BeInCrypto takes a look at the seven cryptocurrencies that have decreased the most over the past seven days, more specifically from Jan 14 to Jan 21.

These cryptocurrencies are:

- Loopring (LRC) : -34.57%

- The Sandbox (SAND) : -24.42%

- Internet Computer (ICP) : -23.94%

- Near Protocol (NEAR) : -23.54%

- Chainlink (LINK) : -21.52%

- Dogecoin (DOGE) : -20.60%

- Solana (SOL) : -17.58%

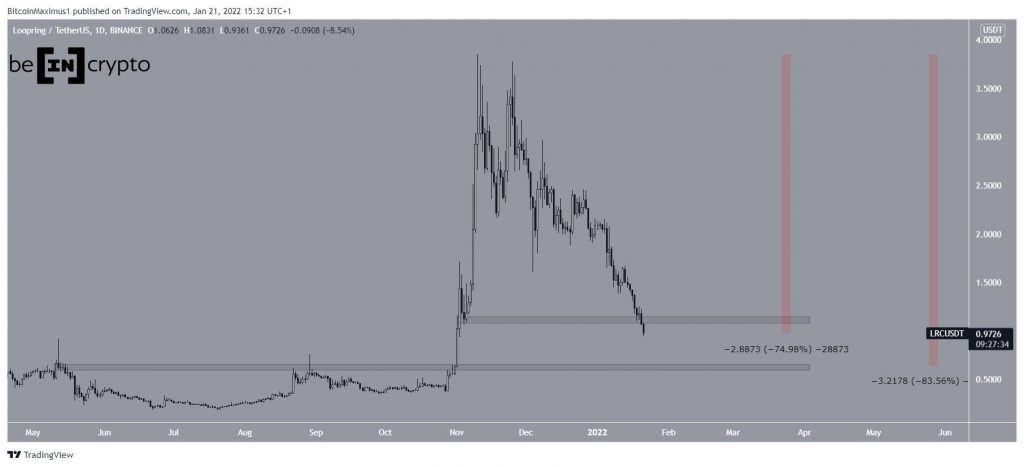

LRC

LRC has been falling since reaching an all-time high price on Nov 10. So far, it has fallen by 75%. On Jan 21, it broke down from the $1.10 support area, above which it had been trading since the beginning of Nov.

The next closest support area is at $0.62. If it reaches it, it would amount to a decrease of 83.50%.

SAND

Similarly to LRC, SAND has been falling since reaching an all-time high price on Nov 25. It is possible that the decrease has taken the shape of a descending parallel channel.

Currently, it is trading just below the 0.618 Fib retracement support level at $3.60. If it breaks down below this area, the next support would be at $2.26, the 0.786 Fib retracement support level and a horizontal support area.

This area would also coincide with the support line of the channel.

ICP

ICP has been falling since Sept 6. On Dec 20, it reached a new all-time low price of $20.88. This caused a breakdown from the $28.50 horizontal support area.

However, the token reclaimed the area shortly afterwards and increased all the way to $38.02.

Despite the increase, the upward movement could not be sustained, as ICP has fallen below the $28 level once more. Until this level is reclaimed, the trend cannot be considered bullish.

