkadot’s market capitalization is 5.5 times higher than Cosmos, suggesting that Cosmos might be undervalued versus Polkadot, or that Polkadot might be overvalued versus Cosmos.”

One of the popular kids?

Maher also used Metcalfe’s Law to understand the network value of each project. According to the same, “a network’s value is proportional to the square of the number of nodes in the network.” In this particular case, the number of active users can be used as a metric instead.

“But the network value, based on the Metcalfe’s Law says it [Cosmos] would only have to increase by 49% in order to match the network value of Polkadot…”

In fact, Maher again used this to conclude that Cosmos could be undervalued or that Polkadot could be overvalued when the two altcoins are compared.

According to the analyst, Polkadot is the overall winner in terms of growth rate, network fees, and transaction volumes. However, when analyzing Reddit comments, Cosmos was the winner in terms of community engagement – though not size.

Interestingly, both projects seemed to be tied in terms of developer activity, according to the researcher.

Chain it up

At press time, ATOM was trading at $28.39, while DOT was priced at $35.95. While ATOM dropped by 9.96% over the last week, it noted a 4.74% hike in the last 24 hours. Meanwhile, DOT fell by 8.36% over the last week and dropped by 0.08% in 24 hours.

One of Polkadot’s advantages is its “canary” or Kusama network for testing new features. It can help identify problems and thus, makes Polkadot seem like a safe bet for investors. Furthermore, Polkadot’s parachain auctions have also fueled a great deal of hype.