In this article, BeInCrypto takes a look at the seven altcoins that increased the most last week, more specifically from Nov 26 to Dec 3.

These altcoins are:

- Gala (GALA) : -19.84%

- Hive (HIVE) : -19.51%

- Storj (STORJ) : 19.38%

- WAX (WAXP) : -16.17%

- Immutable X (IMX) : -15.29%

- Enjin Coin (ENJ) : -15.21%

- Zcash (ZEC) : -13.44%

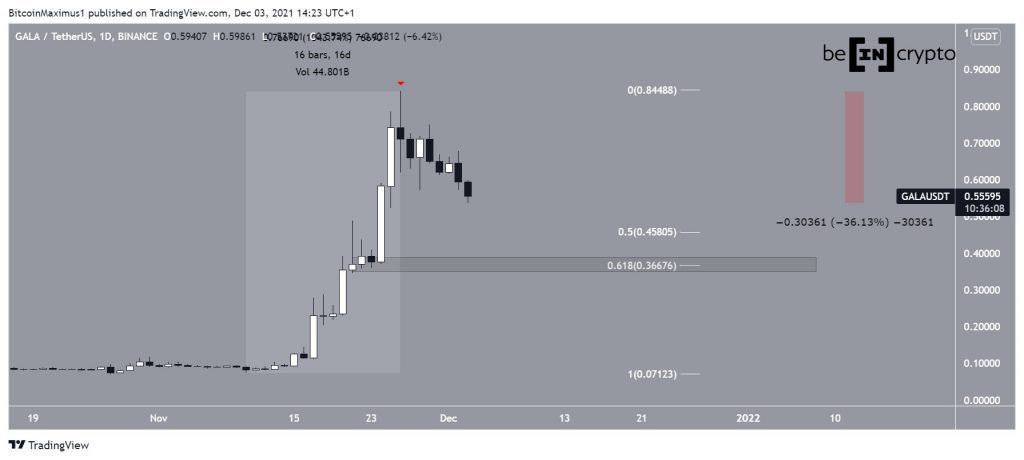

GALA

GALA has been moving downwards since Nov 26, when it reached an all-time high price of $0.84. This was the culmination of a 16-day upward movement with a magnitude of 1045%. Since then, GALA has decreased by 36%.

However, the token is approaching the $0.46 support, which is the 0.5 Fib retracement support level.

If the area fails to initiate a bounce, there would be even stronger support at $0.36, created by both a horizontal support area and the 0.618 Fib retracement support level.