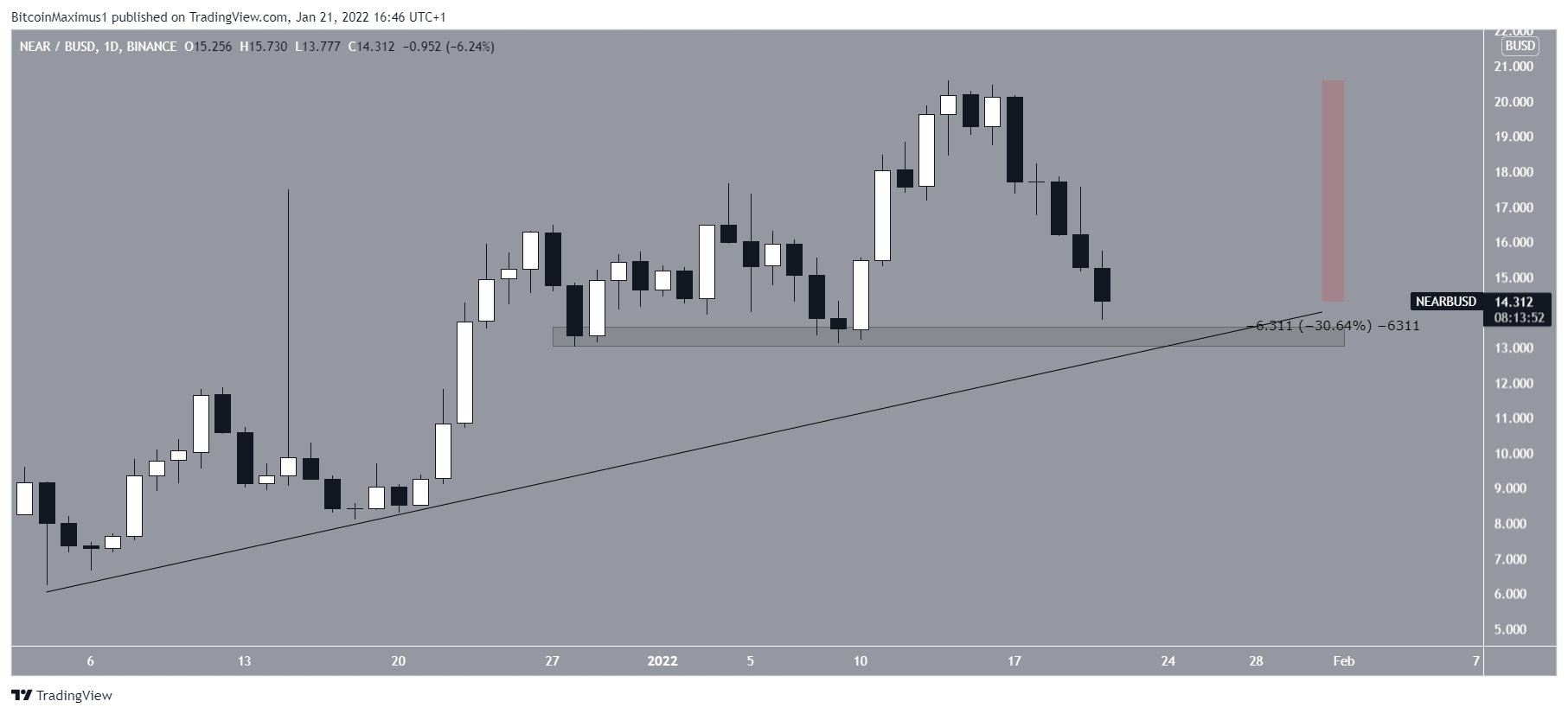

NEAR

NEAR has been falling since Jan 14, when it reached an all-time high price of $20.6. So far, the token has decreased by 30.65%, leading to a low of $13.77 on Jan 21.

There is strong support at $13.30, created by both a horizontal support area and an ascending support line. Therefore, it is possible that this area will initiate a bounce.

LINK

With the exception of a deviation on July 10 (red circle), LINK has been trading above the $16.50 horizontal area since May.

More recently, the area was the catalyst for a significant bounce on Dec 4 (green icon), which led to a high of $28.71 on Jan 11.

However, LINK has been falling since and is approaching the $16.50 area once more. A breakdown below it could trigger a sharp fall.

