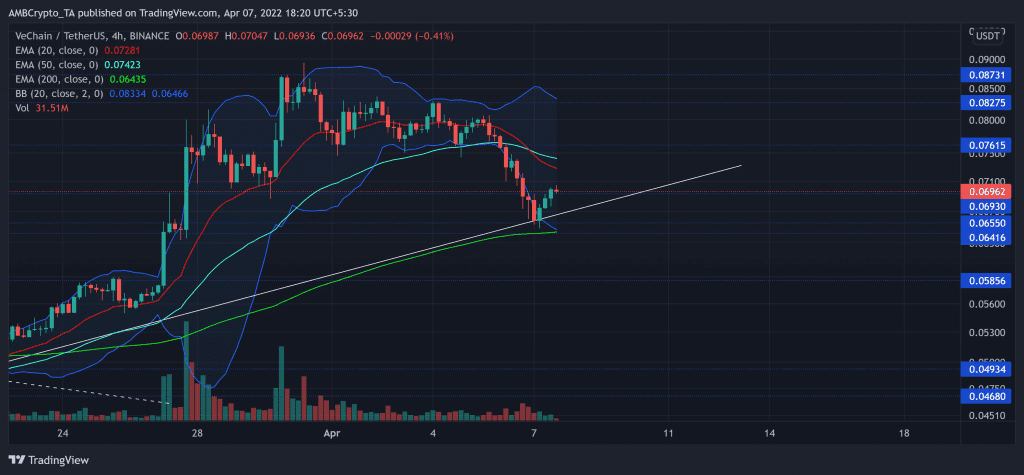

After a week of tight phase between the $0.07-$0.08 range, VeChain (VET) saw a volatile break. It lost nearly 20% of its value in the last two days.

Now, in its recovery from the $0.06 support, VET could face a barrier at its 20 EMA (red) before a possible retest of its trendline support (white). Unless the bulls reinforce this revival on amplified volumes, it could be tricky to sustain a rally above the $0.07-zone. At the time of writing, VET was trading at $0.06962, down by 2.47% in the last 24 hours.

VET 4-hour Chart

Since swooping to its 11-month low in late January, VET bulls finally found their lost ground that helped them overturn the long-term bearish rally. As soon as it broke out of the $0.04-level, the alt saw an over 80% jump.

Also, this upturn gave the buyers enough thrust to keep the price floating above the 200 EMA (green). In the current scenario, the price has been obliging its immediate trendline support for over three weeks. Also, with the recent fall, the Bollinger Bands (BB) widened to affirm the high volatility phase.

A best-case outcome would be if VET would repeat its historical trend of testing the upper band of the BB after bouncing back from the three-week trendline support. But with the 20 EMA falling below the 50 EMA, the bears would pose a hindrance in the alt’s revival towards the $0.08-mark.

Any retracements would likely find a base at its trendline support. A close below this support could lead to a 200 EMA retest before any bullish resurgence.

Rationale

The RSI had not touched the 25-level since 22 January on its 4-hour chart. A likely recovery from this point faced a hurdle at the 38-mark. A close above this would open up chances to enter into a consolidation phase in the 44-47 range.

The MACD histogram projected some revival signs, but its lines were still swaying below the zero-line. Thus, the bears could have an edge in the near-term movements.

Conclusion

Considering the confluence between the 200 EMA and the $0.06-support, VET bounced back from the lower band of BB.

A continued recovery could face a barrier at the 20 EMA before entering a squeeze phase in the $0.06-$0.07 range. The bulls needed to topple the near-term EMAs to alter the current flow in their favor.