Avalanche’s (AVAX) price has been moving in sync with the fall in the global cryptocurrency. European stocks open higher on Tuesday following the subdued Asian session. However, the US dollar index (DXY) trades above 96.00 with 0.32% gains ahead of Fed’s two-days meeting.

- Avalanche price sees bottom buying opportunity near $65.00.

- AVAX price uptrend could speed up in the short term as the RSI holds in the oversold zone.

- Long-term horizontal support around the mentioned level provides support to buyers.

At the press time, AVAX is trading at $64.10, up 1.50% for the day. The 24-hour trading volume is $1,102,980,204 with 24.39% gains.

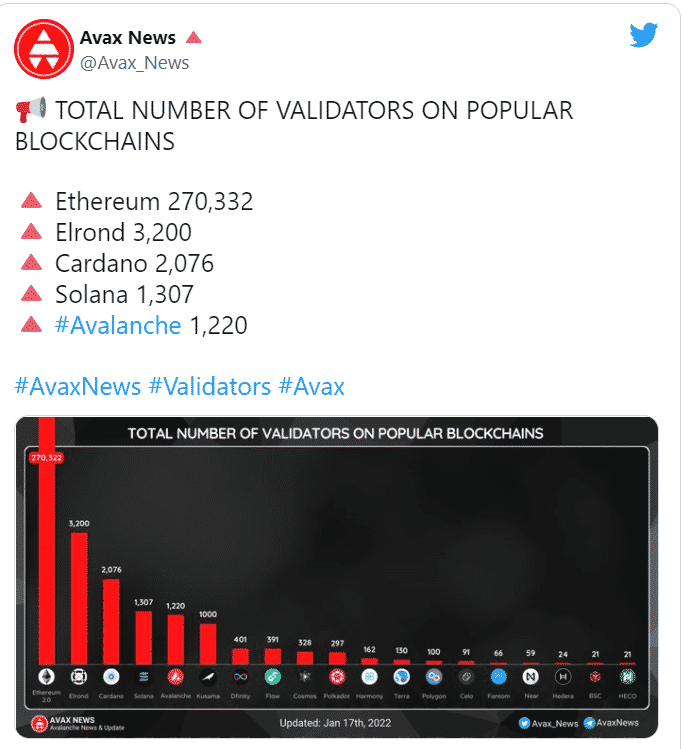

Avalanche constitute 1,200 validators on its platform

As per the latest tweets from Avax news showed that Ethereum top the list with the highest number of validators on a popular blockchain, while Avalanche has about 1,220. The statistics tell the rising popularity of Avalanche in the crypto community.

Technically speaking, the AVAX price has retraced more than 60% from the all-time high made on November 21. The descending trend line from ATH has been tested twice on December 21 and January 1 respectively. AVAX price has breached the 50 EMA (Exponential Moving Average) on January 5.

Avalanche (AVX) price found support near the $59.00 level, this is a double bottom formation. This technical formation suggests bouncing back in the price. Furthermore, the daily relative strength index (RSI) reads at 32. Any uptick in the RSI could result in the upside momentum in the pair toward the first target at horizontal resistance line at $80.00.

Next, the market participant could touch the 50 EMA at $90.00. However, the reversal in trend can further be validated above the mentioned bearish slopping line.

On the flip side, a daily close below the $59.00 level could invalidate the bullish thesis with eyes on $50.00.