Ethereum (ETH) has rallied approximately 3% in the past 24 hours to reclaim the crucial $4,000 level as the market turns green. Ethereum price is trading in the green around $4,033 as many other top cap cryptos. Bitcoin (BTC) is leading the uptick with a 3.64% rise reclaiming the $48,000 crucial level while Cardano (ADA) has rallied $0.35% to $1.26.

The biggest gainers on the among the top 10 are Terra (LUNA) and Avalanche (AVAX), LUNA has leaped 4% to $82.71 to continue its rally after Kraken listing while AVAX gains 11% to trade above $110. Is the market gearing up for a Santa Claus rally over the holidays?

Ethereum Price To Launch An Upswing After Reclaiming the $4,000 Support Level

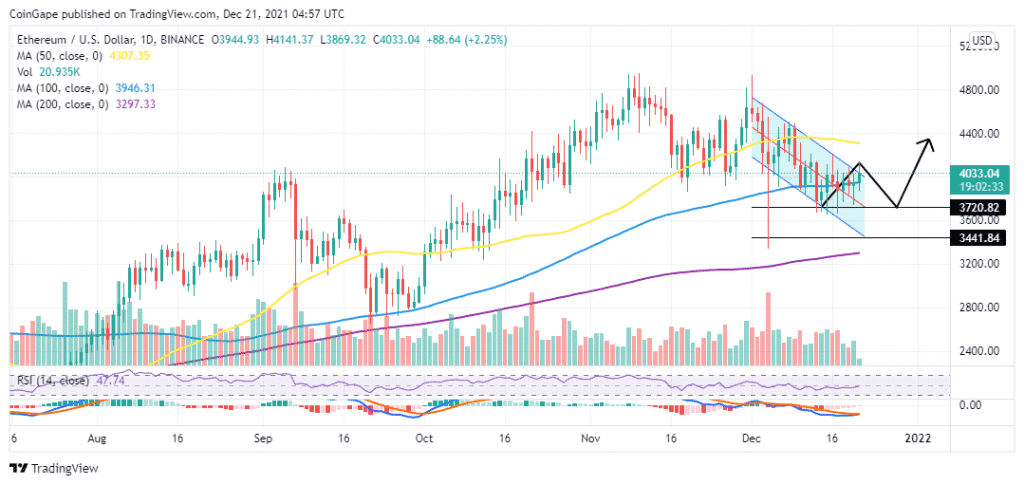

Ethereum price has been trading inside a descending channel since December 01. The bounce off the support line of the channel on December was stopped by the resistance from the upper boundary of the falling channel at $4,060, indicating that bears are selling on rallies.

However, the recent rally has seen the ETH price slice through the aforementioned resistance and now Ethereum trades above both the upper boundary of the channel and the $4,000 psychological level. This is a confirmation of a bullish breakout that is likely to see Ethereum price rise higher towards the $4,400 level.

However, before reaching this level, ETH has to overcome significant resistance at $4,307 posed by the 200-day Simple Moving Average (SMA).

ETH/USD Daily Chart

The upward movement of the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicator the relative strength index (RSI) suggest that the ETH market is bullish.

On the flipside, strong resistance from the $4,100 level could extend the stay inside the descending channel for a few more days. The bulls may then make one more attempt to push the price above the channel. If they succeed, it will indicate that the selling pressure may be reducing. However, if the price breaks below the channel, the bears could challenge the 200-day SMA at $3,297. A break and close below this level could trigger massive sell orders that are likely to take ETH price correction deeper.