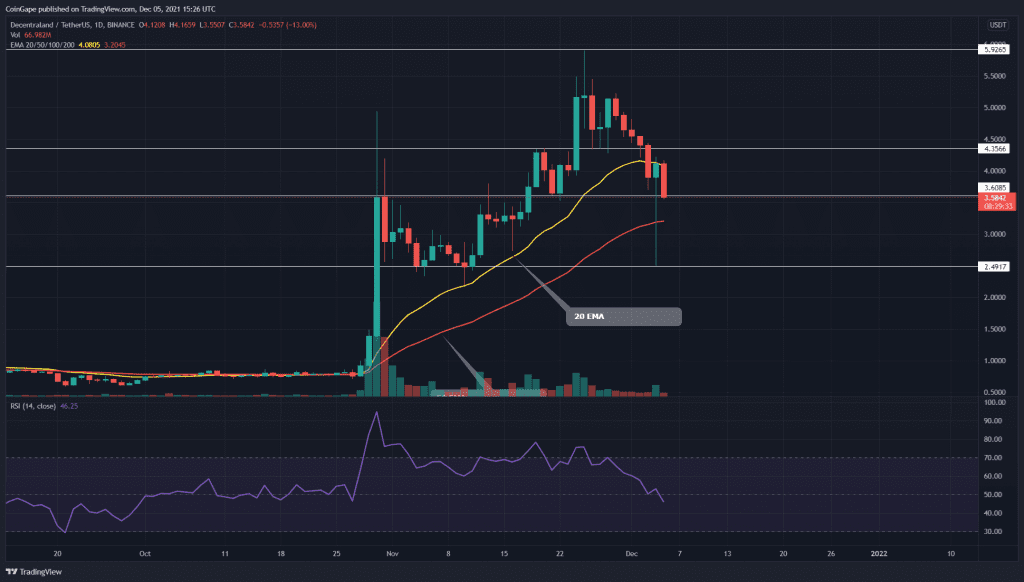

The MANA token is currently under a correction phase, which has plunged its price back to the crucial support of $3.6. However, despite making an impressive recovery from the bloodbath of December 4th, the token sellers are still trying to breach the 3.6 mark.

Key technical points:

- The MANA token bears have converted the strong 20 EMA support into a resistance

- The daily RSI line shows a downtrend in its chart

- The intraday trading volume in the MANA token is $4.2 Billion, indicating a 29.5% loss.

Source- MANA/USD chart by Tradingview

The last time when we covered an article on MANA/USD, the token was steady moving north, where it made a new All-TIme High of the $5.9 mark. After experiencing strong supply pressure from this level, the coin started retracing back and plunged the price to the $3.5 mark.

On December 4th, the crypto market experienced a sudden selling pressure which broke down important support levels for several crypto coins. However, the MANA token managed to sustain above the $3.5 mark and showed a green candle by the end of the day.

The token price is still trading above 100 and 200 EMA, indicating the token maintains its uptrend. However, the 20 EMA line, which was earlier providing good support to the price, is now flipped to act as resistance.

The Relative Strength Index(46) shows its line is steadily approaching the oversold territory, indicating strong selling in the token.

MANA/USD 4-hour Time Frame Chart

Source- MANA/USD chart by Tradingview

The crypto traders can notice that the MANA price is respecting the levels of a descending resistance trendline. Until this trendline is intact, these traders can grab some great short opportunity when the hints a bearish reversal from this line.

On the contrary note, this trendline can also provide an early signal if the price starts to rally again.