With the market staying macro bearish, most of the assets and their blockchains are currently relying on network developments for recovery. Well, Polkadot isn’t any different. It has the Parachain auctions at hand as a tool to engage in the limelight. However, it seems to be not working out as they expected it to.

Polkadot parachain pickle

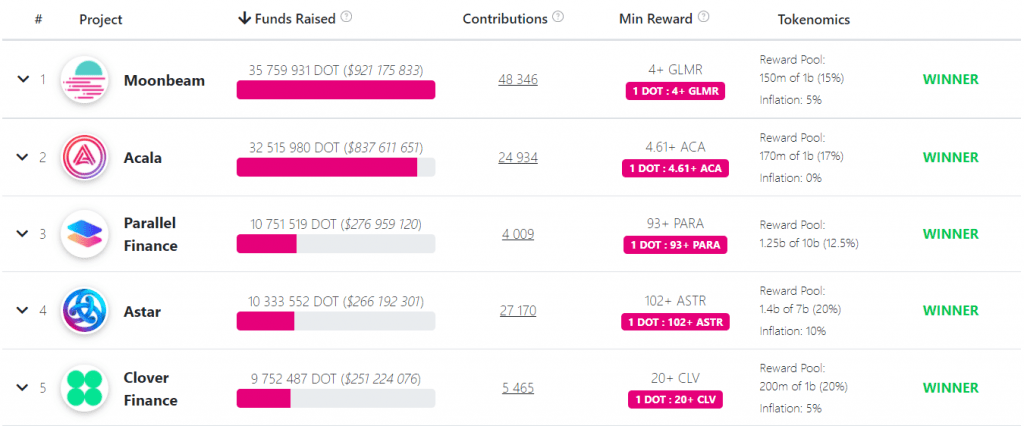

On 16 December, Polkadot Parachain auctions’ first round ended with clover.finance taking the fifth spot. The DeFi project won by raising over $251 million which was just slightly more than the runner-up Efinity.

Parachain auction round 1 winners | Source: Parachains.info

The parachains play a paramount role when it comes to network development as one of Polkadot’s core developers described these parachains as a “blockchain on steroids”

‘A #parachain is like a blockchain on steroids, it’s something that inherently has the ability to do all the functionalities of a blockchain but furthermore, communicate, and connect with, and interoperate with other blockchains.’ – @shawntabrizi, Polkadot Core Developer pic.twitter.com/8br6K0xqW2

— Polkadot (@Polkadot) December 16, 2021

Notably, looking at its development activity, it’s apparent that Polkadot leaves no stone unturned. With over a thousand repositories and 34k commits, its growth is consistent.

But, in comparison to other major cryptocurrencies, its performance as a crypto asset is just above par at best.

Its market value is only slightly better than the likes of Cardano and Uniswap and its Return On Investment (ROI) is significantly lower than Ethereum and Cardano.

ROI comparison | Source: Coinmetrics – AMBCrypto

However, more than that the biggest issue is the lack of active investors which are essential to a successful chain. Also, right now, Polkadot has the least amount of active investors in comparison to other top altcoins.

Active investors on Polkadot | Source: Coinmetrics – AMBCrypto

This is also why the network produces fewer transactions on a daily basis in the lower 200k zone.

Polkadot transaction count | Source: Coinmetrics – AMBCrypto

Consequently, the network is observing lesser inflows and higher outflows. This week Polkadot barely managed to draw in inflows of $1.4 million. While this is an improvement over previous weeks, DOT will still need a lot more to recover from its Month to Date $3.8 million worth of outflows which are the highest of any altcoin.

Weekly inflows | Source: CoinShares

The diminishing interest is also visible on the social fronts as, despite the parachain hype, Polkadot’s dominance is less than 0.8%, at the time of writing.

Thus, for Polkadot, the next big thing will be the second round of auctions which are scheduled to begin on 23 December. So, if it can manage to generate enough hype by then, maybe it could kick DOT off strongly into 2022.