Source: gopixa – Shutterstock

- Bitcoin is trading at $38,340 at press time, and while it has traded sideways in the past week, it’s down by 45 percent from its November all-time high.

- Traders shared how they are coping with the dip, including whether they took profits when BTC shot up and the best way to hedge investments during a bear market.

Since hitting its all-time high of $68,680, Bitcoin has lost 45 percent of its value to trade at $38,340 at press time. In that time, it has shed $600 billion from its market cap as a bear market set on. As it plunged, Bitcoin decimated many traders’ positions, with those that were working with leveraged positions feeling the biggest pinch. A few crypto traders shared how they have been handling the dip, their tactics to hedge their investments, and lessons they have learned along the way.

Just another day in crypto

While the market dip since November has been massive – the overall crypto market has shed more than $1 trillion – crypto traders are used to such changes. As Kraken CEO Jesse Powell once stated, “To me, it’s just another day, just a walk in the park.”

Wendy O, known to her social media fans as CryptoWendyO, concurs with Powell. The trader, who has become a big hit on social media – she has 232,000 followers on TikTok – told TIME Magazine:

Crypto is very volatile. We’re going to have nasty downturns. And that’s okay. People get confused and think, ‘Oh, I’m going to have massive gains all the time’—but that’s not the way things work. Because we have volatile massive gains, we’re also going to have volatile massive downturns.

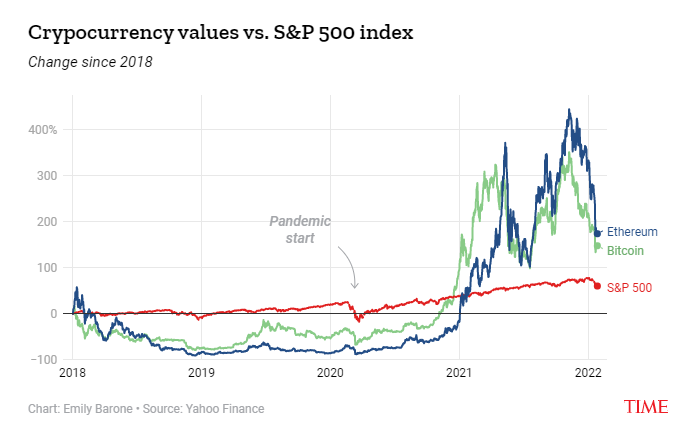

As the chart below shows, Ethereum and Bitcoin have seen much more aggressive market action, be they gains or losses, than the S&P 500 by a country mile since 2018.

For some traders, zooming out and looking at the bigger picture is what has kept them going. Evan Rodgers told the publication that for him, his focus is on accruing Bitcoin, regardless of the price downturn, or in crypto lingo, stacking sats.

When the price goes down, you can’t think of it in terms of dollars that you’re quote-unquote ‘losing.’ You need to look at the actual number of Bitcoin that you have and realize that’s not changing. There’s just a short-term price effect happening.

Buying the dip and taking profits

For others, the dip is just an opportunity to buy more Bitcoin. Lea Thompson, the founder of Girl Gone Crypto, is one of the traders that have been taking advantage of the dip to increase their BTC positions. She stated:

I’m really invested in projects that I think will have a lot more value long-term than where they are currently. […] But if something is really valuable in the long run, then these market dips are more an opportunity to accumulate more than something that’s really scary.

Thank you for including me @TIME! 🔥

When you have a long-term view, dips are really just an opportunity to accumulate. 🤝https://t.co/n5RZXB9fHr

— Girl Gone Crypto (@girlgone_crypto) February 2, 2022

The current dip has seen many traders lose their entire portfolio as they were liquidated out of their leveraged positions. Rodgers was one such trader, and his advice to fellow traders is don’t get into leveraged positions unless you’re absolutely certain about what you’re doing.

“I think any experienced trader will tell you that unless you really know what you’re doing, you’re setting yourself up for a challenging time,” he told TIME.

Leverage is great when the market goes up, but if there’s a sudden downturn, you can get liquidated. That’s something I’ve experienced personally and while it wasn’t a devastating loss, things like that help you learn to minimize risk.

And of course, traders must always remember to take profits whenever the market is going through a bullish period. This way, they can cushion themselves for when the market goes through a dip.

Wendy O stated:

When the market is green and doing really well, you should have specific profit-taking scenarios for when you’re entering, when you’re exiting, and all those types of things.

“There’s no assurance whatsoever”

As Bitcoin hit new highs towards the end of 2021, many predicted that the new year would bring even better tidings for the cryptocurrency. Alex Mashinsky, the CEO of crypto lender Celsius Network, predicted that we would hit $160,000 this year while others like JPMorgan analysts said BTC was heading to $146,000 in the long run and $73,000 this year.

While it may eventually hit these figures later in the year, January was a tough month for the cryptocurrency. This goes against historic patterns, according to Rodgers. He stated:

Even though historically there’s been a big pump in January, the macroeconomics just weren’t right to have a run like that this year. It was relatively obvious that we were in for some chop—not necessarily a 50 percent drawdown, but when we have this chop, it’s also common to see a 50 percent drawdown. So that’s where my head was at.

Lea, known to her fans simply as Girl Gone Crypto, concluded by reminding investors that there are no guarantees whatsoever with crypto trading.

“The fact of the matter is, with any investing, there’s never assurance that’s always [going to be the case]. But when you understand the underlying principles of why you believe in something, it makes it a lot easier to ride out these waves,” she stated.