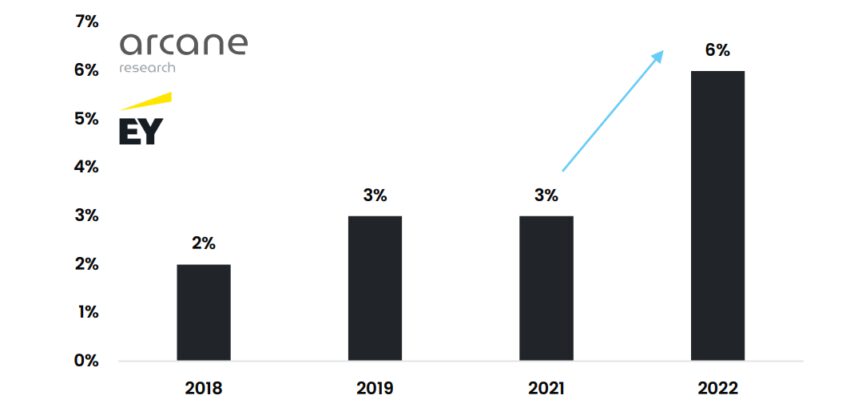

Arcane Research and Ernst & Young polled 1,000 Norwegians online and found the rate of crypto ownership had lept from 3% early last year to 6% by yesterday.

Almost two-thirds of all female respondents said that they first purchased cryptocurrency in 2021. But a gender gap still persists, with male ownership increasing from 6% to 14%. The total number of crypto owners in Norway now stands at 420,000, accounting for 10% of the adult population.

Bitcoin is the most popular asset, with 67% of all Norwegian crypto owners holding the market’s top token. Ethereum follows at 42%

Unsurprisingly, the younger population is keener on crypto than older generations. Younger individuals are more likely to view it as a good asset to hold. Only 4% of the population aged above 40 said that they owned crypto.

As for other cryptocurrencies, XRP and ADA saw a higher than average level of adoption among altcoins. Arcane puts this down to the fact that Norway’s largest crypto exchange, Firi, lists XRP, ADA, LTC, and DAI in addition to BTC and ETH.

There are also some signs that tentatively point to the growth of decentralized finance (DeFi) and the non-fungible token (NFT) market. Only 1% among the 10% that own crypto is involved in the space, but 19% have knowledge about NFTs.

The results from Arcane’s survey are not all that surprising. The country’s adoption levels are nowhere near the likes of Nigeria and Malaysia, but they are keeping in with the global trend of growing adoption.

Crypto ownership boosted by DeFi and NFTs

After the decline in interest following the 2017 ICO boom, interest in crypto among the general public has increased, aided by the growth of DeFi and especially NFTs, which has gone a long way in fostering engagement with the public. More financial advisers have also been supporting crypto.

And governments have taken note of these increased levels of adoption, fast-tracking regulations to ensure that investors and token issuers stay within the law. That has been one of the major talking points of 2022, and everyone from the U.S. to the U.K. is working on a regulatory framework.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.