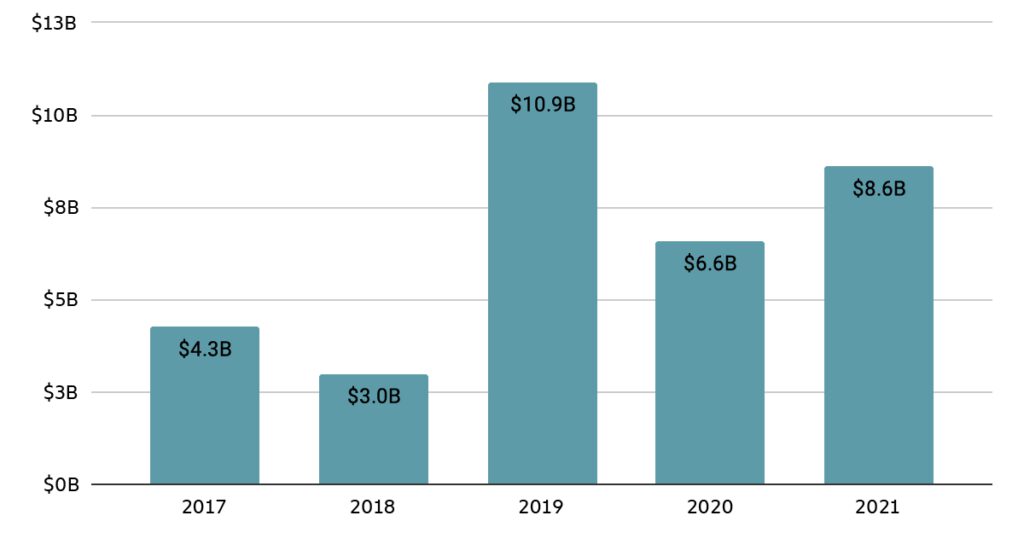

Industry intelligence firm Chainalysis reports that money laundering in the crypto market increased by 30% in 2021 over 2020. Last year saw $8.6 billion laundered through crypto, an increase of $2 billion from the year before that.

A new report published by blockchain and cryptocurrency intelligence firm Chainalysis reveals that money laundering in the crypto market increased by 30% in 2020 compared to the year before. The post precedes the firm’s upcoming 2022 Crypto Crime Report, due to be released in February.

Chainalysis says that money laundering “underpins all other forms of cryptocurrency-based crime.” It states that money laundering activity in the cryptocurrency market is highly concentrated, and all the money ends up linked to a small group of entities.

A total of $8.6 billion was laundered in 2021, compared to the $6.6 billion in 2020. That’s still less than the $10.9 billion of 2019 — which may be because law enforcement agencies have begun cracking down on crypto-related money laundering operations. Most of the money laundered since 2017 has apparently ended up at centralized exchanges, though the firm is quick to point out that money laundering affects all forms of economic value transfer.

Governments are very keen to limit illicit financial activities related to cryptocurrencies, as they simultaneously work on broad frameworks for the market. In a letter sent to the U.S. Treasury, U.S. Democratic Senator Dianne Feinstein asked the U.S. Treasury and the IRS about the role cryptocurrencies played in human and drug trafficking.

NFTs are also involved in fraud, according to the IRS. The agency’s criminal investigators said that crypto and NFTs can facilitate money laundering, market manipulation, and tax evasion. The IRS is also working on measures it can take to prevent illicit activity.

2022 to bring some heavy regulation

All the signs point to much more regulation for the crypto space, especially in the U.S. Authorities in the country have made it clear that it will provide some rules for the market. The Biden administration is rumored to be preparing laws by way of an executive order.

The SEC, which is the agency that will oversee much of the market, has also been clear about regulation. SEC Chair Gary Gensler has named crypto exchanges as a top priority for examination.

However, not many countries are looking at a complete ban. One positive takeaway is that governments are willing to allow the market, albeit with some restrictions and heavy oversight.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.