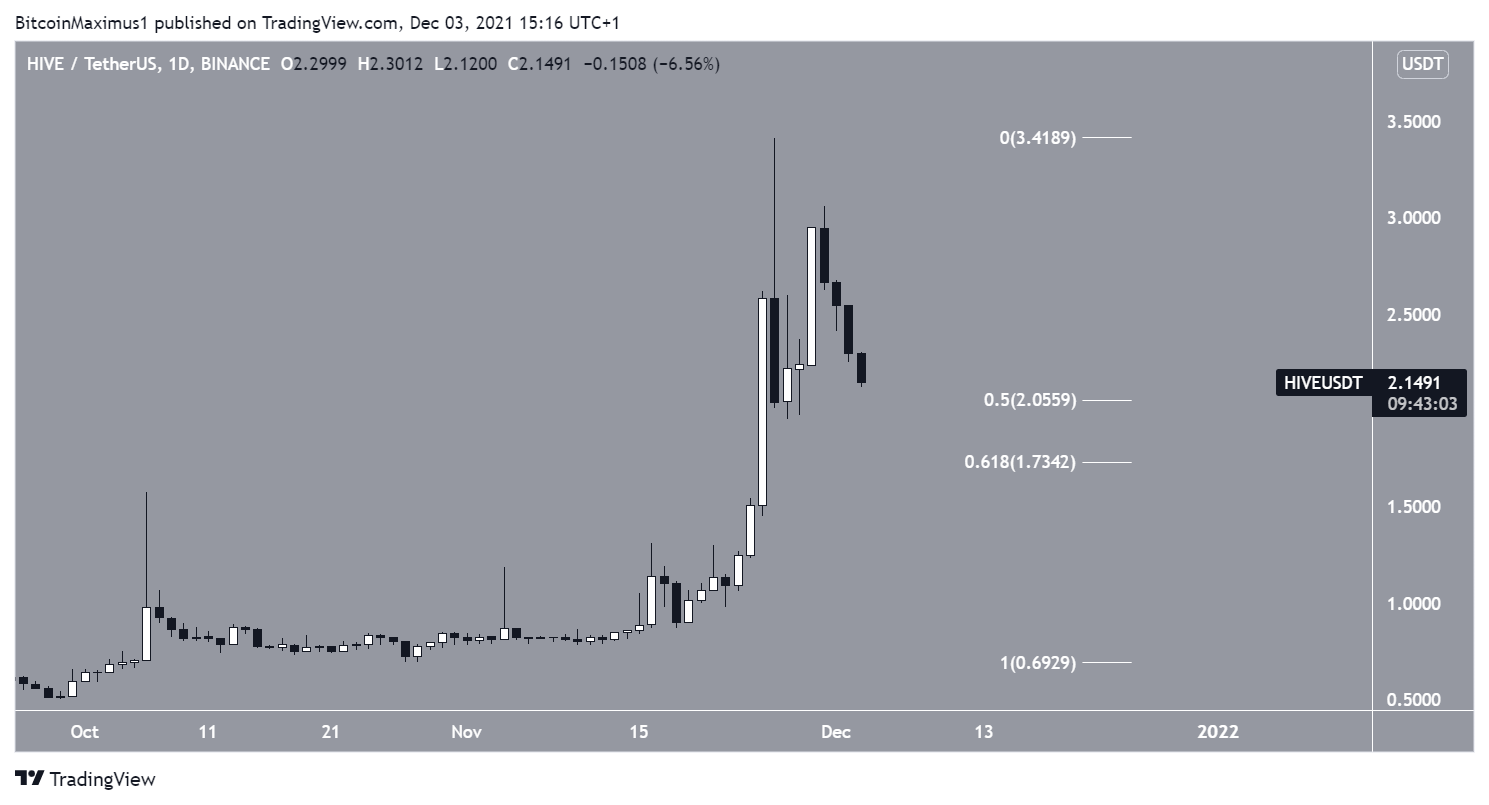

HIVE

HIVE reached a new all-time high price on Nov 26. After a drop, it initiated another upward movement. However, it failed to reach its previous highs and created a low high on Nov 30 (red icon). This is considered a bearish sign since the price did not have enough strength to reach its previous highs.

However, HIVE is approaching the 0.5-0.618 Fib retracement support area between $1.73 and $2.05, an area which is likely to initiate a bounce.

