Crypto.com one of the best-known crypto companies for its marketing strategies, is not immune to the broader market trend. It is falling down further with every passing day. Despite its recent efforts to breakthrough, CRO has not been able to paint a sustainable rise.

Crypto.com leading in the wrong direction

In the last few days, Crypto.com and affiliated networks have been pushing alluring campaigns to bring more investments into the network.

The rebranding of Crypto.org Coin to Cronos and the ongoing Supercharger reward staking, as well as the UFC tickets giveaway, are all steps in that direction.

But at its core, the on-chain statistics do not indicate if fortune is really favoring the bold right now given that investors are not in the best state.

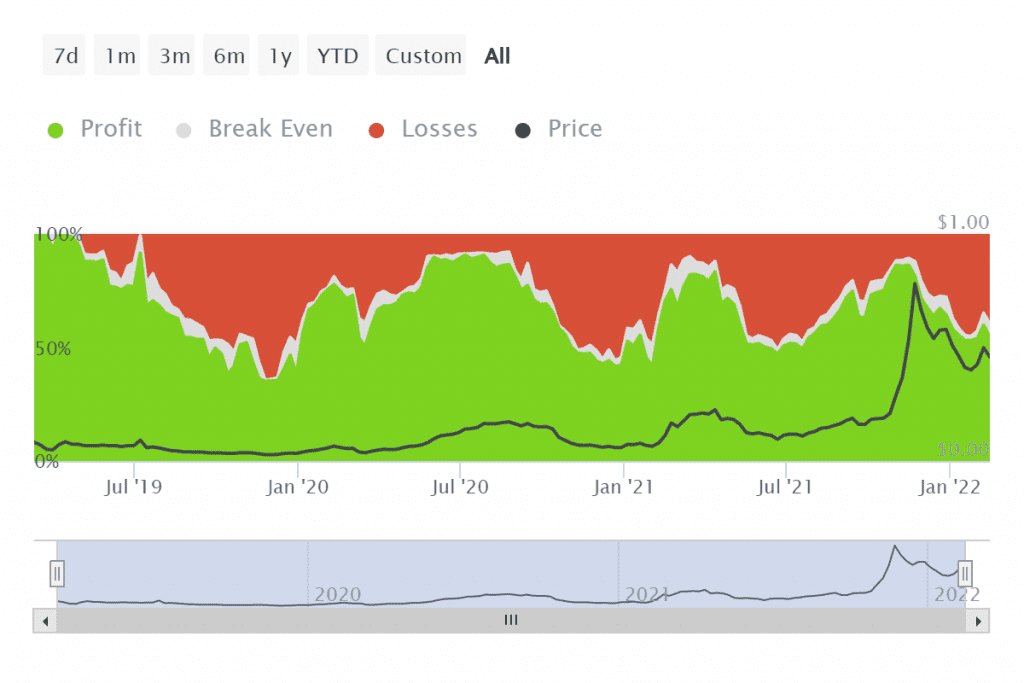

The ensuing losses have left, over 36% of investors out of money where their holdings are sitting in losses.

Crypto.com investors out of money | Source: Intotheblock – AMBCrypto

However, the blow wasn’t suffered by the retail investors alone. Whales’ transaction volumes have also been meager lately. Averaging at $10 million – $20 million, whales’ volume hasn’t crossed $100 million throughout this year except for one occasion.

Crypto.com whale transactions | Source: Intotheblock – AMBCrypto

The impact of the downtrend post the November rally has reduced the average balance on every address to $211k. It is back at the same level it was in February 2021.

Investors have been joining the network. However, these new investors are mostly FOMO-stricken who have been looking to buy in the dip. Also, the overall supply of CRO on exchanges has not decreased by a greater margin.

Rising at a rate of 500 new addresses every day, these investors have mostly been HODLing. Out of 216k total balance holding addresses only 1.4k on an average conduct transaction on-chain.

Crypto.com active addresses | Source: Intotheblock – AMBCrypto

This is also verified by the rise in the number of Long-term holders (LTH) and mid-term holders (MTH). Interestingly, there has also been a sudden drop in short-term traders since December. Put simply, people are trying to HODL their way out of the prevalent market conditions.

Crypto.com investors distribution | Source: Intotheblock – AMBCrypto

Unfortunately, both Crypto.com and investors’ efforts are being subdued by the broader market cues. This is why CRO is down by 21.44%. And, it is the biggest loser of the week.

Crypto.com price action | Source: TradingView – AMBCrypto