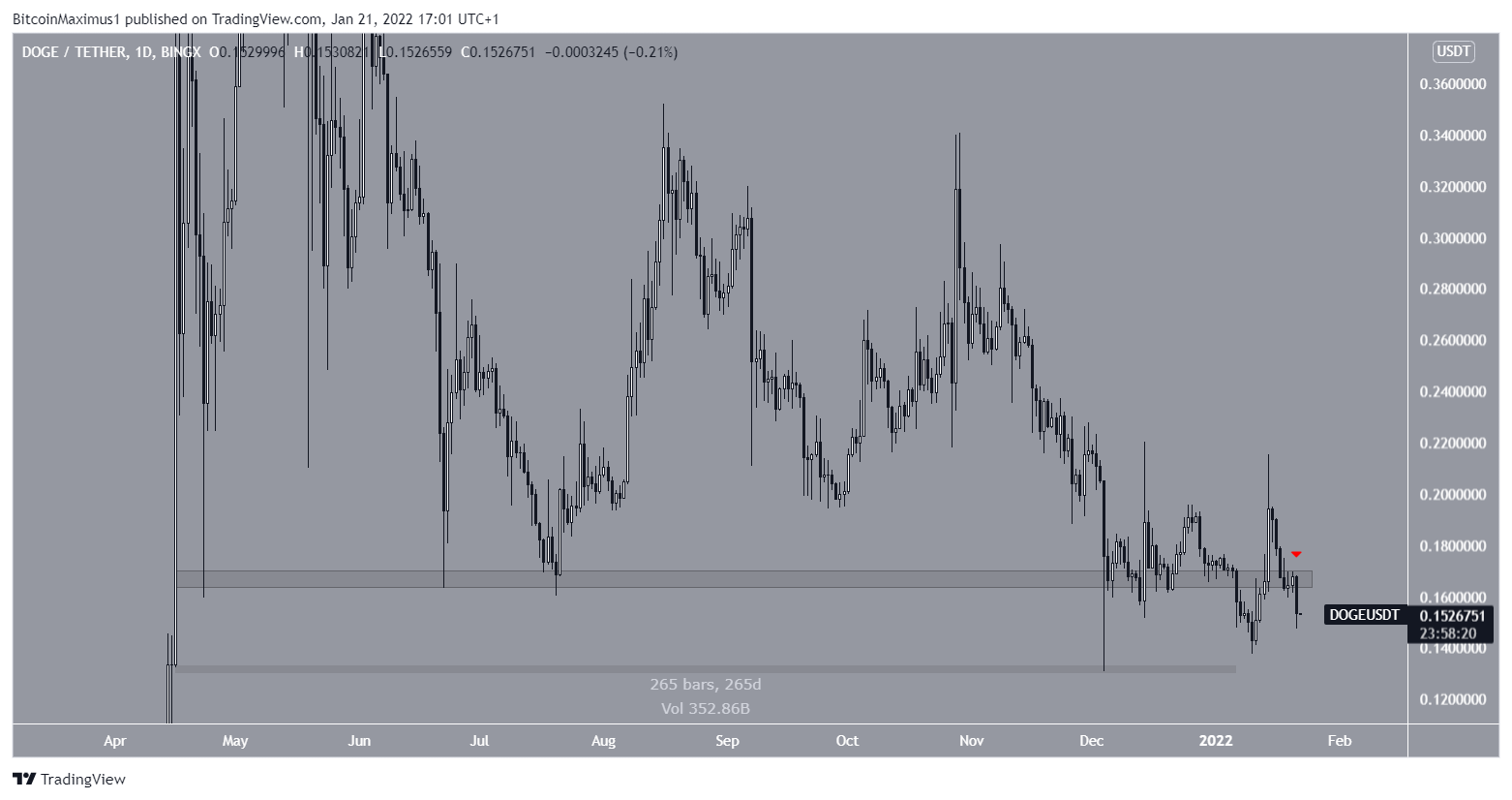

DOGE

Since April 16, DOGE has been trading above the $0.166 horizontal support area. However, the token broke down after 265 days, more specifically on Jan 6.

While it bounced afterwards, it failed to sustain the upward movement and is now back below the $0.166 area.

Whether the token reclaims this area or gets rejected from it will likely determine the direction of the future trend.

SOL

SOL has been falling since reaching an all-time high price of $259 on Nov 6. So far, it has decreased by 53%.

On Dec 8, it broke down from an ascending support line (red icon) and accelerated its rate of decrease.

Currently, it is trading just above the 0.618 Fib retracement support level at $111. Since there is no support below this area until $74, it is crucial that SOL manages to hold on above the current support.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.