As of December 12, around 90% of all the bitcoin that will ever exist is in circulation today, and the top five exchanges hold 1.6 million bitcoin. The bitcoin holdings on Coinbase, Binance, Huobi, Kraken, and Okex combined represent 7.96% of the 21 million bitcoin supply cap. The bitcoin held by Coinbase is a whopping 51% of the 1.6 million bitcoin or $41.6 billion using today’s exchange rates.

5 Exchanges Hold 1.6 Million Bitcoin Worth $81 Billion

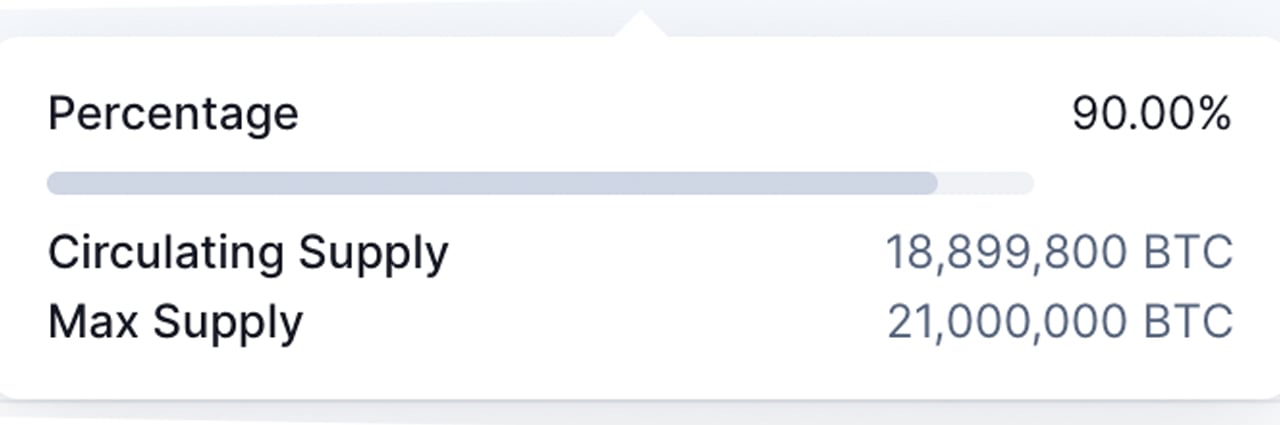

At the time of writing, 90% of the 21 million bitcoin supply cap has been mined into existence. Currently, there is 18,899,800 BTC that has been mined so far and in the near future, 19 million bitcoin will be mined into existence.

We also know that a decent fraction of bitcoin has been lost and Satoshi Nakamoto may have mined around 1.1 million BTC before leaving the bitcoin community. A study published by Coin Metrics on November 19, 2019, indicates that the assumed amount of lost coins was around 1.5 million at block height 600,000.

Today, five exchanges hold 1,673,460 bitcoin or $81.6 billion worth using today’s USD exchange rate. The five exchanges are Coinbase, Binance, Huobi, Kraken, and Okex and they all hold a significant amount of ethereum as well. Coinbase holds 853,530 BTC according to metrics from Bituniverse, Peckshield, and Chain.info.

The company’s ether holdings are not disclosed but in terms of bitcoin, Coinbase holds 51% of the aggregate held on the top five exchanges. Binance holds 290,080 BTC or $14.1 billion and Binance also has a stash of 3.59 million ethereum worth $14.2 billion. Furthermore, Binance has 1.24 billion of tether (USDT) in reserves as well.

Top 10 Exchanges Custody 7% of the $2.3 Trillion Crypto Economy

Huobi has 160,950 BTC today, 2.13 million ether, and 747 million USDT as well. Metrics indicate that Kraken has 102,900 BTC in reserves and 2.27 million ethereum. Lastly, the fifth-largest digital currency exchange in terms of BTC reserves, Okex, has around 266,530 bitcoin but only 248,840 ethereum.

Okex is followed by Gemini’s 116,000 BTC and 1.15 million ether, and Bitfinex’s 195,550 BTC and 353,660 ether in reserves. These exchanges are followed by Bittrex (48,110 BTC and 301,370 ether), Bitmex (111,650 BTC), and Bitflyer (75,030 BTC). Between the top five crypto exchanges, in terms of reserves, there’s $132.36 billion held on these platforms.

The combination of all the reserves held on the top ten exchanges is around $165.89 billion. For some perspective, there’s more crypto value on the top ten exchanges than the entire stablecoin economy of $162.6 billion. In fact, the funds held on the top ten crypto trading platforms represent roughly 7.07% of the $2.343 trillion crypto economy.

What do you think about the amount of crypto value held on centralized cryptocurrency exchanges today? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Bituniverse, Coinmarketcap,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer