Argano is a decentralized protocol and liquidity aggregator built and supported on the Polygon sidechain network.

The Argano protocol aims to provide the best services of a decentralized exchange with clear new and innovative features in the DeFi space. The main features that distinguish Argano from other protocols are shown in the next key points of the document structure.

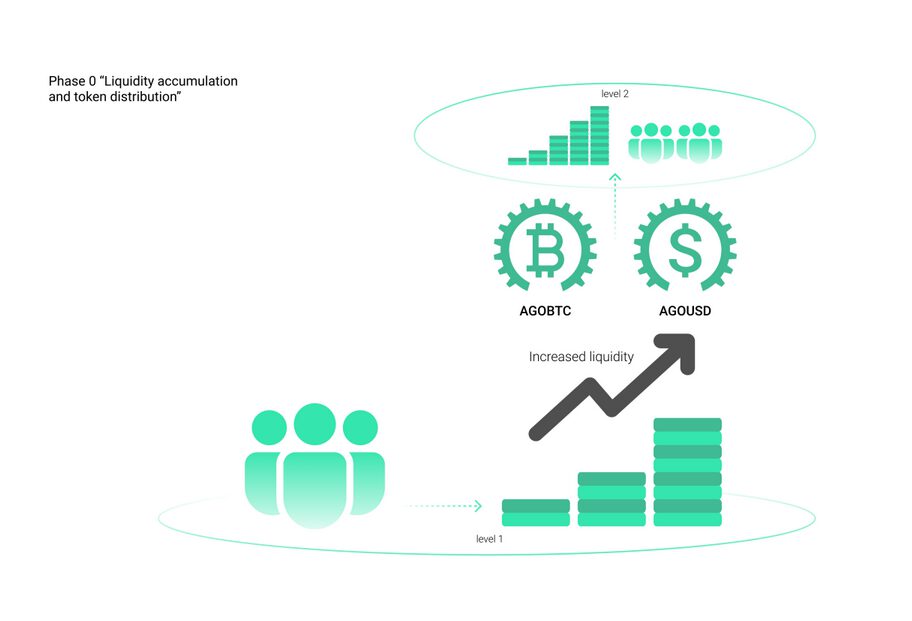

In the future launching stage, the Argano team will provide you with attractive features of the DEX such as protocol liquidity mining, promising to bring worthy rewards in the form of native governance token AGO. Most importantly, the main goal of Argano is to launch the algorithmic cycle function of AGOBTC & AGOUSD tokens, which will provide arbitrage opportunities under different market conditions and will provide calculation liquidity for the future Argano DEX platform.

In addition, Argano has its own utilities related to native, synthetic, AGOBTC & AGOUSD tokens, partial collateral and algorithms, the functionality of which will be described in more depth in the following sections.

Thanks to all the early investors, contributors and community members, the beta version of Argano is finally here. It was launched on November 17 with a lot of attractive features here:

2AGO Liquidity Token ($AGOy)

AGOy is the liquidity token of the Argano protocol, used to reward early contributors for participating in the liquidity provision. Note that you cannot trade AGOy. AGOy was created solely to reward participants before the official launch and show off a portion of their contribution. After the official launch, all AGOy token liquidity holders will have the ability to exchange AGOy for AGO governance tokens on a 1:1 ratio.

Since Argano’s private sale has ended, further investment phases will continue to be implemented to complete the protocol’s full functionality. And to start implementing media campaigns, the Argano team has launched a Beta test program of the protocol with limited features, such as:

➤ AGOUSD and AGOBTC minting and redeeming functionality.

➤ Staking AGOUSD, AGOBTC, and AGOy token.

➤ Liquidity mining event with a reduced reward distribution in the form of AGOy.

2How to get Pre-IDO Allocation

You can do it easily with just 6 simple steps:

⧫ Step1: Go here https://app.argano.io/

⧫ Step 2: Connect your MetaMask wallet and select the Polygon network. No Polygon network? You don’t have Polygon network in your Metamask?

Just add a new network and paste the following:

Name: Polygon mainnet

RPC URL: https://polygon-rpc.com/

Network ID: 137

Currency Symbol: MATIC

⧫ Step 3: Visit our Mint / Redeem page to familiarize yourself with current token generation rates and their collateral https://app.argano.io/mint-redeem

⧫ Step 4: Mint AGOUSD or AGOBTC synthetic assets using your USDT/WBTC in accordance with

⧫ Step 5: Visit our Staking page to familiarize yourself with the current reserve of AGOy allocation on staking pools https://app.argano.io/staking

⧫ Step 6: Submit your pooled assets and claim your pre-allocation of IDO tokens.

Note: Deposit documents include deposit fee (4%) and lock deposit (7 days)

Follow the steps above to earn both CNUSD and CNBTC share tokens! Those are tradable tokens and you can choose what to do with them: fix profits by getting rewards, reinvest in liquid pools, use it to mint synthetic assets when the balance ratio mortgages will change their mortgage rates ️

And again, it’s not just the ability to claim attribution, the Argano DAO is coming…

2Profitable farming within liquidity pools

Since Argano has launched its own DEX, users are offered to become liquidity providers to receive trading fees (0.25% for any swap) and additional rewards in the form of tokens argo shared token, each of which is responsible for its own separate token and acts as part of a collateral for the aggregated AGOUSD (dollar) and AGOBTC (Bitcoin) pegged tokens.

2How to earn CNUSD and CNBTC share tokens

5 Easy steps on how to provide liquidity and earn interest:

👉 First, you need to visit the liquidity pools page at https://app.argano.io/liqudity-pools

Eligible pools for earning share tokens

1. AGOBTC/WBTC (stable pool without impermanent loss)

2. WMATIC/CNBTC

3. AGOUSD/USDT (stable pool without impermanent loss)

4. WMATIC/CNUSD

Currently, Argano has allocated 20,000,000 CNUSD and 2,000 CNBTC tokens for community rewards!

👉 Choose the pool you need and paste the number of tokens you want to provide at a 50%/50% ratio

👉 Approve tokens and click on the “provide” button on the right side

👉 Go to the “Stake LP” page under the chosen pool and stake your LP tokens

Congratulations, you just became a liquidity provider and started earning community rewards!

What is the main usage?

As we have mentioned before, CNUSD and CNBTC share tokens will act as partial collateralization for the synthetic assets minting, so there are 2 ways to gain them:

1. Provide liquidity and earn them as a reward token.

2. Buy share tokens inside the trading pair.

2Foundry Staking

One of the super-cool features of the Argano protocol is Foundry Staking which incentives share token holders to stake and earn additional interest in the form of USDT/WBTC from minting and redeeming fees. Mint/redeem fee structure is described here: Minting AGOBTC & AGOUSD

🔻 Fees are set as follows:

Minting — 0.3%

Redeeming — 0.4% basic and 0.2% for $AGO token holders (decreased redeeming fee will be available after AGO token listing)

2Argano Roadmap Update

So after the beta is launched, what new things will they have to make us stand still? Let’s take a look at the next plans of the Argano team in 2022 through the following roadmap:

Q1

✅ Argano Beta launch event

✅ Pre-IDO staking and distribution additional token allocation (using AGOy utility) as rewards for the users’ testing activity

⬜ dApp visual and technical improvements

⬜ Holding a public fundraising event after the partnership establishment with various launchpads

⬜ Testing, troubleshooting, and error corrections

Q2

⬜ Argano official launch event, token distribution following the developed plan of token cliffs and vestings

⬜ Implementation of the Argano limit order functionality backed by automatic on-chain tools

⬜ Improvements of the Argano personal account page for the portfolio management feature:

– P&L processing and storage of the historical data

– Enhanced pools’ and trading activity management for the better UX On-chain governance (implementation v1)

Q3

⬜ Argano DAO governance discussion and approvement from the community

⬜ Implementation of the community investment pools and asset management through the Argano DAO

⬜ Creation of the Argano NFT limited edition to select the best members of the community and distribute accesses

⬜ Argano DAO final changes and improvements of the entire governance structure (on-chain governance v2)

Q4

⬜ Implementation of automatic yield strategies in the form of the Argano DAO general liquidity vaults

⬜ Argano DEX improvements:

– Margin trading and Futures trading functionality creation within the gradual testing and implementation of the L2 solutions

– Multifunctional management system development and implementation, reaching the level of centralized exchanges

– Argano DAO voting for the new real-world pegged assets and their technical execution, TGE and DEX support

⬜ Open-source code creation for connection through third-party services using API keys

⬜ Mobile app development for both IOS and Android devices

Agonomics (aka Argano Tokenomics)

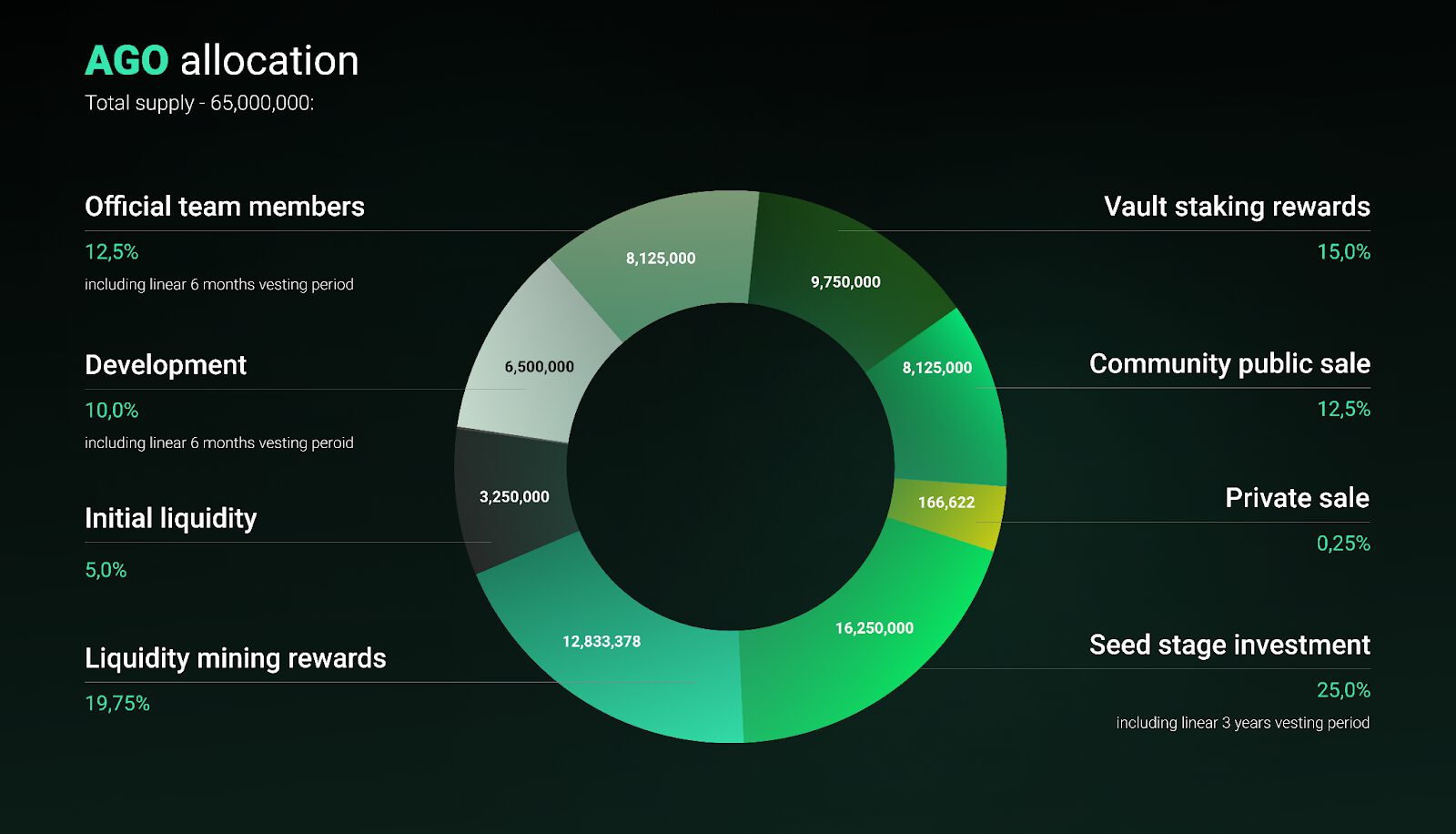

$AGO total supply – 65,000,000

- Vault staking rewards – 9,750,000 (15%)

- Liquidity mining rewards – 12,833,378 (19.75%)

- Initial liquidity – 3,250,000 (5%)

- Development – 6,500,000 (10%) including linear 1 year vesting peroid

- Official team members – 8,125,000 (12.5%) including linear 1 year vesting period

- Community public sale event – 8,125,000 (12.5%)

- Private sale event – 166,622 (~0.25%)

- Seed stage investment – 16,250,000 (25%) including linear 3 years vesting period

2Partnership with EASYCRYPTS

And finally is a BIG news for you: Argano officially has EASYCRYPTS as a strategic partner in the journey of building the protocol.

As stated EASYCRYPTS: “We are actively seeking promising start-ups to offer support in the earliest stages of their development. This direction fascinates us with the number of ambitious projects, innovative ideas, and pure potential.”

The valuable experience of Easy Crypto and other major partners (to be announced later) will definitely help Argano achieve more successful milestones in the future.

Argano Official Links:

Twitter: https://twitter.com/argano_io

Discord: https://discord.io/Argano_io

Telegram: http://t.me/ARGANO_DEFI

Telegram Announcement: https://t.me/Argano_io

Medium: https://argano.medium.com/