Mlkomeda has launched and the Cardano community could not be more ecstatic and overjoyed with what has been deployed, and what is to come.

Liquidity providing Ethereum and Cardano via the same pool certainly would give any crypto enthusiast—goosebumps. But this is only the beginning of the Cardano-Milkomeda story that is yet to unfold.

Blueshift is here to manifest a new era in the blockchain ecosystem by offering to its users—groundbreaking new DeFi mechanisms and a cross-chain environment.

Some of these groundbreaking new DeFi mechanisms include a top-to-bottom reinvention of the AMM protocol, Liquidity Portfolios, Virtual Pairs, Blueshift Reserve Model, and Zero fee arbitrage.

Each of these innovations offers Blueshift users an edge in their crypto ventures.

Benefits that are derived from implemented inventions offer a staggering reduction of Impermanent Loss by ten times, creation of liquidity portfolios, ability to perform single-sided liquidity provision, utilization of professional portfolio management, and much more.

These inventions’ benefits are likewise multiplied with the functionalities of Milkomeda! The technological achievement that is Milkomeda offers over 1500 TPS, 2-second finality and cross-chain capabilities.

Although Milkomeda has already launched and Blueshift already offers the use of its basic DEX utilities, neither Blueshift nor Milkomeda has launched its token. Milkomeda’s business model is built differently—without the existence of a token and to the benefit of its users, whilst Blueshift will release BLUES tokens in days to come.

The BLUES tokens have a tokenomics distribution table and staking parameters that reflect the long-term & community-oriented vision of the Blueshift team. Luckily for the wide crypto community, there is still time to register for the Blueshift IDO which will be the first and only public sale of the BLUES tokens!

Before we dive into IDO details that will enable individuals to acquire BLUES tokens at a fixed exchange rate per token—let’s take a look under Blueshift’s hood.

Blueshift catalyzing DeFi 2.0

DeFi 2.0 will be marked by Blueshift’s liquidity portfolios that can contain multiple cryptocurrencies. Aside from higher capital efficiency and effectiveness, liquidity portfolios will even out impermanent losses.

In other words, Blueshift users will be able to simply provide a single type of cryptocurrency for trading through the AMM protocol to maximally reduce impermanent loss.

Likewise, Blueshift’s DeFi 2.0 will bring the following cutting-edge mechanisms and functionalities:

- Zero or even negative fees for arbitrage operations

- Controlled token minting & burning process

- Access to external protocols that generate APY for users

- Integrated Farms and Yield Pools

- Revenue generation from slippage for liquidity providers

- Executing multi-token trades at the cost of a single transaction

- Every possible swap pair between tokens in a portfolio

- Price slippage reduced by 2-10x

- Impermanent loss reduced by up to 10x

Blueshift’s position in the market is assured by coupling all these aforementioned functionalities and benefits—with a DAO, an enhanced user experience, improved convenience, superior security, and APRs of 60-75%.

The APR mentioned above is certainly a very conservative estimate as Blueshift users will gain APR on their assets via four different channels:

- Portfolio APR—related to the growing market value of portfolios and the users` shares in them

- DEX APR—related to trading fees that can be gained

- Farm APRs—related to gains from the users` contributions to farming and yield pools

- External protocol APRs—related to revenues gained from supplying liquidity to partner protocols, for example through lending

Blueshift Token launch

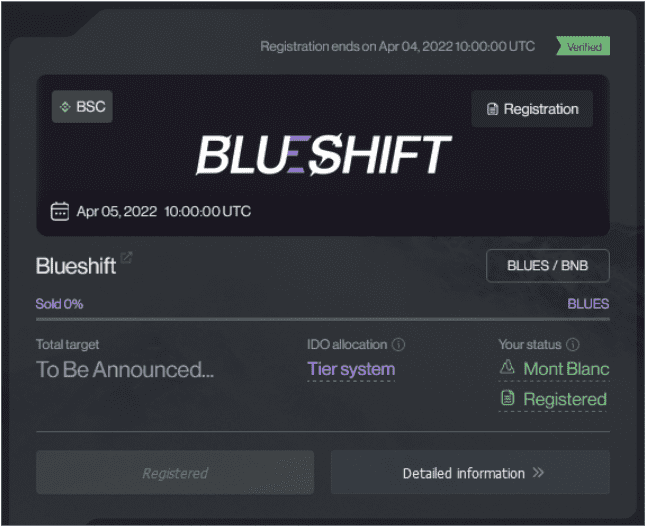

To partake in the Blueshift ecosystem and maximally utilize the Blueshift technology—individuals will be able to acquire the BLUES token via the OccamRazer launchpad!

Afterward, the only way to acquire the BLUES tokens will be via the secondary market.

Days after the conclusion of the IDO BLUES token will be added to a single CEX. BLUES holders and those that want to become a holder can expect more listings on both CEXes and DEXes—in the near future.

The key takeaway from analyzing the Blueshift tokenomics is that crypto users do not need BLUES tokens to utilize or benefit from the Blueshift platform. However, having BLUES in one’s wallet will provide significant staking APY as well as the ability to participate in the governance of the Blueshift ecosystem.

The Blueshift IDO will be executed via the Binance Smart Chain, which means interested parties do not need to worry about high gas fees. The distribution of Blueshift tokens which will happen virtually immediately after the IDO pool is closed—will be performed on the Cardano blockchain. In other words, the original form of BLUES will be of the CNT standard.

Potential IDO participants should know that the one and only Blueshift Seed round has been closed, with Shima Capital leading the Seed Round. Likewise, for those that are considering participating in the IDO—Blueshift’s IDO tutorial will be a helpful resource.

With the execution of Blueshift’s IDO, we can expect DeFi 2.0 to be right around the corner.

To find out the latest information with regards to the project, follow Blueshift’s Twitter page and join Blueshift discord.

Disclaimer: This is a paid post and should not be treated as news/advice.