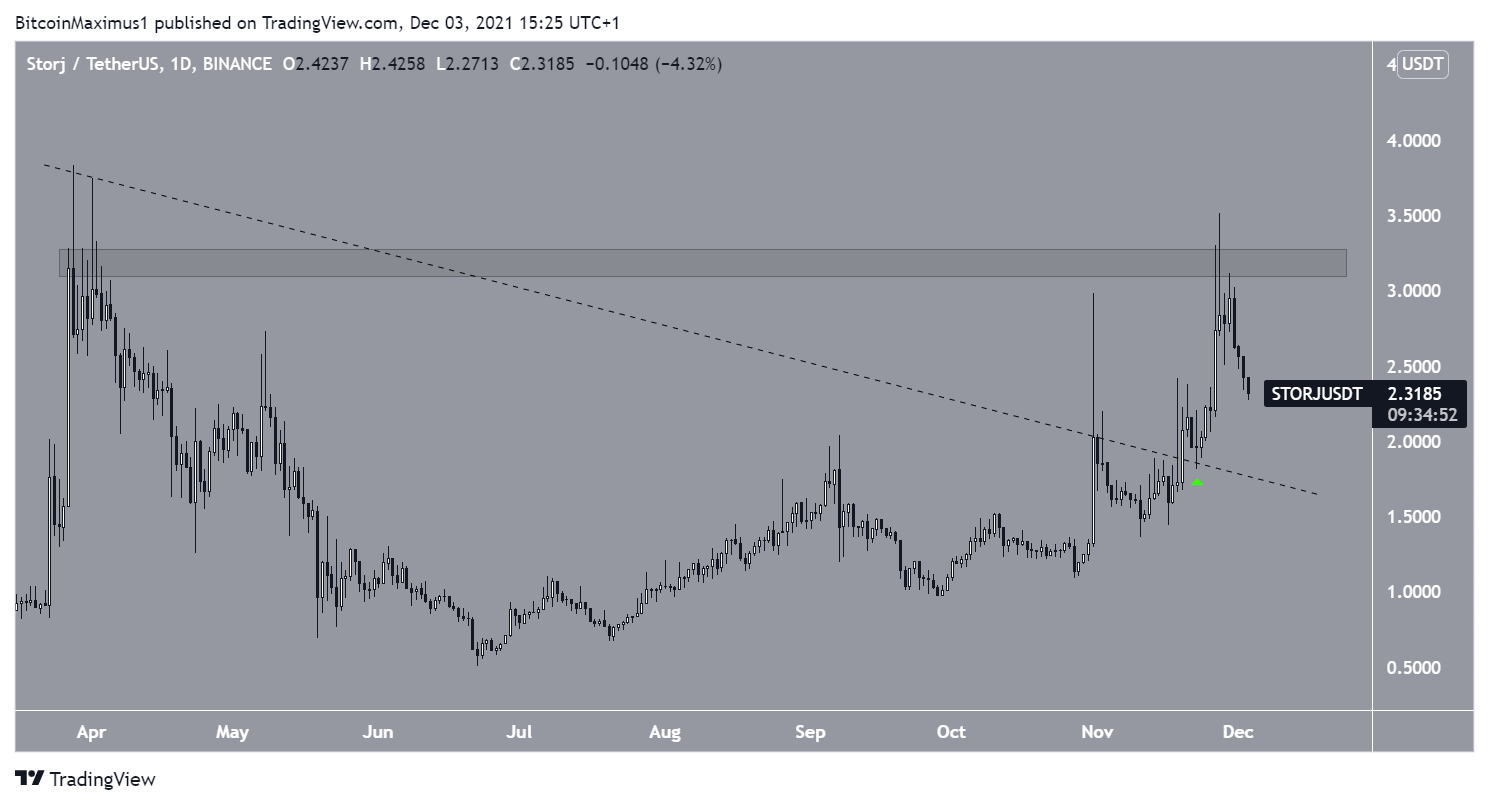

STORJ

On Nov 19, STORJ broke out from a descending resistance line. Afterwards, it returned to validate it as support three days later (green icon).

Afterwards, it began another upward movement, which led to a high of $3.51 on Nov 27. However, the token was rejected by the $3.30 horizontal resistance area and fell. This if the final resistance prior to a new all-time high price.

Therefore, a breakout above it could lead to an acceleration of the upward movement.

WAXP

WXP has been decreasing since Nov 17, when it reached a new all-time high price of $0.99. So far, it has fallen by 39%.

On Nov 30, it broke down from an ascending support line and further accelerated its rate of decrease.

The closest support area is at $0.485. This is the previous all-time high resistance area, which is now expected to act as support.

IMX

IMX has been decreasing inside a descending wedge since Nov 26. The wedge is considered a bullish pattern, meaning that an eventual breakout from it would be likely.

On Dec 2, the token bounced at the support line of the wedge, which coincided with the 0.618 Fib retracement support area. The confluence of support levels strengthened the validity of the bounce.

If IMX breaks out, the next closest resistance would be at $8.25.

ENJ

ENJ has been decreasing since Nov 25, when it reached a new all-time high price of $4.84. So far, it has fallen by 31%.

However, it bounced on Dec 3 (green icon), validating a long-term ascending support line.

As long as the ascending support line is in place, the bullish structure remains intact.

ZEC

On Nov 21, ZEC broke out from an ascending parallel channel. However, it failed to clear the $270 resistance area, which is created by the 0.618 Fib retracement resistance level.

ZEC deviated above the resistance before falling back below it once more.

However, the token bounced on Dec 2, validating the channel as support (green icon). Therefore, it is possible that it will soon make another attempt at breaking out.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.