$4k is an essential level for Ethereum. Not only has it been a critical resistance and support, but it is also a crucial psychological level, and Ethereum has not seen its sights once since the beginning of this year.

However, there is a fair chance that it could happen before 9 April, but if it doesn’t, then Ethereum investors might have to wait until the next month for the same to occur.

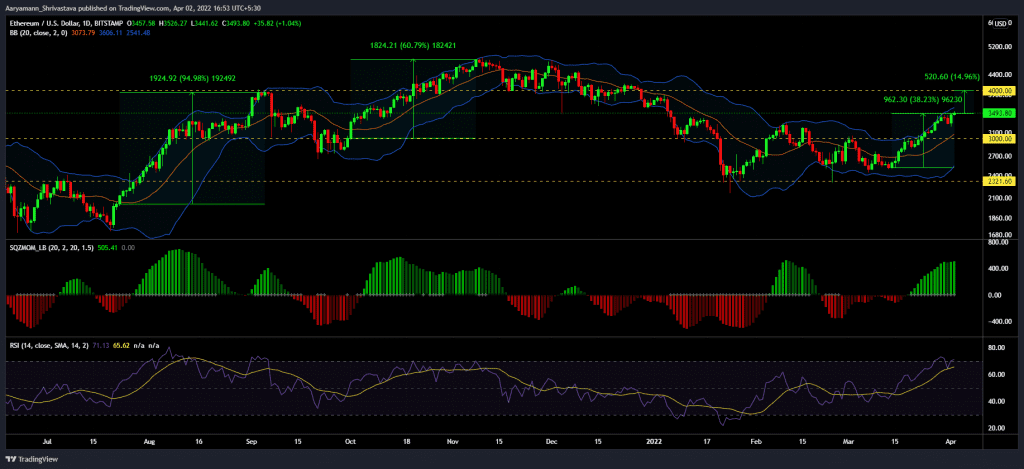

Ethereum marching towards $4k

Trading at $3,493, ETH is only 14.78% away from $4k. While it may sound like it’s pretty close, it actually isn’t. While skyrocketing rallies are typical for cryptocurrencies, they usually occur with coins that have much lesser valuations, not with the second-biggest cryptocurrency in the world.

To put things into perspective, understand that throughout the recent rally, which lasted over 19 days, ETH only gained 38.23%. However, at the same time, it is this bullishness that also makes it possible to climb 14% in the next seven days.

Ethereum price action | Source: TradingView – AMBCrypto

Price indicator Bollinger Bands do indicate the possibility of a sustainable rise since the basis is currently acting as support for the candles. The last time this support lasted for more than ten days, ETH witnessed rallies over 60 and 90%.

Furthermore, since ETH is in an active squeeze release, the indicator is displaying bullishness across the board. Even though it seems to be slightly wearing off, in the past, ETH has still managed to rise, which is what is keeping the hopes alive.

Further backing this is the net unrealized profits of Ethereum. As per the indicator, in the last few days, Ethereum managed to enter the bullish zone of Belief. Historically, an entry into this space is followed by a sustained rally for a while, which is how Ethereum is expected to hit $4k.

Ethereum NUPL | Source: Santiment – AMBCrypto

On top of that, an immediate trend reversal is unlikely since ETH is far away from marking a market top. Market tops occur when more than 95% of the total supply happens to be in profit. Since that figure is currently standing at 88.79%, there is no reason to worry about a market top anytime soon.

Ethereum supply in profit is still below 95% | Source: Santiment – AMBCrypto

But the possibility of consolidation does loom over the altcoin since its RSI is breaching the overbought zone. It might overextend in that zone for a while, but pretty soon, the uptrend will flip (ref. Ethereum price action).

If this happens and Ethereum fails to cross $4k, expect the same to happen in May unless an external development pushes the price up.