Bitcoin registered a strong recovery of 28 November with the price rising by 5%, after dropping down to a low of $53,500. However, bullish momentum hasn’t been monumental over the past few days, and recovery has been more conservative.

Yet, fundamentally, there were strong developments on the derivatives side as one metric suggested a change last witnessed in 2019.

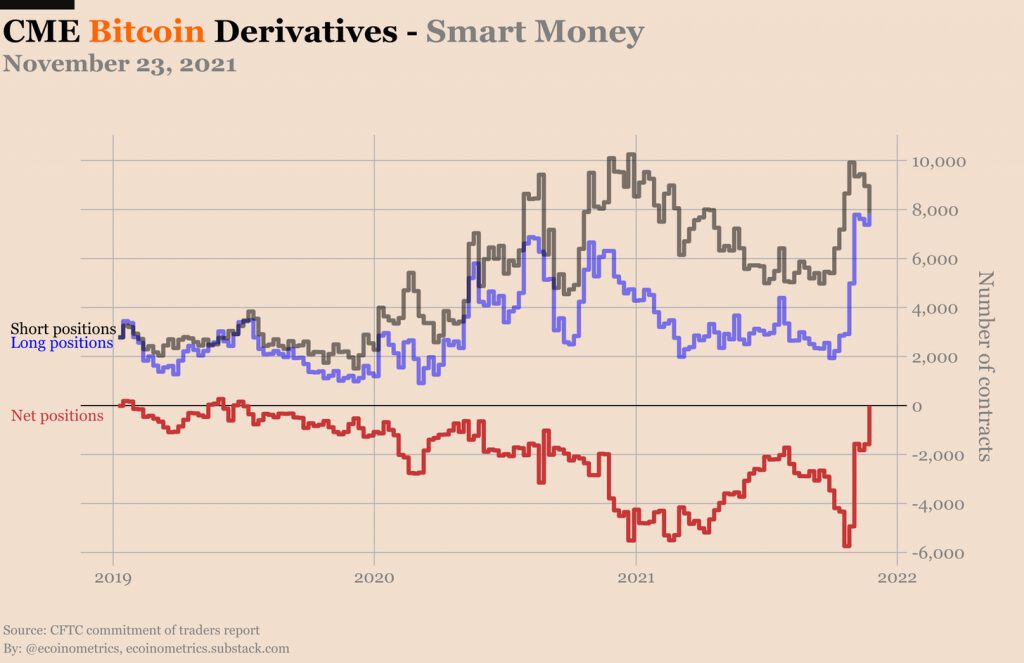

CME Bitcoin Smart Money net-flat?

According to data from Ecoinometrics, the smart money in CME Bitcoin futures indicated a net flat ratio between short positions and long positions. Here, the premium on futures is currently at par with the spot market. This has happened for the first time since 2019.

The report indicated that the recent approval of Proshares BTC futures ETF assisted in creating an influx of long positions on the CME market. Additionally, it mentioned,

“The rollover from the November to December contract as well as the price correction also contributed a little bit by reducing the number of short positions held by the leveraged funds.”

Now, since the beginning of 2020, short positions have had an edge over long positions. Given that smart money had been expecting a correction since the beginning of the bullish rally. Premium spreads were covered during corrections throughout the year, but now with a lower premium, the possibility of incentivizing on short positions has been reduced.

In addition to that, the CME Options market remained unaffected as puts to calls ratio remained the same.

Overall, the reduction of premium on BTC futures is a strong bullish sign considering the market is on a high. Right now, net-flat premium only reduces the lucrativeness of shorting the market. Hence, selling pressure automatically reduces on the institutional level.

Chart structure for the weekend

A stark difference from last weekend, when Options expiry on 26 November, pushed prices down to $53,500. Now a lack of premium in addition to the rising market can create a long squeeze for Bitcoin.

Well, on 3 December, the CME futures will close down for the weekend again, and the relative bullishness of the market may allow the asset to push above $60,000 during the less volatile phase. The absence of CME futures can act as a hall pass for the token to rally based on possible retail interest.

The possibility of Bitcoin reaching above $60,000 over the weekend is high, but confirmation will be needed over the next 24-hours.