You might have heard a lot of Ethereum users complaining about fees, but what about Bitcoiners? It’s probably a rare occurrence, and according to a new report, might become even more of an anomaly in the future.

Here’s why.

Bitcoin giving out discounts

A report by the Head of Firmwide Research at Galaxy Digital, Alex Thorn, stated that Bitcoin fees were at “all-time lows.”

#bitcoin fees are at all-time lows. the craziest thing? fall 2021 was the first bull run not accompanied by a major spike in fees.

how is that possible? what does it mean? here’s a thread explaining the most confounding (and awesome) chart in bitcoin. (remember june 2021) pic.twitter.com/gnWssTckX2

— Alex Thorn (@intangiblecoins) April 5, 2022

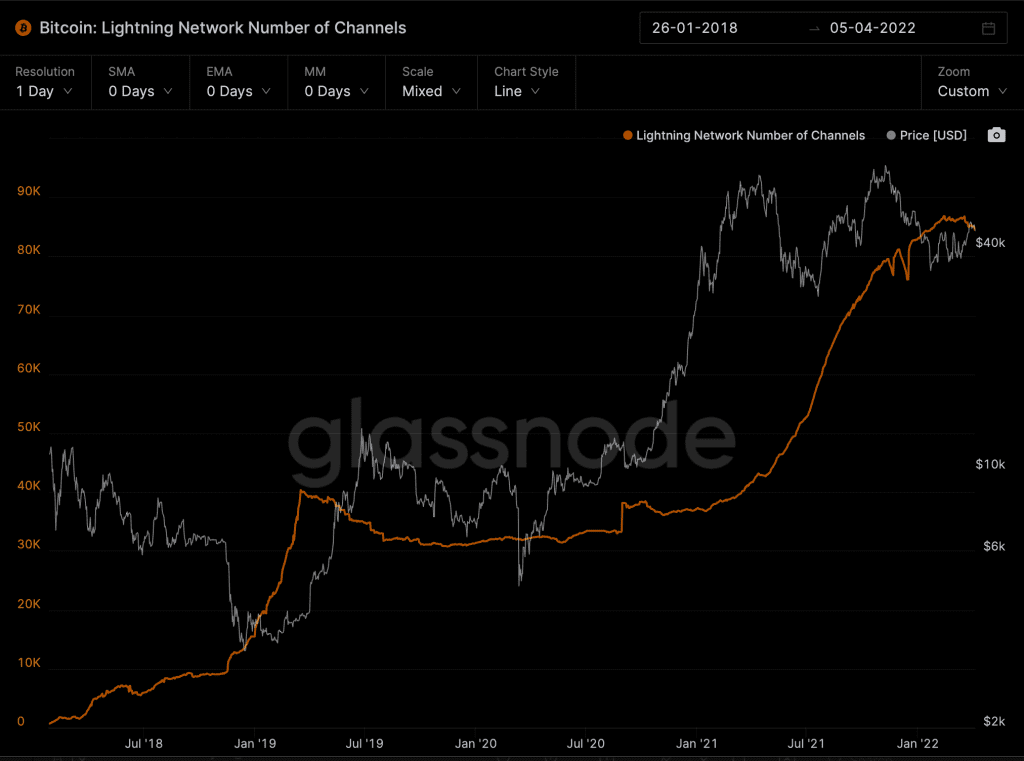

Thorn listed some reasons for this trend. These included Segwit adoption, a rise in transaction batching, less usage of OP_RETURN transactions, increasing growth on the Lightning Network, and less miner selling.

The report stated,

“Bitcoin transaction fees are at all-time lows by some measurements, despite significant price volatility. Persistent low fees are the result of efficient block space usage, rather than a decline in economic use of the Bitcoin network.”

What’s Segwit? Short for Segregated Witness, this Bitcoin network upgrade upped block space and storage efficiency by removing signature data from transactions, and adding it elsewhere. This also had the effect of decongesting the mempool.

However, as Thorn noted, this isn’t a brand new trend. The fall in fees has been happening for more than several months. What makes it special this time is the fact that – unlike previous occasions – Bitcoin’s bull run in the fall of 2021 was not accompanied by a corresponding surge in fees.

The report added,

“The mean transaction fee paid to send a bitcoin transaction in 2022 is 0.00004541 ₿ (the lowest ever), while the median is 0.00001292 ₿ (the lowest of any year except 2011).”

All in all, these are positive signs, as they indicate a rise in not just user adoption, but also make a case for technologies like the Lightning Network and its development as well.

At press time, however, the Lightning Network was seeing a small downtrend in the number of channels, which was around 84,521 on 5 April. Despite this, the LN’s dips have been historically followed by steady long-term growth and the unlocking of new ATHs.

Source: Glassnode