Bitcoin price lost the crucial $44,000 level on Wednesday after reports emerged that the Federal Reserve’s December FOMC session was set to re-confirm plans to decrease its balance sheet and increase interest rates in 2022.

Following these news, the stock market corrected as well as the crypto market with Bitcoin shedding $330 of its market value in just 30 minutes.

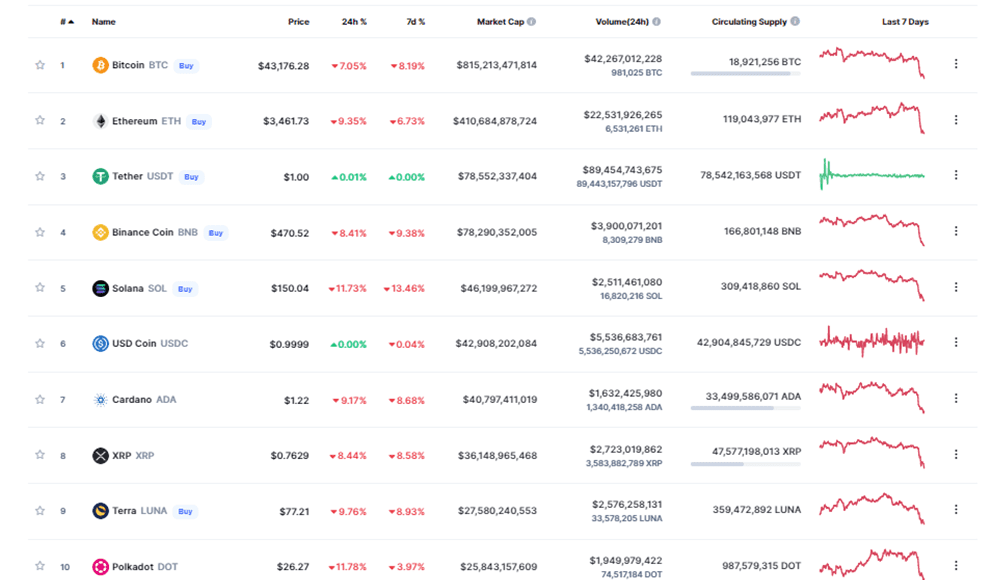

All top 10 cryptocurrencies are in deep red, apart from stable coins (USDT and USDC) according to data from CoinMarketCap.

This validates the outlooks of bears that we might experience a bear crypto market for the better part of 2022.

However, the short-term outlook for the big crypto points to a deeper correction in the near-term.

Bitcoin Price Could Drop 7.5% Further To $40,000

Wednesdays crypto market crash saw BTC price fall below the horizontal support line of the descending triangle as shown on the four-hour chart.

Losing the aforementioned support at $45,645 was crucial for bears as the price of the pioneer cryptocurrency escaped from the confines of the governing chart pattern.

The target of the descending triangle chart pattern is $40,011. Therefore, if the current Bitcoin price correction continues, it will drop further to tag the target of the chart pattern just above $40,000.

If this happens, BTC/USD price will drop approximately 7.57% from the current price around $43,308.

BTC/USD Four-Hour Chart

Note that the entry of the Moving Average Convergence Divergence Indicator (MACD) into the negative region validates this bearish outlook. Also, the MACD sent a call to sell Bitcoin yesterday when the 12-four-hour exponential moving average (EMA) crossed below the 26 EMA suggesting that the market momentum had flipped red.

In addition, the entry of the RSI into the oversold zone is an indication that the bears are currently in control of the BTC price, adding credence to the bearish outlook.

Looking Over The Fence

On the flipside, the oversold RSI is an indication that the selling pressure might fade out soon pointing to a reversal in the price action in the near future.

If this happens, Bitcoin might rise to reclaim the $44,000 support level, which might bolster bulls to undo yesterday’s losses.