Crypto market including large cap coins like Bitcoin (BTC) and Ethereum (ETH) are facing bloodbath & prices have fallen by 10% and 13% over last week respectively. Things have turned worse for first crypto exchange IPO Coinbase as $COIN stock price has fallen by more than 11% over last month. But, why this Cathie Wood backed stock is getting hit hard?

Why Cathie Wood backed Coinbase ($COIN) stock price is dumping Hard?

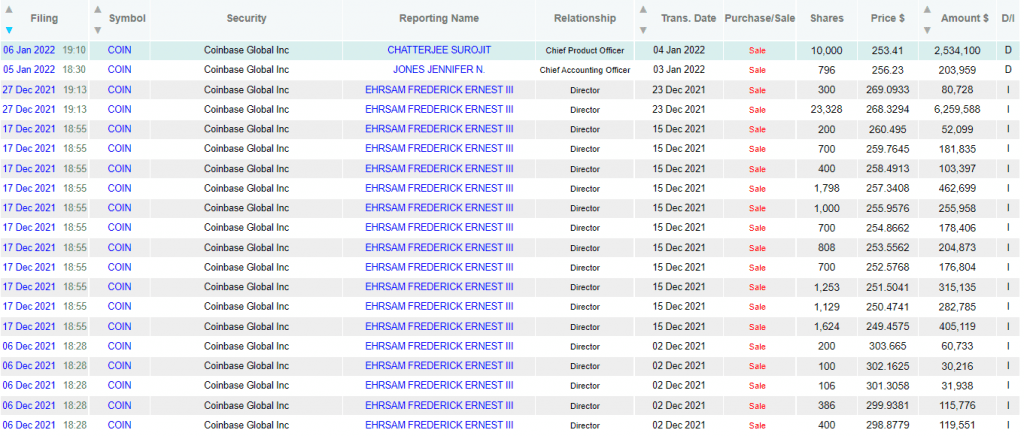

As per reports, Coinbase officials including its directors, chief product officers and chief accounting officers are dumping millions worth of $COIN shares in the market. While the drop in price of $COIN can be largely attributed to ongoing crypto market bloodbath this large selling by Coinbase employees is also among major factor for sharp decline in prices.

Back in April 2021, Coinbase gifted each of its 1700 employees 100 shares each worth $56 million. At the end of first day of trading $COIN was trading at $328 and it reached at all time high price of $342 on Nov. 12th, 2021. Coinbase also announced a $1.5 billion private senior note offering in Sep. 2021.

Another key factor for the downfall of this once hyped stock is interference by SEC. Coinbase CEO Brian Armstrong’s plans to capture Defi Lending market took a hit when SEC called it a security. SEC asked Coinbase to shut down their lending operations and Coinbase CEO took this to public in an official tweet.

So. over and all, not all is good in Coinbase camp as insiders selling amid crypto market dump and a close rivalry with SEC seems to be very negative sentiment for retail investors. Though Cathie Wood and her ARK investment still holds Coinbase ($COIN) shares it will be interesting to see her reaction to these reports of insider selling.