Fantom became another victim of the bear attack as the overall crypto market lost over $410.2 billion in total market cap on 4 November. However, for Fantom, this wasn’t a first of an experience.

Fantom reminiscing?

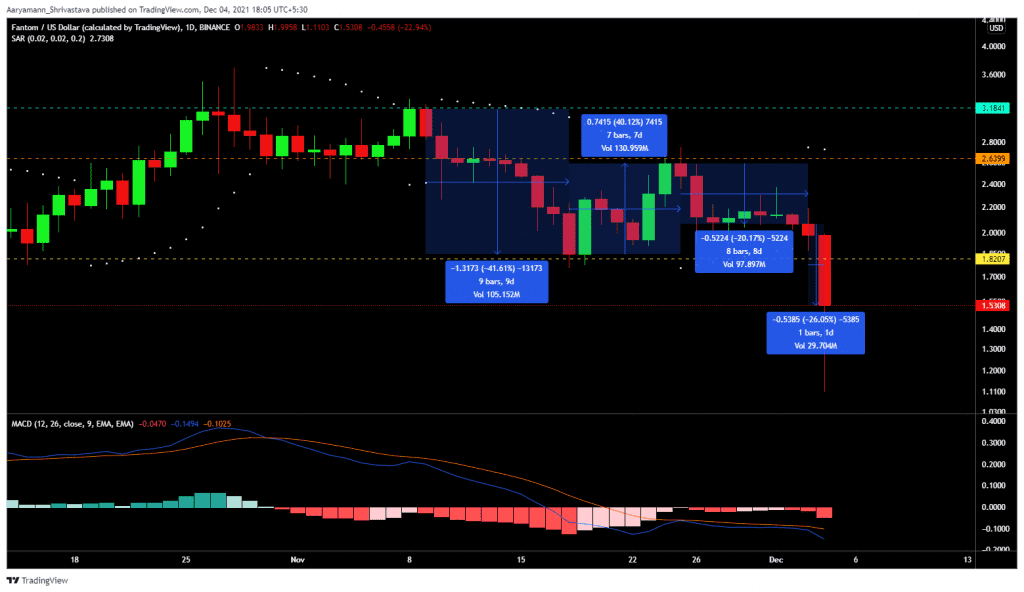

Fantom’s dip wasn’t sudden as it already was trading in red for a while now. However, Fantom was almost at -30% which made it the topmost losing coin at one point. It has since slightly recovered and is presently at -26%.

But for investors, this one-day 25% dip came right after the eight long days of red candles which took FTM down by 20.17%. In all, the altcoin lost about 40%+ in just nine days.

However, this is not the first time FTM investors witnessed something like this. Just last month, at the beginning of November, FTM had again posted a 41.6% depreciation in the span of nine days exactly, after which it rallied by 40% over the next seven days.

Fantom price action | Source: TradingView – AMBCrypto

Well, a rally won’t be likely this time since indicators are strictly bearish for the altcoin. Parabolic SAR’s white dots have just shifted their position to move above the candles and MACD is absolutely bearish right now.

Regardless of that, Fantom has been pretty good at pulling in new investors. Ever since its rally in August, STH figures have grown by over 17%.

Fantom STH traders | Source: Intotheblock – AMBCrypto

This also led to a significant increase in FTM’s volume which now averages at $50.7 million.

Fantom average volumes | Source: Intotheblock – AMBCrypto

However, the price fall over the month has caused significant losses to these investors who represent almost 30% of all addresses.

Fantom addresses in loss | Source: Intotheblock – AMBCrypto

The events that transpired over the last 24 hours also took a shot at the chain’s TVL in DeFi market as it came down by 16% (almost $1 billion)

Fantom TVL yesterday vs today | Source: DeFi Llama – AMBCrypto

But Fantom’s network development continues to grow at a good pace so it could see more investors enter and the price could react accordingly. The integration of Ren protocol, the bridge between Fantom and Terra via Anyswap, among others, are examples of the same.